Each tax year, millions of Americans receive a stack of tax documents. Among these, IRS Form 1099 distinguishes itself as both a significant and frequently misunderstood document. Whether one is a freelancer, gig worker, small business owner, or investor, 1099 forms are essential for reporting taxable income that does not originate from a conventional W-2 employer.

In this post, we’ll cover:

- Why Form 1099 exists

- How to fill it out

- Real-life gig economy stories (including DoorDash)

- Consequences of mishandling it

- Key takeaways

- Final tips for smooth filing

Let’s dive in.

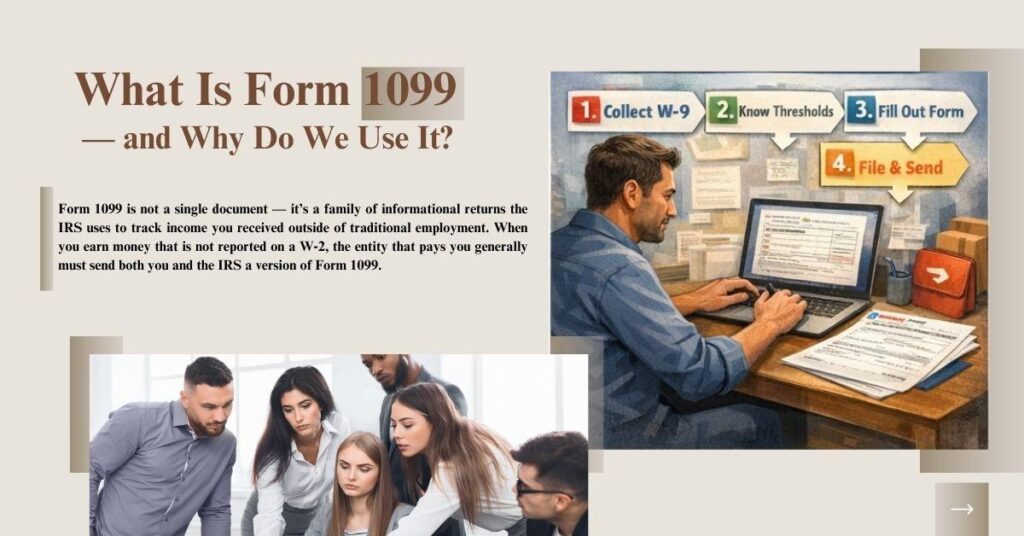

What Is IRS Form 1099 — and Why Do We Use It?

Form 1099 is not a single document — it’s a family of informational returns the IRS uses to track income you received outside of traditional employment. When you earn money that is not reported on a W‑2, the entity that pays you generally must send both you and the IRS a version of Form 1099. (irs.gov)

Related Topic – Form 1099-DA Explained (2025): How to Report Crypto Tax And Avoid IRS Penalties

Types of 1099 forms include (among others):

- 1099‑NEC — for nonemployee compensation (contractors, freelancers, gig workers like DoorDash drivers)

- 1099‑MISC — Examples of miscellaneous payments, such as rent, prizes, royalties

- 1099‑K — payments from third-party settlement entities (payment apps, marketplaces, delivery platforms)

- 1099‑INT / 1099‑DIV — interest and dividends

- 1099‑B — broker transactions and capital gains

Why does the IRS need this?

The IRS uses 1099s to cross-check your tax return information and make sure all taxable income is reported. If your return doesn’t match the IRS’s records, it can trigger notices or audits. (businessinsider.com)

How to Fill Out an IRS Form 1099 — A Step‑by-Step Overview

There are many 1099 forms, but the most common filings for small businesses and freelancers are 1099‑NEC and 1099‑MISC. Here’s how to approach them:

Step 1 — Collect Accurate Payee Info Using Form W‑9

Before you pay an independent contractor, vendor, or gig worker, have them fill out Form W‑9. This gets you:

- Name

- Address

- Taxpayer Identification Number (TIN) — SSN or EIN

Without this, you risk backup withholding and penalties. (irs.gov)

Step 2 — Determine Your Threshold

Usually, you must file a 1099 if:

- You paid $600 or more in the tax year to a nonemployee or vendor. (irs.gov)

DoorDash example: If you earned $3,200 as a Dasher in 2025, DoorDash will report your earnings via 1099‑NEC or 1099‑K, depending on how you received payments. You need to report that income on your tax return, even if you didn’t receive a 1099 (e.g., tips paid directly in cash).

Step 3 — Fill the Form

Key boxes for 1099‑NEC (nonemployee compensation):

- Payer Information — DoorDash’s business details

- Recipient Information — your personal info (from W‑9)

- Amount Paid — gross earnings from deliveries (excluding expenses)

- Box Numbers — nonemployee compensation goes in Box 1

Each 1099 form has detailed instructions from the IRS. (irs.gov)

Step 4 — Furnish and File

Deadlines matter:

January 31, 2026 — furnish recipient copies and file Form 1099‑NEC.

February 28, 2026 — file paper Forms 1099‑MISC with the IRS.

March 31, 2026 — file 1099‑MISC electronically.

Electronic filing is now required if you file 10 or more information returns. (irs.gov)

Tax Related Topic: Form 1040 Tax Schedules Guide — How to File by April 15, 2026

Real-Life DoorDash Story

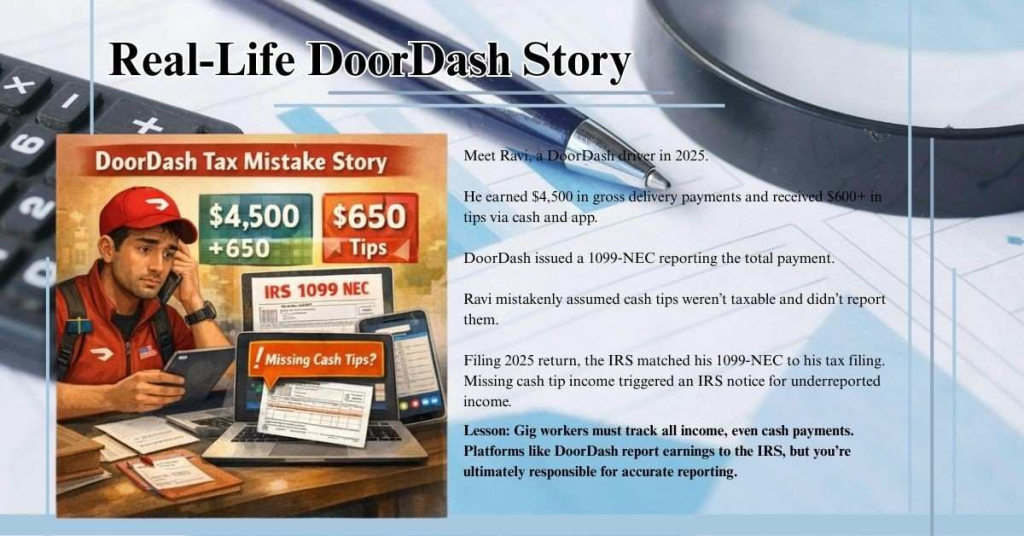

Meet Ravi, a DoorDash driver in 2025.

- He earned $4,500 in gross delivery payments and received $600+ in tips via cash and app.

- DoorDash issued a 1099‑NEC reporting the total payment.

- Ravi mistakenly assumed cash tips weren’t taxable and didn’t report them.

- Filing 2025 return, the IRS matched his 1099‑NEC to his tax filing. Missing cash tip income triggered an IRS notice for underreported income.

Lesson: Gig workers must track all income, even cash payments. Platforms like DoorDash report earnings to the IRS, but you’re ultimately responsible for accurate reporting.

Consequences of Mishandling Form 1099

Ignoring or misfiling 1099s can lead to:

1. Penalties

Missing deadlines or incorrect filings can cost you per unfiled/inaccurate form.

2. Delayed Refunds

If your return doesn’t match 1099 information, expect delays and possible audits.

3. Legal Risks

Fraudulent claims — like inventing income or withholding to game refunds — can lead to fines and criminal charges.

Key Takeaways About IRS Form 1099

- Form 1099 is essential for reporting non‑W‑2 income.

- Common forms include 1099‑NEC, 1099‑MISC, and 1099‑K.

- Know the filing thresholds and deadlines.

- Use W‑9 to collect accurate payee data.

- Report all income — especially gig economy earnings from DoorDash, Uber, Lyft, and other apps.

Know more about Capital Gain Tax Return: How to Pay Zero Federal Capital Gains Tax on $1M+ Profits (2026 Guide)

Final Tips for Gig Workers

- Track every payment. Use apps or spreadsheets to log cash and electronic payments.

- Deduct eligible expenses. Mileage, car maintenance, and delivery-related expenses reduce taxable income.

- Consider quarterly estimated taxes. If your gig income is substantial, this avoids penalties.

- File early. January is perfect for organizing 1099s and preparing for April 15, 2026.

- Stay updated. DoorDash Platforms may change reporting thresholds (especially 1099‑K).

Final Thoughts On IRS Form 1099

For gig workers, DoorDash drivers, and freelancers, Form 1099 isn’t optional — it’s essential. Treat it as a tool for compliance, not just paperwork. By tracking your earnings, reporting accurately, and staying ahead of deadlines, you can reduce stress, avoid penalties, and keep your financial house in order.

Remember, the 2025 tax filing deadline is April 15, 2026 — plan, report everything, and keep those dashboards updated. Your future self will thank you.

Hi there! I am Sudip Sengupta, the face behind “Tfin Career”. Tfin Career is a sole proprietorship finance and consulting firm that makes complex tax and financial concepts easy to understand for everyone. With more than 21 years of experience in the field, I have noticed that people cannot make the right decisions in this field. So, I decided to create “Tfin Career” to help individuals and businesses alike. Here I urge those who are confused to make better choices. Also, it is good news for my dear clients and every visitor that I/we are going to start a training module for those who want to choose a career path in Finance and Taxation. Just follow my website.

Thank you for reading this post, don't forget to subscribe!