Let’s be honest. Tax forms can feel like a secret code. You see words like “qualified dividends and capital gain” on your forms and wonder, “Does this make my taxes harder?” Not necessarily! In fact, it might mean you paylesstax. The IRS has a special worksheet to figure this out, and understanding it is like finding a key to a tax break.

Think of it this way: The U.S. government wants to encourage people to invest for the long term. As a reward for that patience, certain types of investment income get a special, lower tax rate. The “Qualified Dividends and Capital Gain Tax Worksheet” is simply the tool that calculates your bill using these friendly discounts.

When preparing your federal income tax return, most people simply look up their tax liability using the Tax Table or the Tax Computation Worksheet. But if you received qualified dividends or capital gain distributions, your tax situation is a little more complex — and that’s where the Qualified Dividends and Capital Gain Tax Worksheet comes into play. (eitc.irs.gov)

What Is This Worksheet and Why Does It Matter?

The U.S. tax code gives preferential tax rates for certain investment income — specifically:

- Qualified dividends, and

- Long‑term capital gains.

Unlike ordinary income, which is taxed at regular federal income tax rates (10%–37%), these types of income are taxed at lower rates: 0%, 15%, or 20%, depending on your total taxable income. (Kiplinger)

Because of these favorable rates, the IRS provides a separate worksheet to calculate how much tax you owe on your total income when part of it qualifies for this special treatment. That worksheet appears in the IRS instructions for Form 1040, Line 16 and is used when:

You have qualified dividends reported on Form 1040, Line 3a,

or

You have capital gain distributions and aren’t filing Schedule D,

or

You have a Schedule D with gains on Lines 15 and 16 that are both more than zero. (eitc.irs.gov)

Download Woeksheet Provided by The IRS – Qualified Dividends and Capital Gain Tax Worksheet—Line 16

Overview of the Worksheet

To calculate your tax using the worksheet, you follow a series of steps where your total taxable income is separated into portions taxed at:

- 0%

- 15%

- 20%

- Ordinary income rates (via the normal Tax Table or Tax Computation Worksheet)

This method ensures each portion of your income is taxed at the correct rate.

Related and Important Article – Form 1040 Tax Schedules Guide — How to File by April 15, 2026

How the Key Lines Work

Here’s a breakdown of what each major part of the worksheet does:

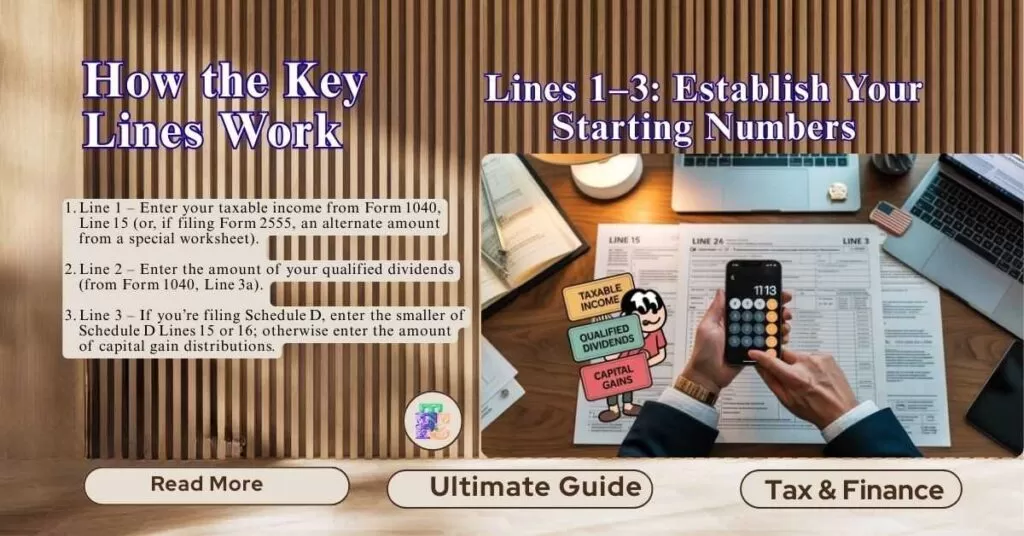

Lines 1–3: Establish Your Starting Numbers

- Line 1 – Enter your taxable income from Form 1040, Line 15 (or, if filing Form 2555, an alternate amount from a special worksheet). (eitc.irs.gov)

- Line 2 – Enter the amount of your qualified dividends (from Form 1040, Line 3a). (eitc.irs.gov)

- Line 3 – If you’re filing Schedule D, enter the smaller of Schedule D Lines 15 or 16; otherwise enter the amount of capital gain distributions. (eitc.irs.gov)

Lines 4–9: Figure Your 0% Rate Portion

- Add qualified dividends and capital gains.

- Subtract this from total taxable income.

- –8. These lines compare that amount to income thresholds tied to filing status (e.g., single, head of household, married filing jointly) to figure how much income falls into the 0% tax bracket. 9. The result is the portion of your income — up to a threshold — that is taxed at 0%.

This 0% tier acts as a buffer zone, ensuring low‑income taxpayers with favorable investment income don’t pay federal tax on that income. (eitc.irs.gov)

Lines 10–21: Apply 15% and 20% Rates

10–12. These lines help split your income into the part that will be taxed at 15%, after subtracting the 0% portion.

13–17. Using higher thresholds tied to filing status (e.g., single, married filing separately), this portion figures out how much income should be taxed at 15% versus 20%.

18. Multiply the 15% portion by 15% to get that segment of your tax.

20–21. Multiply the 20% portion by 20% for that rate component.

Note: The IRS adjusts these threshold amounts annually for inflation. (eitc.irs.gov)

Lines 22–25: Compute and Compare Final Tax

- Compute the tax on your ordinary taxable income using the regular Tax Table or Tax Computation Worksheet.

- Add the three components:

- 0% portion tax (which is $0)

- 15% portion tax

- 20% portion tax

- Compute the tax on total taxable income (as if nothing were taxed at special rates).

- The IRS directs you to take the smaller of Line 23 or Line 24 and enter that on Form 1040, Line 16. This ensures you get the full benefit of preferential rates without overpaying. (eitc.irs.gov)

Why This Matters to Most Taxpayers

Many taxpayers today receive income beyond wages — including stock dividends and gains from selling investments — and often preferential tax treatment can reduce their federal tax bill significantly.

Here is how these special rates play out in practice:

- If your total taxable income is low enough, your qualified dividends and capital gains might be taxed at 0%. (Kiplinger)

- For most middle‑income taxpayers, these gains are taxed at 15%. (Kiplinger)

- Only high‑income taxpayers pay 20% or more (before net investment income tax). (Kiplinger)

This progressive design aims to encourage long‑term investment and to reduce the tax drag on individual investors’ returns.

Practical Tips For Dividends and Capital Gain Tax Worksheet

- Always gather your Forms 1099‑DIV and 1099‑B before tax season — these show qualified dividends and capital gains.

- If you’re filing Schedule D for capital gains, make sure you compare whether Schedule D Tax Worksheet or this Qualified Dividends worksheet gives the correct calculation. (IRS)

- Tax software and professionals automatically perform these calculations, but understanding the worksheet helps you verify your tax owed — especially if you’re handling taxes manually. (Reddit)

Final Thoughts On Dividends and Capital Gain Tax Worksheet

The Qualified Dividends and Capital Gain Tax Worksheet is one of the IRS’s most useful tools for taxpayers with investment income. It may seem complicated at first glance, but at its core it ensures your investment income is taxed fairly — often at rates far below ordinary income.

Understanding this worksheet is a key financial skill, especially for investors, retirees, and anyone with portfolio income. If this sounds intimidating, tax‑preparation software or a tax professional can help — but now you know what’s happening behind the scenes! (eitc.irs.gov)

Remember: Follow our Next Article with Real time Example of fillin of Qualified Dividends and Capital Gain Tax Worksheet (Line 16)

Thank you for reading this post, don't forget to subscribe!