OLT Tax Software 2026: The Cheapest and Easiest Way to File Your Taxes Online

It’s early 2026.

You are at your desk. A warm cup of tea sits beside you. Then you see the reminder:

“Time to file your tax return.”

Your shoulders drop.

You do not want to use hard tax terms.

Don’t want expensive software.

You do not wish to surprise charges at checkout.

You want something simple.

That’s where OLT Tax Software (Online Taxes) comes in.

But is it really easy?

Is it safe?

And most importantly, is it worth using in 2026?

Let’s break it down in plain, easy English.

What Is OLT Tax Software?

OLT Tax is an online tax filing website. You do not need to download anything. You simply log in through your web browser and start filing.

It is an IRS-authorised e-file provider, meaning it is approved to submit your tax return directly to the IRS.

With OLT, you can:

- File your federal tax return

- File your state tax return

- Report W-2 income

- Report freelance or self-employment income

- Add rental or investment income

- Claim common tax credits and deductions

Everything happens online, step by step.

Know More About OLT Tax Software from the Official Website

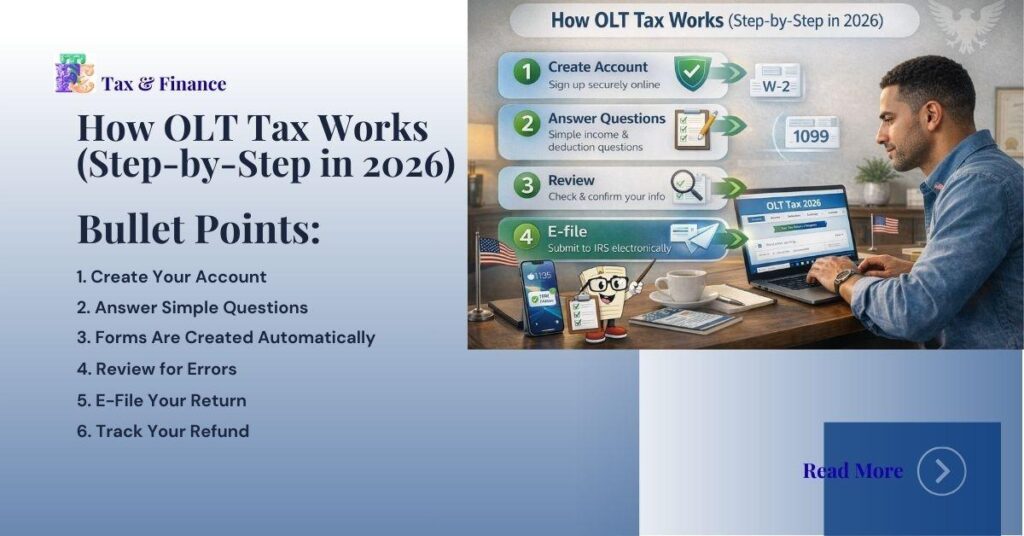

How OLT Tax Software Works (Step-by-Step in 2026)

Here is how most people use OLT:

1. Create Your Account

Sign up with your email and create a secure password.

2. Answer Simple Questions

Instead of filling out IRS forms yourself, OLT asks you easy questions about:

- Your job (W-2 or 1099)

- Business income

- Deductions

- Tax credits

You answer. The system fills in the forms for you.

3. Forms Are Created Automatically

Behind the scenes, OLT prepares the correct IRS forms based on your answers.

4. Review for Errors

The software checks for missing information and possible mistakes.

5. E-File Your Return

You submit your return electronically to the IRS.

6. Track Your Refund

Once accepted, you can monitor your return and download a copy anytime.

For simple tax situations, many users finish in less than one hour.

Why Many People Find OLT Easy

OLT does not try to impress you with flashy graphics. It focuses on one thing: getting your taxes done.

Here’s why users say it feels simple:

- Clean, question-and-answer format

- No constant pop-ups asking you to upgrade

- Clear pricing

- Works well for basic returns

If you are comfortable reading and answering questions, you’ll likely find it easy.

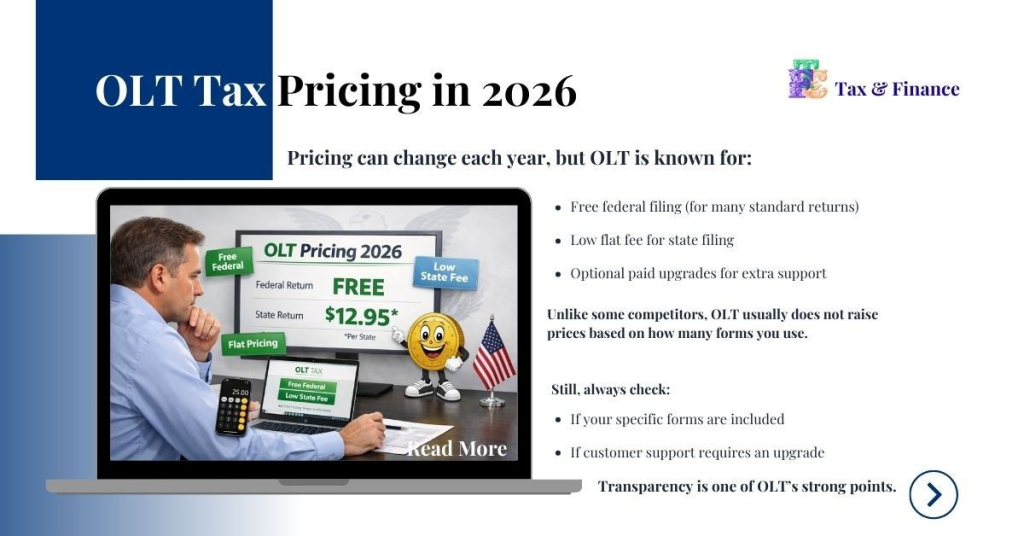

OLT Tax Pricing in 2026

Pricing can change each year, but OLT is known for:

- Free federal filing (for many standard returns)

- Low flat fee for state filing

- Optional paid upgrades for extra support

Unlike some competitors, OLT usually does not raise prices based on how many forms you use.

Still, always check:

- If your specific forms are included

- If customer support requires an upgrade

Transparency is one of OLT’s strong points.

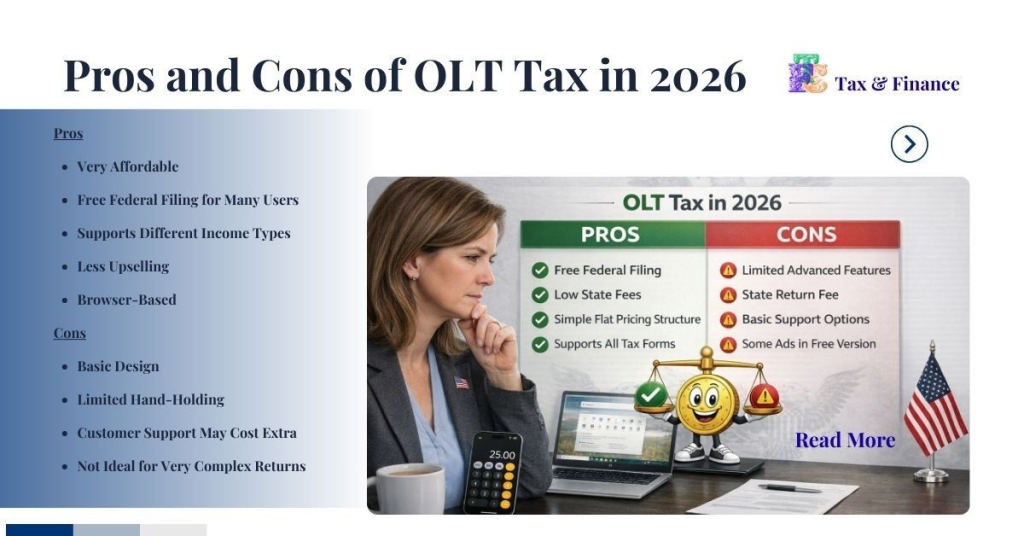

Pros and Cons of OLT Tax in 2026

Pros

1. OLT Tax Software is Very Affordable

OLT is often much cheaper than big-name tax software.

2. Free Federal Filing for Many Users

This makes it attractive for employees and offers simple returns.

3. Supports Different Income Types

You can report:

- W-2 income

- Self-employment income (Schedule C)

- Rental income (Schedule E)

- Investment income

4. Less Upselling

You won’t feel pressured to buy expensive add-ons every few minutes.

5. Browser-Based

No downloads. Use it from any secure computer.

Cons

1. OLT Tax Software created with Basic Design

The interface works fine, but it may look outdated compared to premium software.

2. Limited Hand-Holding

If you are filing for the first time, guidance may feel light.

3. Customer Support May Cost Extra

Phone or live help may require a paid plan.

4. Not Ideal for Very Complex Returns

Advanced investors or complex business owners may prefer more robust tools.

Who Should Use OLT Tax Software in 2026?

Best For:

- W-2 employees

- Freelancers with simple business income

- Budget-conscious taxpayers

- People are comfortable using online forms

May Not Be Best For:

- First-time filers who need step-by-step coaching

- High-net-worth investors

- People who want full audit defence services

OLT works best when your tax situation is clear and straightforward.

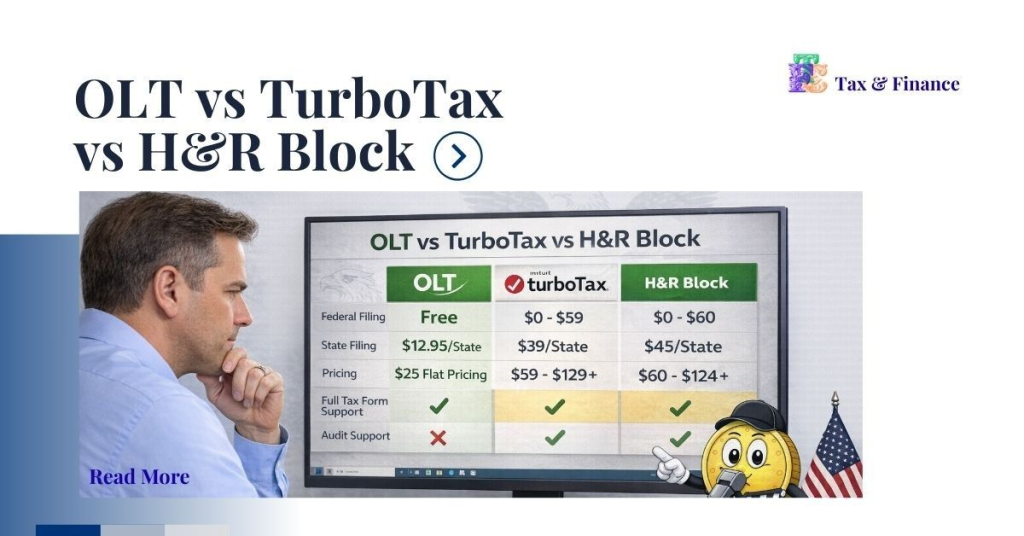

OLT vs TurboTax vs H&R Block

Here’s a simple comparison:

| Feature | OLT | TurboTax | H&R Block |

| Federal Filing | Often Free | Tiered pricing | Tiered pricing |

| State Filing | Low flat fee | Higher | Moderate |

| Interface | Simple | Very polished | Modern |

| Support | Limited unless upgraded | Extensive | Extensive |

| Upselling | Minimal | Frequent | Moderate |

OLT competes on price and simplicity, not luxury design.

TurboTax vs OLT Tax: Affordable vs Feature-Rich – Which Tax Software is Right for You?

Is OLT Tax Software Safe?

Yes. OLT uses encrypted connections to protect your data. As an IRS-authorised provider, it must follow federal e-file standards.

But you should still:

- Use a strong password

- Avoid public Wi-Fi when filing

- Enable two-factor authentication if available

Your security also depends on your habits.

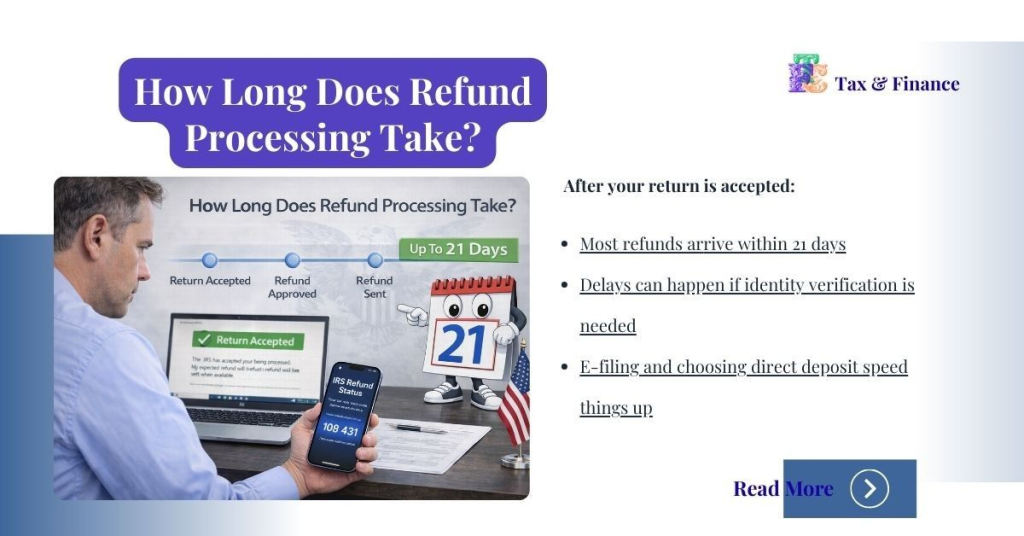

How Long Does Refund Processing Take?

After your return is accepted:

- Most refunds arrive within 21 days

- Delays can happen if identity verification is needed

- E-filing and choosing direct deposit speed things up

OLT submits your return electronically, but the IRS controls refund timing.

Final Verdict: Is OLT Tax Software the Easiest Way to File in 2026?

OLT may not win design awards.

But if your goal is:

- Save money

- File quickly

- Avoid aggressive upselling

- Complete a simple return

Then OLT is a strong choice.

If you prefer premium visuals, detailed explanations, and live expert access, you may want a higher-priced platform.

It all depends on what matters most to you.

Overall Rating (2026 Tax Season)

- Ease of Use: 8/10

- Affordability: 9/10

- Features: 7/10

- Customer Support: 6.5/10

- Overall Value: 8/10

Bottom Line of OLT Tax Software

OLT Tax stands out in 2026 as a practical and budget-friendly way to file your 2025 federal tax return.

It keeps things simple.

It keeps costs low.

And for many taxpayers, that’s exactly what they need.

Before choosing any tax software, always consider:

- How complex your tax return is

- Whether you need live help

- The total cost (federal + state + upgrades)

If simplicity and affordability matter most, OLT Tax deserves serious consideration this filing season.

Hi there! I am Sudip Sengupta, the face behind “Tfin Career”. Tfin Career is a sole proprietorship finance and consulting firm that makes complex tax and financial concepts easy to understand for everyone. With more than 21 years of experience in the field, I have noticed that people cannot make the right decisions in this field. So, I decided to create “Tfin Career” to help individuals and businesses alike. Here I urge those who are confused to make better choices. Also, it is good news for my dear clients and every visitor that I/we are going to start a training module for those who want to choose a career path in Finance and Taxation. Just follow my website.

Thank you for reading this post, don't forget to subscribe!