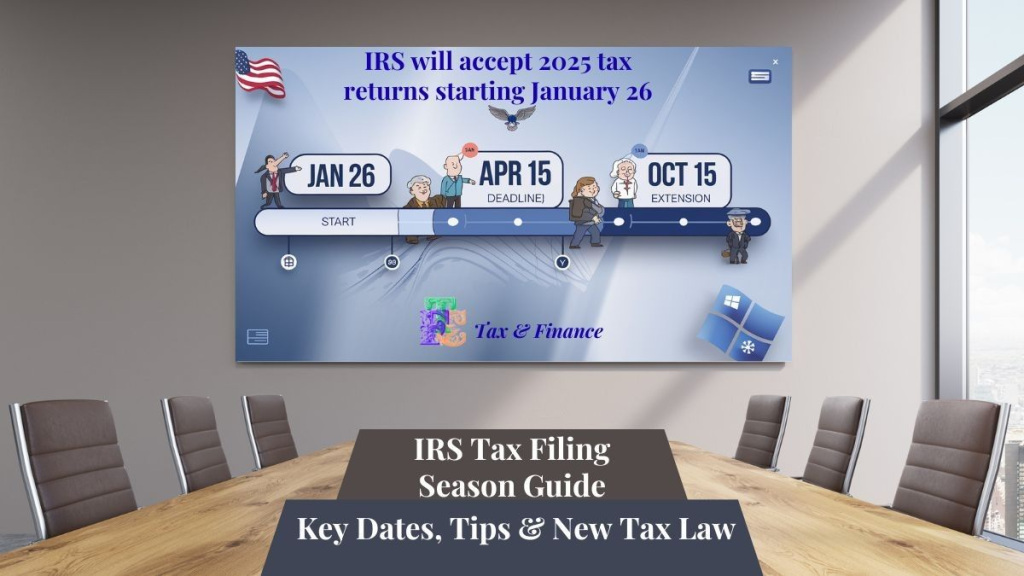

Good news for taxpayers: The IRS Tax Filing Starting Date has officially announced that it will begin accepting 2025 federal income tax returns on Monday, January 26, 2026. That means the tax season is about to kick off — and you can file early!

Tax season can be stressful for many people, but filing early gives you more time to prepare, avoid mistakes, and get your refund faster if you’re owed one. In this article, we’ll walk you through everything you need to know — in simple, clear English. (The Internal Revenue Service)

IRS Tax Filing Important Dates You Need to Remember

| Event | Date |

| IRS begins accepting 2025 tax returns | January 26, 2026 (IRS) |

| Deadline to file and pay without penalties | April 15, 2026 (IRS) |

| Deadline with extension | October 15, 2026 (if extension requested) (IRS) |

Even though tax season officially begins in late January, many software companies let you start entering your information earlier — they’ll hold your return and submit it for you once the IRS systems open. (Reddit)

Fill the Form Strees Free: Form 1040 Tax Schedules Guide — How to File by April 15, 2026

What Does This Mean for You?

When the IRS says it’s accepting returns, it means your tax return can be officially submitted and processed. You don’t have to wait until April — you can file as soon as January 26 if you’re ready.

Filing early is wise for most people. But there are key changes this year you should understand before you submit your return.

Major Tax Changes for 2025 Returns

Several provisions from the One, Big, Beautiful Bill Act went into effect beginning with the 2025 tax year — the year you’re now filing for. These changes affect deductions, credits, and other tax rules.

New Deductions and Benefits

- No tax on tips and overtime income: If you earn tipped income or overtime, more of that income could be tax-free under the new rules.

- Special deduction for seniors (65+): Eligible older taxpayers can claim an extra deduction on top of the standard one.

- Car loan interest deduction: Some taxpayers may benefit from a deduction related to car loan interest.

- Big boosts in standard deductions: The IRS increased standard deduction amounts for 2025, making it easier for many taxpayers to lower their taxable income.

These changes could reduce your taxable income or increase your refund, so it’s a good idea to review them carefully — especially if you’re used to preparing your taxes the same way each year.

Related Article: How to Pay Zero Federal Capital Gains Tax on $1M+ Profits (2026 Guide)

Refunds — How to Get Yours Fast

The IRS strongly encourages filing electronically and choosing direct deposit for refunds. That’s the fastest and safest way to get your money.

Paper refund checks are ending. As part of a modernization plan, the IRS has begun phasing out paper checks — so having a bank account for direct deposit is more important than ever. (The IRS)

Tip: After you file, you can use the IRS tool “Where’s My Refund?” online to track your refund status.

Check for Maximum Refund – TurboTax Free Edition Explained 2026: Everything You Need To Know

Pros and Cons of IRS Tax Filing Early

TAX FILING EARLY – Pros

- Get your refund sooner — no waiting until spring.

- More time to fix mistakes — early filing reduces panic near the deadline.

- Direct deposit speeds things up — safe and quick.

TAX FILING EARLY – Cons

- Forms might be updated — if there are last-minute changes, early filers may have to refile or adjust.

- Not all tax software updates arrive immediately — some tools take time to reflect new tax provisions.

- Waiting may be easier if you’re unsure — filing later can give you time to understand the new rules before submitting.

Tools to Help You File

The IRS offers many helpful resources:

IRS Individual Online Account

Check your balance, payment history, return details, and more.

Schedule 1-A

This is a new form taxpayers use to claim certain deductions and benefits under the updated law. (IRS)

The IRS Free File and Fillable Forms

- IRS Free File: Available early (starting January 9, 2026) for eligible taxpayers with lower incomes. (Fox Business)

- Free File Fillable Forms: Available beginning January 26 for all taxpayers. (Fox Business)

Volunteer Tax Assistance

IRS-certified volunteers and programs like Volunteer Income Tax Assistance (VITA) offer free help for eligible taxpayers. (IRS)

Tips to Make IRS Tax Filing Season Easier

- Gather your tax documents now: W-2s, 1099s, receipts, and other records.

- Start early with software: Many tax apps let you prepare your return and hold it until the IRS starts processing. (Reddit)

- Review new tax rules: Changes in deductions or credits could mean a bigger refund.

- Watch out for scams: The IRS doesn’t contact you first by phone or email asking for payment. (IRS)

Final Thoughts on IRS Tax Filing

Tax season officially begins on January 26, 2026 when the IRS will accept 2025 tax returns. Filing early can save money, stress, and time — especially with many new tax law changes now in place. But it’s best to be well prepared and informed before submitting your return. (IRS)

Thank you for reading this post, don't forget to subscribe!