Are you ready for 2026 taxes? The Tax Cuts and Jobs Act (TCJA) may seem complex. The IRS has made it easier than ever with updated training materials. These resources are designed to help both tax professionals and everyday taxpayers understand new rules, plan effectively, and avoid mistakes. In the 2026 TCJA guide, we will walk through the latest TCJA updates, practical applications, and tips that make tax planning a little less stressful.

Why TCJA Still Matters in 2026

The TCJA, passed in 2017, significantly changed U.S. taxes. From lower individual and business rates to new deductions, the law continues to affect millions. In 2026, the IRS is emphasizing:

- Tax brackets and rates: Adjusted for inflation, these affect your paycheck and year-end tax bill.

- Deduction limits: SALT deductions remain capped, and business expenses must be carefully tracked.

- Credits: Child tax and energy-efficient home credits are adjusted for 2026.

Example: Jane, a small business owner in Texas, used IRS training materials to apply depreciation rules for new equipment. This simple adjustment saved her $12,000 in 2025 taxes.

Finally! A Tax Break on New Car Loan Interest (2026)

What’s New Training Materials for 2026 TCJA?

The IRS has revamped the TCJA training materials with modern, practical tools. Here’s what you can expect:

- Step-by-step e-learning modules with interactive examples

- Webinars for tax professionals covering recent changes

- Case studies using 2025 and 2026 real-world tax data

These resources ensure that you not only understand the law but also know how to apply it correctly.

2026 US tax law changes: How to Prepare Your Finances This Year

Practical Tips for Tax Professionals

If you’re a CPA, enrolled agent, or tax preparer, these materials are a goldmine. They focus on real-world applications:

- Using TCJA rules to maximize client deductions

- Adjusting for multi-state SALT deductions and limits

- Incorporating inflation-adjusted thresholds for 2026

Case Study: A mid-size consulting firm in New York revised its payroll calculations using IRS training guides. The result? $18,000 saved in estimated tax payments for 2025 projections.

Easy Guidance for Individual Taxpayers

Not a tax professional? No worries! 2026 TCJA training materials are written to be user-friendly:

- Understand how your standard deduction and credits work

- Learn about child tax and dependent care credits

- Plan retirement contributions to reduce taxable income

Tip: Even a few minutes reviewing IRS interactive guides can help prevent common mistakes, such as missed deductions or incorrect filing status.

Taxes Could Be High in 2026: How to Protect Your Wealth?

Tech Tools for Simplified Tax Filing

The IRS also encourages using technology to make your life easier:

- Tax preparation software linked to IRS guidelines

- Automated worksheets to calculate deductions and credits

- Secure online filing and recordkeeping tips

Example: Using an IRS-approved software, a family in Ohio quickly identified energy credits for 2025, earning $2,500 in tax savings without extra paperwork.

Frequently Asked Questions About TCJA 2026

What is 2026 TCJA, and why is it important?

The Tax Cuts and Jobs Act is a federal tax reform law affecting rates, deductions, and credits. In 2026, IRS updates help taxpayers comply and optimize their tax returns.

Where can I access the IRS TCJA training materials?

Official IRS TCJA training resources for 2026 are available here.

How do small businesses benefit from TCJA?

Small businesses can take advantage of pass-through deductions, depreciation rules, and payroll adjustments, which are explained in IRS training guides.

Can individuals use 2026 TCJA training materials?

Yes! The IRS provides simplified modules and guides to help anyone understand deductions, credits, and filing requirements for 2026.

What are the main deduction limits in 2026?

Key limits include SALT capped at $10,000, standard deduction of $14,600 (single) and $29,200 (married filing jointly), and business expense limits adjusted for inflation.

Are there new tax credits for 2026?

TCJA itself didn’t introduce new credits, but IRS materials include updated calculations for energy-efficient home credits and child tax credit.

How can professionals stay informed about the TCJA?

Attend IRS webinars, complete e-learning modules, and review updated case studies every year to stay current with rules and compliance.

Are the 2026 TCJA training materials free?

Yes! All official IRS TCJA materials for 2026 are available online for both taxpayers and professionals.

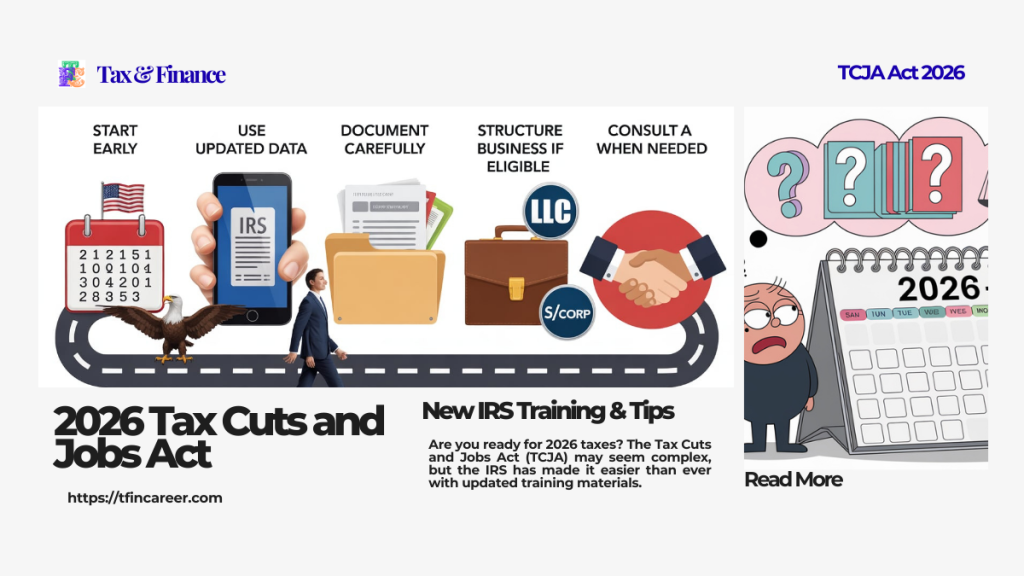

2026 TCJA training: Actionable Takeaways

- Start early: Review IRS TCJA guides before the filing season begins.

- Use technology: Leverage software tools to track deductions and credits.

- Seek guidance: Consult tax professionals for complex situations.

- Keep records: Accurate documentation ensures smooth Audits and filings.

Following these steps ensures you stay compliant, save money, and make informed decisions for 2026 taxes. Remember, the IRS training materials are your best friend for navigating the TCJA maze!

References

- IRS: TCJA Training Materials

- IRS Inflation Adjustments 2026

- Tax Policy Center: TCJA Overview

- Social Security Bulletin: Tax Impacts

Hi there! I am Sudip Sengupta, the face behind “Tfin Career”. Tfin Career is a sole proprietorship finance and consulting firm that makes complex tax and financial concepts easy to understand for everyone. With more than 21 years of experience in the field, I have noticed that people cannot make the right decisions in this field. So, I decided to create “Tfin Career” to help individuals and businesses alike. Here I urge those who are confused to make better choices. Also, it is good news for my dear clients and every visitor that I/we are going to start a training module for those who want to choose a career path in Finance and Taxation. Just follow my website.

Thank you for reading this post, don't forget to subscribe!