Introduction: Retirement Crisis And Retirement Savings Gap

Retirement Crisis 2026 and Retirement Savings Gap: Retirement was once seen as the reward after decades of hard work. A peaceful life. Time with family. Freedom from stress.

But in 2026, many American retirees feel something very different.

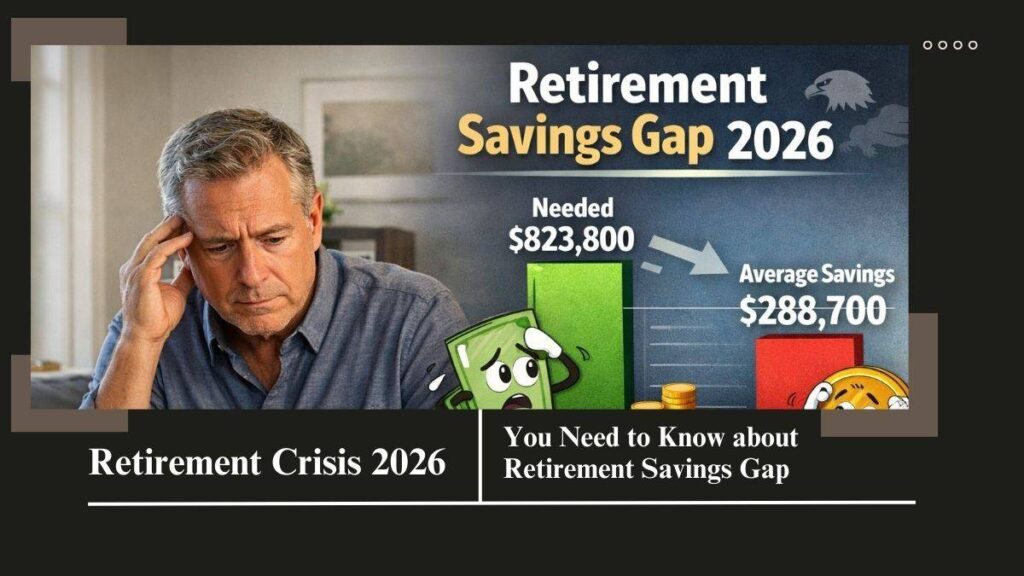

Recent survey data shows that retirees believe they now need $823,800 to retire comfortably. Yet the average retiree has only $288,700 saved. Even more concerning, nearly 3 out of 10 retirees have no savings at all.

That gap is not small. It is life-changing.

So, is the United States really facing a retirement crisis? Let’s break it down in simple terms.

The Big Retirement Savings Gap in 2026

Just one year ago, retirees believed they needed around $580,000 to retire comfortably. In 2026, that number jumped to $823,800.

That is a massive increase in a short time.

At the same time, average savings dropped from about $308,000 to $288,700.

Why Did the Required Amount Rise So Fast?

Several factors are pushing costs higher:

- Higher grocery prices

- Rising insurance premiums

- Expensive healthcare

- Property taxes and housing costs

- Longer life expectancy

People are living longer. That means retirement savings must last 20 to 30 years — sometimes even longer.

When the American Dream Fails: Hidden Retirement Crisis USA

Do Retirees Feel Financially Secure?

The short answer: Many do not.

Here’s what retirees are saying:

- 64% believe America is in a retirement crisis

- 48% worry they cannot maintain their lifestyle long term

- 23% are unsure they can manage even for one more year

- 51% have no plan if their money runs out

Those numbers show real fear — not just mild concern.

Retirement plans – Provided by The IRS – Also read this Article from your Authentic Site

Daily Life in Retirement: Cutting Back to Survive

Many retirees are not living freely. They are living carefully.

- 67% spend more than expected on groceries

- 60% spend more on insurance

- 14% skipped medical visits to save money

- 12% skipped meals

These are not luxury cuts. These are basic needs.

Some retirees even say they would rather die than see their savings run out. That shows deep stress and emotional pressure.

Housing: The Biggest Worry

For many retirees, their home is their biggest asset.

But it can also be their biggest expense.

- 49% say a drop in home value would hurt their plans

- 25% worry they cannot afford housing next year

- 73% would do anything to stay in their home

Homes provide security. But rising property taxes, repairs, and insurance are heavy burdens.

Possible Solutions to the Retirement Crisis 2026

There is no single solution. But several ideas are being discussed. Let’s look at them clearly — with pros and cons.

1. Raising the Retirement Age

Some experts suggest increasing the retirement age beyond 62 or 65.

Pros:

- More years to save money

- Shorter time relying on savings

- Stronger Social Security system

Cons:

- Hard for workers in physical jobs

- Health problems may prevent longer work

- Age discrimination can limit job options

Over half of retirees (58%) oppose raising the retirement age.

Retirement Bucket Strategy 2025: How to Use the 3-Bucket Retirement Strategy

2. Working Part-Time During Retirement

Many retirees now take part-time jobs.

Pros:

- Extra income

- Social interaction

- Slower withdrawal of savings

Cons:

- Less freedom in retirement

- Health or mobility limits

- Fewer job opportunities for older workers

This option works well for healthy retirees, but not everyone can do it.

3. Downsizing or Relocating

Selling a large home and moving to a smaller or cheaper place.

Pros:

- Lower monthly costs

- Cash from home equity

- Easier home maintenance

Cons:

- Emotional attachment to family home

- Moving costs

- Leaving friends and community

This can improve finances, but it can be emotionally difficult.

4. Better Financial Planning Earlier in Life

Starting retirement planning in your 20s or 30s.

Pros:

- Compound growth over time

- Less stress later in life

- More financial freedom

Cons:

- Hard for low-income workers

- Student loans and living costs limit savings

- Requires strong financial education

Early planning is powerful — but not always easy.

Retirement WARNING: New 401(k) Rule in 2026 Will Cost High Earners Big

Expert Insight: What 2026 Tells Us About the Future

Retirement is changing.

In the past, many workers had pensions. Today, most depend on 401(k) plans and personal savings. That means individuals carry more risk.

At the same time:

- Healthcare costs continue to rise

- Americans live longer

- Inflation remains higher than pre-2020 levels

- Social Security faces long-term funding challenges

This creates pressure from every direction.

Retirement in 2026 is not just about saving money. It is about planning wisely, controlling expenses, and staying flexible.

Is America Truly in a Retirement Crisis?

For many retirees, the answer feels like yes.

The gap between what people need ($823,800) and what they have ($288,700) is wide. Too wide.

But it is not hopeless.

With smarter policies, better financial education, delayed retirement options, and flexible work models, the situation can improve.

The retirement system is not collapsing — but it is under strain.

Final Thoughts: What Should Americans Do Now?

If you are already retired:

- Review your spending

- Explore part-time income options

- Speak with a financial advisor

- Consider housing adjustments

If you are still working:

- Start saving early

- Take full advantage of employer matching

- Invest consistently

- Avoid unnecessary debt

Retirement is no longer automatic. It requires planning.

The sooner Americans adjust to this new reality, the stronger their financial future will be.

FAQs About the US Retirement Crisis 2026

How much do Americans need to retire comfortably in 2026?

About $823,800 according to recent survey data.

What is the average retirement savings in 2026?

Roughly $288,700.

Are most retirees confident about their finances?

No. Many worry about maintaining their lifestyle long term.

Is raising the retirement age a solution?

It could help financially, but many retirees oppose it due to health and job concerns.

Conclusion on Retirement Crisis 2026

Retirement in 2026 looks very different from what previous generations expected. Costs are higher. Savings are lower. And uncertainty is growing.

But knowledge is power.

Understanding the problem is the first step toward solving it.

America may be facing a retirement challenge — but with smart decisions and practical planning, it does not have to become a permanent crisis.

Hi there! I am Sudip Sengupta, the face behind “Tfin Career”. Tfin Career is a sole proprietorship finance and consulting firm that makes complex tax and financial concepts easy to understand for everyone. With more than 21 years of experience in the field, I have noticed that people cannot make the right decisions in this field. So, I decided to create “Tfin Career” to help individuals and businesses alike. Here I urge those who are confused to make better choices. Also, it is good news for my dear clients and every visitor that I/we are going to start a training module for those who want to choose a career path in Finance and Taxation. Just follow my website.

Thank you for reading this post, don't forget to subscribe!