Hello World

Taxes

Tax Loss Harvesting: Turns Losses Into Tax Savings – Professional Review

Discover what tax loss harvesting is, how it works, and how investors can offset gains, reduce taxes, and carry forward losses for tax efficient investing

Taxes

2025 Tax Changes You Need to Know Before Filing

Learn the 10 biggest 2025 tax changes under the One Big Beautiful Bill Act. Simple explanations, pros and cons, and planning insights.

Taxes

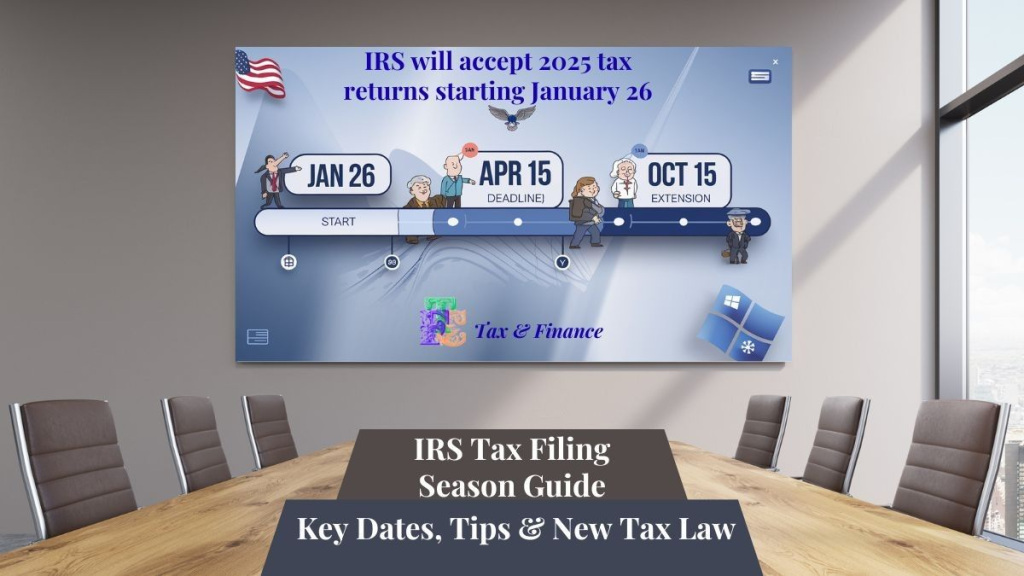

2026 IRS Tax Filing Season Guide: Key Dates, Tips & New Tax Law Changes — Everything you need to know

Prepare for IRS tax filing season 2026 with our beginner-friendly guide — January start, deadlines, credits, deductions, and refund tips to make filing easier.

Taxes

How to Pay Less Tax on Investments in 2025 Using IRS Capital Gains Tax Worksheet

Capital Gains Tax Worksheet: Discover how investment income can lower your tax bill in 2025 using the IRS capital gains tax worksheet

Taxes

Ultimate Guide to the IRS Qualified Dividends and Capital Gain Tax Worksheet (Line 16)

Learn how the IRS Qualified Dividends and Capital Gain Tax Worksheet works, how Line 16 is calculated, and how lower tax rates apply to investment income.

Taxes

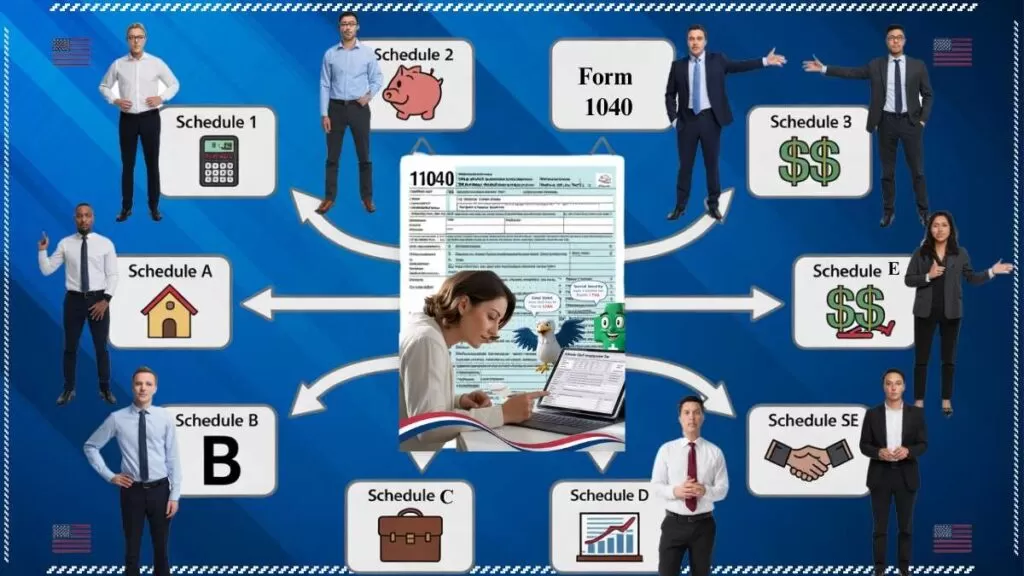

Form 1040 Tax Schedules Guide — How to File by April 15, 2026

A clear, beginner-friendly breakdown of Form 1040 Tax Schedules for 2025 tax filing. Discover how Schedules 1–3, A, B, C, D, E, and SE affect your return.