How DoorDash Taxes are implemented on Drivers

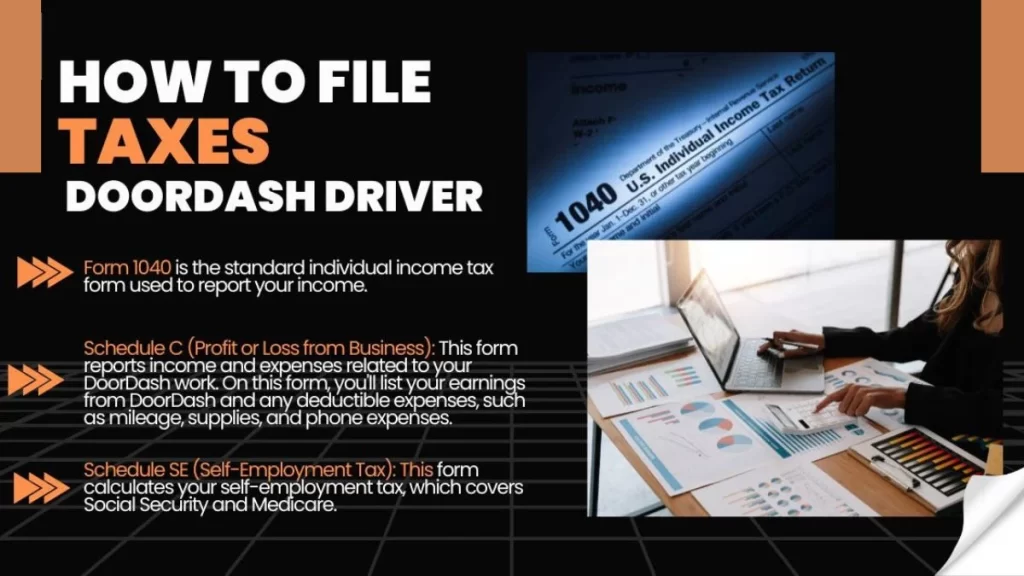

As an independent contractor, you are responsible for income and self-employment taxes.

Income tax: This tax is based on your total income for the year. As a DoorDash driver, your income includes:

- All payments you receive from DoorDash.

- Tips from customers.

- Any other sources of income you earn from driving.

Self-employment tax: Since you’re not an employee, you are also responsible for self-employment taxes. This tax covers Social Security and Medicare contributions, typically split between employers and employees in traditional jobs. However, as an independent contractor, you pay the employer and employee portions, totalling 15.3%.

These taxes can add up, so keeping track of all your earnings and deductions is essential to reducing your tax burden.

Thank you for reading this post, don't forget to subscribe!