Hello World

Blog

Fair Taxes, Fair Society: A Simple Breakdown of Progressive Tax System

Wondering how the progressive tax system affects you? This guide simplifies tax brackets and rates, so you can understand how taxes work and why they’re important.

Blog

Breaking Down the Marginal Tax Rate: What You Pay

Understand your marginal tax rate, how it’s calculated, and how it differs from other tax rates. Use examples to see how different income levels are taxed.

Blog

Trump’s Overtime Tax Proposal 2025: The Truth About Your Extra Earnings

Overtime Tax: Wondering if your overtime pay is taxed? How overtime taxes work in the USA and what you need to know to keep more of your hard-earned money

Blog

Inflation-Protective Tax Brackets Adjustment May Affect Your Tax

Get ready for tax season! Discover how income tax brackets adjustments can impact your tax liability. Detailed guide helps you understand the changes and plan your finances wisely

Blog

Tax Loopholes 2024: Only Rich People Understand

Tax Loopholes: These assessment benefits can maximize riches maintenance, permitting long-term money-related development and soundness.

Blog

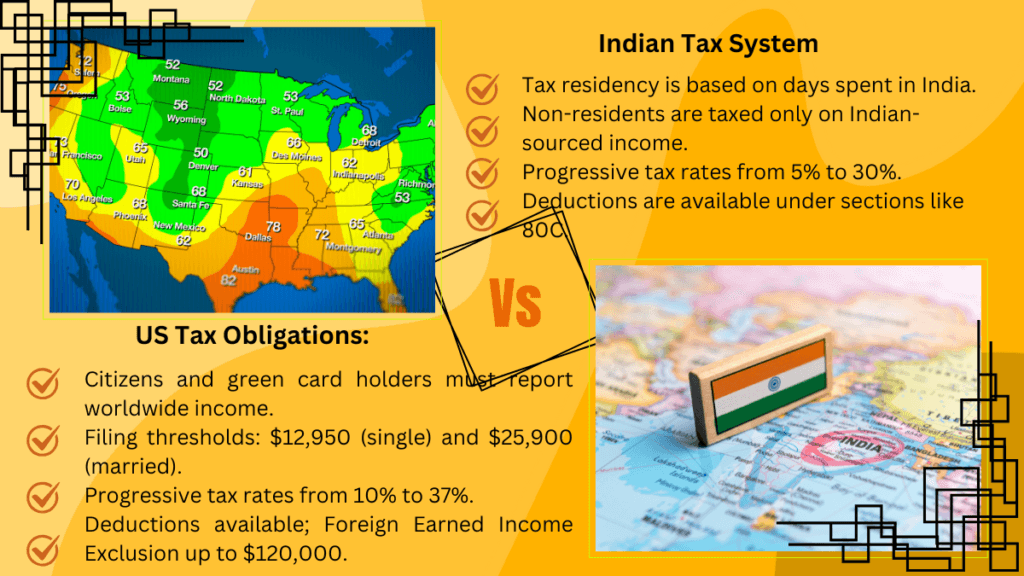

Tax Mastery for Expats: Ultimate Guide to Navigating US and India Tax Systems

US and India Tax Systems: Expats and visa holders in the United States and India face distinct tax obligations based on their residency status, income sources, and the tax treaties between the two countries