Hello World

Blog

New 2025 Property Tax Rules – Tax Loopholes You Need to Know

Selling your home? These 2025 Property Tax rules could save you thousands. See real examples of how smart sellers are eliminating capital gains tax..

Blog

How to Pay 0% Capital Gains Tax (Legally) in 2025: What You Need to Know

Capital gains tax rates are changing in 2025. This guide breaks down short-term (up to 37%) vs long-term (0%-20%) rates, NIIT surcharges, and loopholes to save.

Blog

Beat the Tax: How to Use Tax Loss Harvesting for Maximum Savings in 2025

Tax loss harvesting can cut your 2024 taxes! Explore 6 essential FAQs to learn how this strategy can help you keep more of your money!

Blog

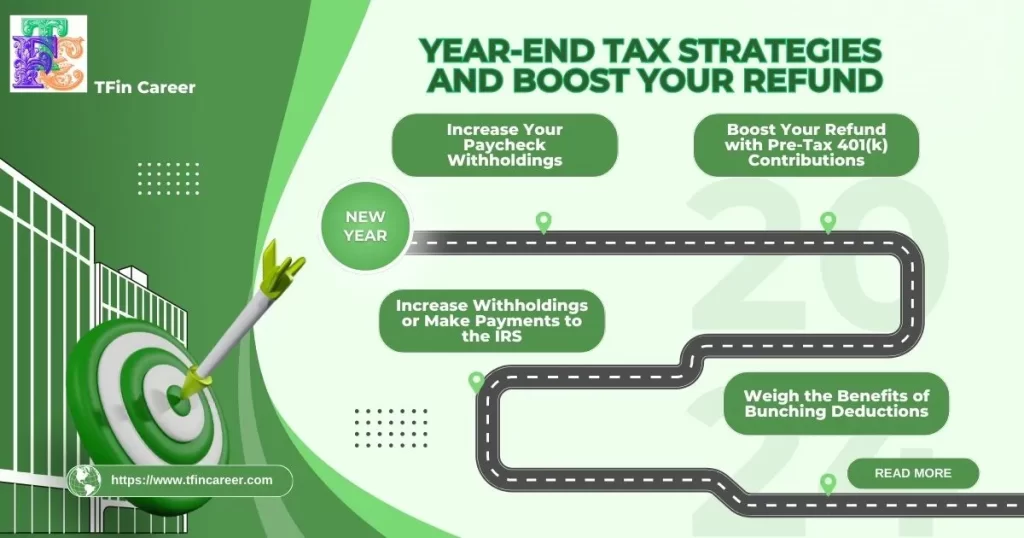

End-of-Year Tax Strategies: How to Lower Your Taxes or Boost Your Refund for 2024

Take control of your taxes before 2024! Discover 4 Simple Ways to Cut Your Taxes and Boost Your Refund Before 2024

Blog

2024 Tax Brackets: Surprising Financial Landscape for Families with Children

Unlock the secrets of 2024 tax brackets! Discover how your family can save hundreds, navigate the new 'Goldilocks Zone,' and turn tax changes into opportunities. Learn smart strategies to keep more money in your pocket and less stress in your life. Your family's financial wellness starts here!

Blog

Tax Bracket Changes: What Middle-Income Earners Need to Know Practical

Explore how 2024 tax bracket changes impact middle-income earners. Learn about expanded brackets, potential savings, and smart planning strategies for the new tax year.