Hello World

Taxes

Tax Planning Checklist: How to Lower Your 2025 Tax

Plan ahead with this 2025 Year End Tax Planning Checklist to legally lower your federal tax, capture deductions, and maximize credits before Dec. 31, 2025

Taxes

How to Take Tax Advantage of the 2025 SALT Deduction Increase | Year-End Tax Guide

Take Tax Advantage: Maximize your 2025 tax savings before December 31 — learn how to leverage SALT deduction, health-savings accounts (HSA), tax-loss harvesting and charitable giving with clear law references

Blog

Section 174A Explained: Should Eligible Small Businesses Amend Now?

Fully understand Section 174A relief for 2022 24 R&D: eligibility, deadlines, and strategic pros/cons of amending vs filing new returns.

Blog

IRS Guidance Roundup: A Clear & Simple Summary

Discover the IRS Guidance Roundup June–July 2025 updates: 1099 NEC reporting raised to $2,000, Opportunity Zone rules made permanent, and updated Employee Retention Credit deadlines. Stay compliant and informed!

Financial Tools

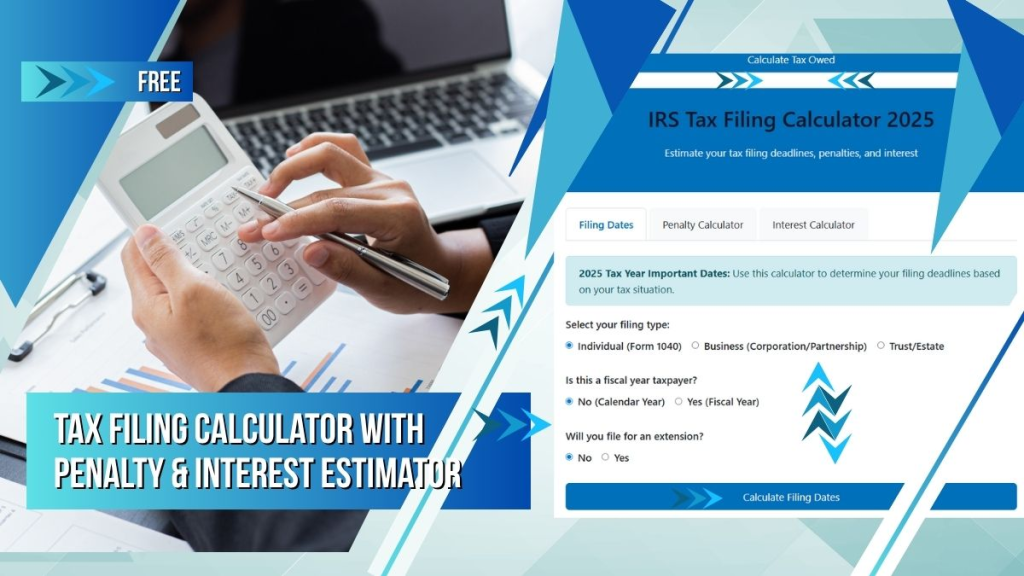

Tax Filing Calculator With Penalty & Interest Estimator 2025 | Free

Use our free 2025 IRS tax filing calculator to estimate refunds, penalties, and interest. Covers all filing statuses, credits, and late fees. Get accurate projections now!"

Blog

2025 Capital Gains Tax: Rates, Strategies & How to Pay Less

2025 capital gains tax rates just updated! Learn 5 legal strategies to reduce taxes on stocks, real estate & investments. Includes calculator examples