Hello World

Taxes

How It’s Possible to Legally Pay Zero Federal Income Tax

Learn how to legally pay zero federal income tax in 2025 — step-by-step IRS-compliant strategies, deductions, credits, and planning for high earners

Taxes

Tax Planning Checklist: How to Lower Your 2025 Tax

Plan ahead with this 2025 Year End Tax Planning Checklist to legally lower your federal tax, capture deductions, and maximize credits before Dec. 31, 2025

Taxes

How to Take Tax Advantage of the 2025 SALT Deduction Increase | Year-End Tax Guide

Take Tax Advantage: Maximize your 2025 tax savings before December 31 — learn how to leverage SALT deduction, health-savings accounts (HSA), tax-loss harvesting and charitable giving with clear law references

Taxes

TurboTax Guide 2026: How to File Taxes Easily & Max Your Refund

Discover how TurboTax simplifies tax filing with step-by-step guidance for salaried, self-employed or investment income — get the maximum refund without stress

Taxes

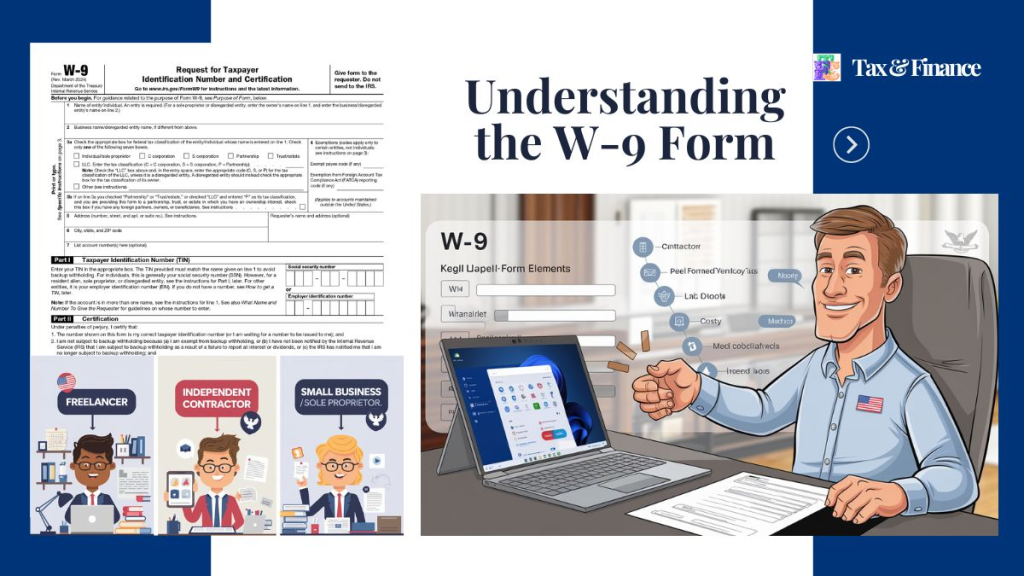

How to Fill Out a W-9 Form — Step-by-Step Tutorial

Learn what the W-9 form is, why your client needs it, and how freelancers or contractors use it to avoid backup withholding — easy, step-by-step explanation

Blog

Index Funds: Should You Buy Now, in an Overvalued Market?

Highlighting the main pros of investing in index funds in this environment, such as diversification, lower fees, passive approach, and long-term perspective.