Hello World

Blog

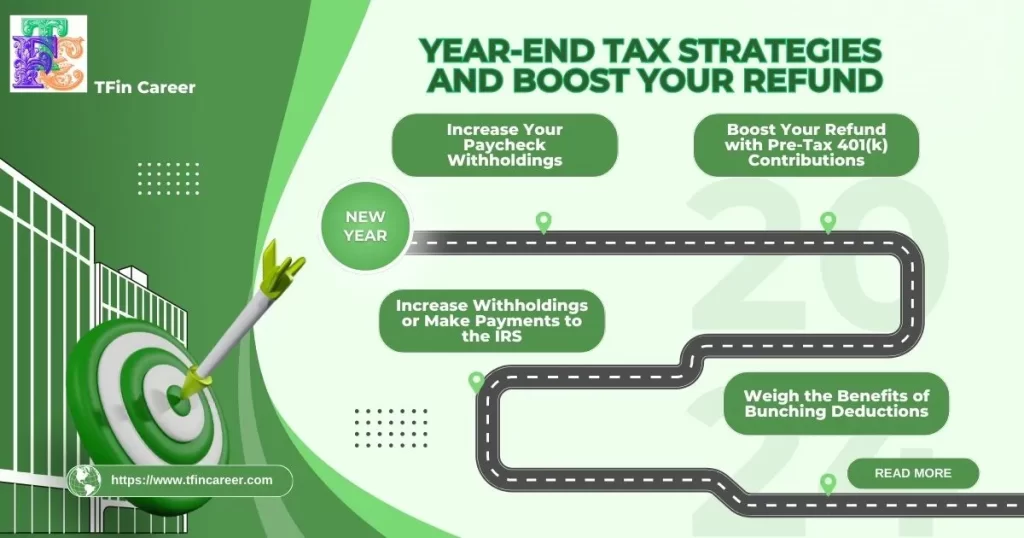

End-of-Year Tax Strategies: How to Lower Your Taxes or Boost Your Refund for 2024

Take control of your taxes before 2024! Discover 4 Simple Ways to Cut Your Taxes and Boost Your Refund Before 2024

Blog

Tax Bracket Changes: What Middle-Income Earners Need to Know Practical

Explore how 2024 tax bracket changes impact middle-income earners. Learn about expanded brackets, potential savings, and smart planning strategies for the new tax year.

Blog

IRS Announces Major Tax Deadline Extension for 2024: What You Need to Know

IRS shakes up tax season with major deadline extension. Uncover the reasons behind this move and what it means for your 2024 taxes.