Hello World

Blog

Winning The Powerball: Unlocking the Secrets of Taxes

Winning the Powerball is exciting, but taxes are part of the deal. Get full explanation how much you'll owe, from federal to local taxes, and how to handle it

Blog

OLT Tax Filing: The Easiest and Most Affordable Way to File Your Taxes

OLT Tax Filing: Is OLT the right choice for your tax filing? Read this guide to understand how OLT works, its pricing, and whether non-residents can use it.

Blog

tax credit eitc: the earned pay how to claim

Claim the EITC and get a bigger refund! Simple guide to qualifying, filing, and maximizing your refund with the Earned Income Tax Credit

Blog

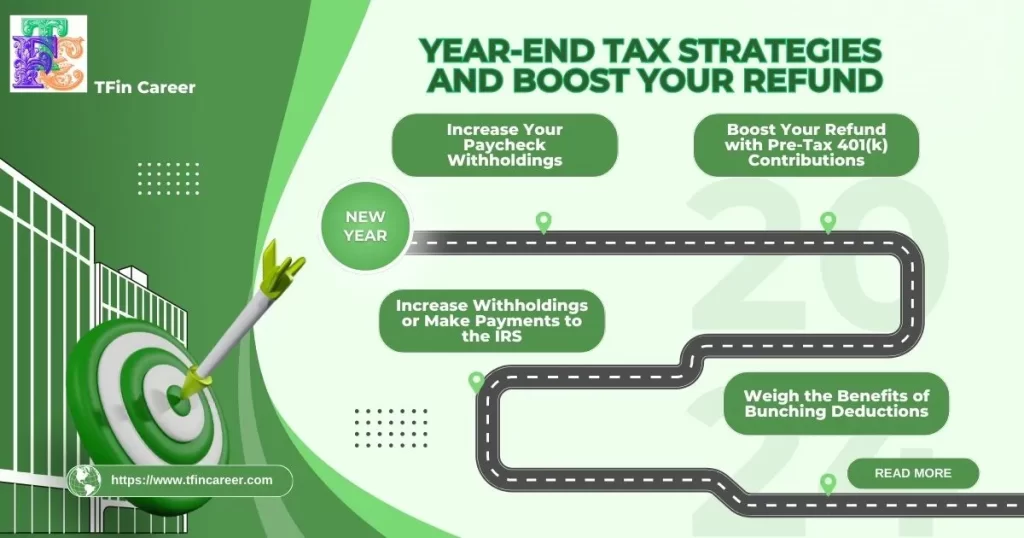

End-of-Year Tax Strategies: How to Lower Your Taxes or Boost Your Refund for 2024

Take control of your taxes before 2024! Discover 4 Simple Ways to Cut Your Taxes and Boost Your Refund Before 2024