Hello World

Blog

2025 Tax Extension: How to File + Deadlines Explained

Learn how to file IRS Form 4868 for 2025 tax extension, key deadlines, and payment tips to avoid penalties.

Blog

New IRS 1099-K Threshold: Avoid Penalties for Unreported Side Hustles

New IRS 1099-K rule lowers threshold to $600. Find out if your side hustle income is taxable and how to stay compliant.

Blog

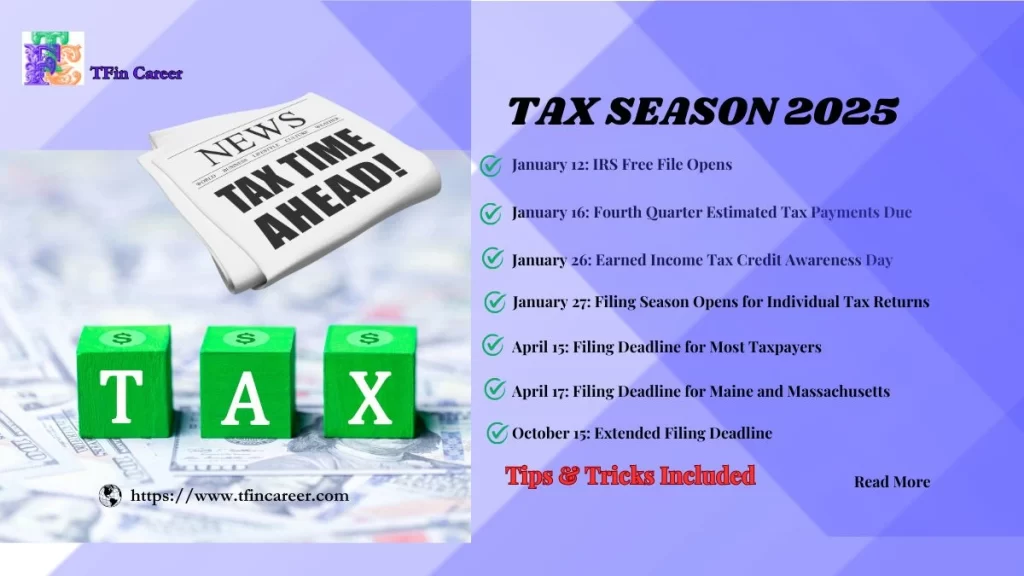

2024 Tax Deadlines: Key Dates You Need to Know

Don’t miss the 2024 tax deadlines! Learn key IRS dates, how to file for free, EITC eligibility, and tips for a faster refund. File on time and avoid penalties!