This professional tax filing calculator helps you:

- Calculate Your 2025 Tax Owed

- Estimates federal tax based on income, filing status, credits, and payments

- Uses projected 2025 tax brackets

- Determine Penalties & Interest

- Calculates late filing (5%/month) and late payment (0.5%/month) penalties

- Computes daily interest (8% annual rate for 2025) on unpaid balances

Key Features:

- Two-step workflow (Tax Owed → Penalties)

- Auto-fills amounts between sections

- Handles all filing statuses

- Mobile-friendly design with tooltips

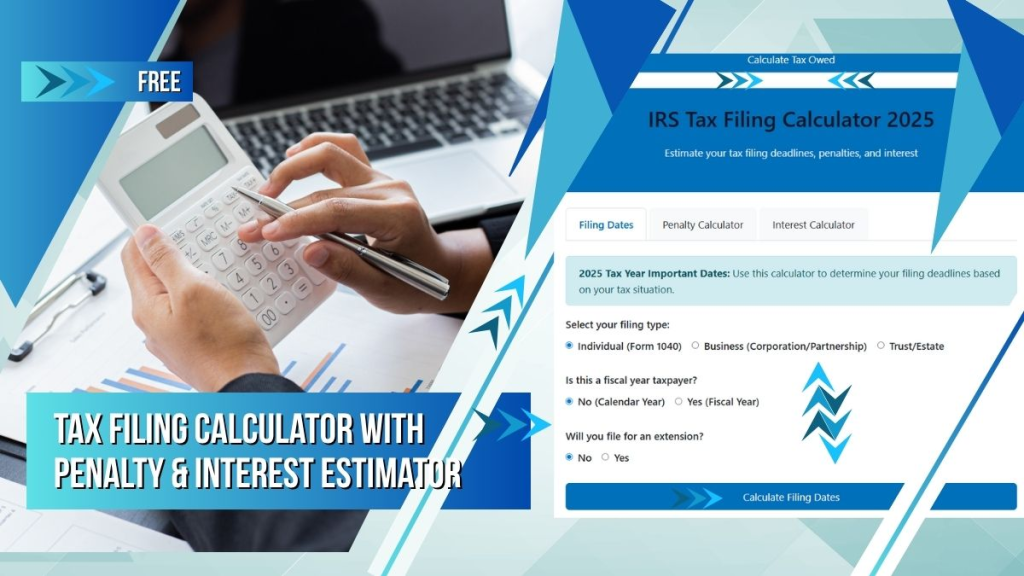

IRS Tax Filing Calculator 2025

Calculate tax owed, then estimate penalties and interest

IRS Tax Filing Calculator 2025

Estimate your tax filing deadlines, penalties, and interest

You can also check your Taxes from the Internal Revenue Service

Key Points of Tax Filing Calculator

- Four Calculation Tools in One:

- Calculator for Tax Owed

- Filing deadline calculator with extensions

- Penalty estimator (late filing, late payment, underpayment)

- Interest calculator for unpaid taxes

- 2025-Specific Updates:

- Uses current IRS interest rate (8% for 2025)

- Includes all 2025 tax deadlines

- Handles fiscal year taxpayers correctly

- User-Friendly Design:

- Responsive layout works on all devices

- Clear tab navigation between calculators

- Help tooltips for complex fields

- Accessible form controls

- Professional Tax Filing Calculator:

- Accurate penalty formulas (monthly rates, maximum caps)

- Daily compounding interest

- Proper handling of weekends/holidays

- Fiscal year adjustments

- Clear Results Display:

- Well-formatted result cards

- Breakdown of calculations

- Explanatory notes

The calculator provides estimates that closely match IRS calculations but always recommends verifying with a tax professional for final figures.

Explore Our Financial Tools

Capital Gains Tax Calculator 2025-2026: Estimate Your IRS Liability (Free Tool)

This calculator estimates your capital gains tax liability for the 2025 and 2026 tax years based on projected IRS tax brackets and rates. It includes:

Smart Investment Calculator | Forecast Growth with Inflation Insights

Our advanced investment calculator helps you forecast long-term wealth growth while accounting for inflation and increasing contributions. Its dynamic projections, presented in nominal and real values, help you make informed financial decisions.

Future-Proof Your Dreams: The Wealth Creation Calculator

Your aspirations—owning a sunlit beachfront property, cruising in a sleek convertible, or launching the next big start-up—reflect who you are and where you’re headed.

Retirement Calculator: Plan Your Future & Achieve Financial Security

Welcome to the Interactive Retirement Planner, a comprehensive tool designed to help you estimate your retirement savings needs.

Advanced Income Tax Calculator

The Advanced Income Tax Calculator for 2024-2025 is designed to help individuals estimate their federal and state tax liabilities.

Hi there! I am Sudip Sengupta, the face behind “Tfin Career”. Tfin Career is a sole proprietorship finance and consulting firm that makes complex tax and financial concepts easy to understand for everyone. With more than 21 years of experience in the field, I have noticed that people cannot make the right decisions in this field. So, I decided to create “Tfin Career” to help individuals and businesses alike. Here I urge those who are confused to make better choices. Also, it is good news for my dear clients and every visitor that I/we are going to start a training module for those who want to choose a career path in Finance and Taxation. Just follow my website.

Thank you for reading this post, don't forget to subscribe!