Understanding Solvency Ratio

Solvency ratio is a key financial metrics that measure a company’s ability to meet its long-term obligations, indicating its overall financial health. These ratios are crucial for investors, creditors, and management to assess the financial stability and risk level of a business.

Solvency ratios differ from liquidity ratios, which focus on short-term financial health. While liquidity ratios measure a company’s ability to cover immediate obligations, solvency ratios evaluate long-term stability and debt repayment capacity.

Regular monitoring of solvency ratios helps businesses make informed decisions about capital structure, debt management, and strategic planning. These ratios are particularly important during economic downturns or when considering expansion plans.

Solvency Ratio Calculator

Expert financial analysis for business stability assessment

Solvency ratios measure a company’s ability to meet its long-term obligations and indicate its financial health. Use these calculators to assess key solvency metrics.

Debt-to-Equity Ratio

Formula: Total Debt / Total Equity

Expert Insight: Measures financial leverage. A ratio above 2.0 may indicate higher risk, while below 1.0 suggests more conservative financing.

Debt-to-Asset Ratio

Formula: Total Debt / Total Assets

Expert Insight: Shows the percentage of assets financed by debt. Above 0.6 may indicate higher risk, while below 0.4 suggests stronger financial stability.

Times Interest Earned (TIE) Ratio

Formula: EBIT / Interest Expense

Expert Insight: Measures a company’s ability to cover interest payments. A ratio below 1.5 may signal financial distress, while above 2.5 indicates comfortable coverage.

Equity Ratio

Formula: Total Equity / Total Assets

Expert Insight: Indicates the proportion of assets financed by equity. Higher ratios (above 0.6) suggest lower financial risk, while lower ratios (below 0.4) may indicate higher leverage.

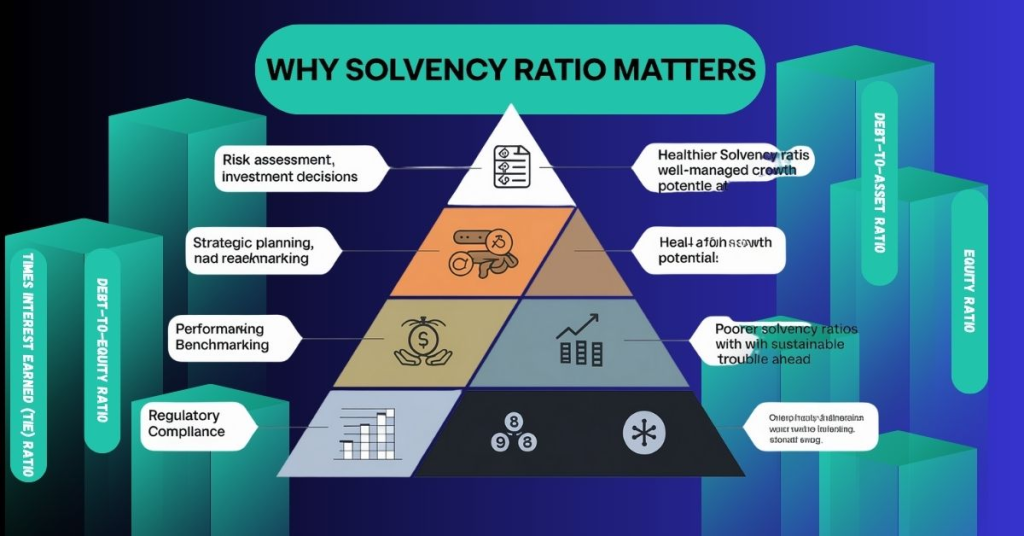

Why Solvency Ratio Matters

- Risk Assessment: Helps creditors evaluate the risk associated with lending to a business

- Investment Decisions: Provides investors with insight into a company’s financial stability

- Strategic Planning: Guides management in making decisions about debt and equity financing

- Performance Benchmarking: Allows comparison with industry standards and competitors

- Early Warning System: Identifies potential financial distress before it becomes critical

- Regulatory Compliance: Ensures businesses meet financial health requirements

To know more, read this related journal from Wall Street, “Solvency Ratio”

Healthy solvency ratios typically indicate a well-managed company with sustainable growth potential, while poor ratios may signal financial trouble ahead.

Hi there! I am Sudip Sengupta, the face behind “Tfin Career”. Tfin Career is a sole proprietorship finance and consulting firm that makes complex tax and financial concepts easy to understand for everyone. With more than 21 years of experience in the field, I have noticed that people cannot make the right decisions in this field. So, I decided to create “Tfin Career” to help individuals and businesses alike. Here I urge those who are confused to make better choices. Also, it is good news for my dear clients and every visitor that I/we are going to start a training module for those who want to choose a career path in Finance and Taxation. Just follow my website.

Thank you for reading this post, don't forget to subscribe!