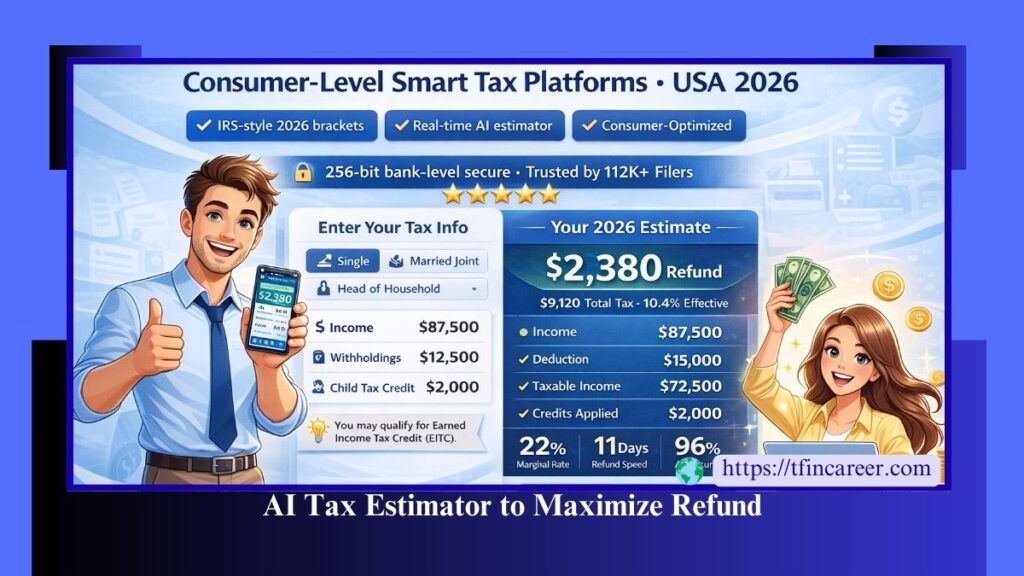

Free 2026 Tax Estimator: Estimate Your Refund with This Smart AI Tool

Consumer-Level Smart Tax Platforms – USA 2026

Calculate your 2025 return (taxes you file in 2026) with our tax refund estimator by TurboTax

Frequently Asked Questions

Is this tax calculator really for the 2026 tax year?

Yes, this calculator is specifically designed for the 2026 tax year. It uses projected IRS tax brackets, standard deductions, and credit limits based on current legislation and inflation trends.

How does the ‘AI estimator’ feature work?

The AI estimator analyzes your inputs in real-time and cross-references this data with historical tax scenarios to provide personalized tips, such as adjusting your W-4 withholding or increasing retirement contributions.

Is this tool really free, and is it accurate?

Absolutely. The calculator is 100% free with no sign-up. It uses the same progressive tax bracket logic as the IRS, making it a powerful estimate for planning purposes.

Is my financial data secure on this platform?

Yes. All calculations happen directly in your browser (client-side). We do not store, sell, or transmit your income or personal details to any server.

How can I maximize my refund using this calculator?

Test different scenarios: switch between ‘Standard’ and ‘Itemized’ deductions, input dependents for the Child Tax Credit, and read the dynamic ‘Smart Tip’ box for personalized advice like EITC eligibility.

Our Other Free Financial Tools:

Salary Take-Home Paycheck Calculator: All-in-One Result-Oriented

Finance Calculator Suite: Time Value of Money, Loans, And Investments

FinRisk Pro 2026: Best Free Financial Risk Management Tools and Trends

Hi there! I am Sudip Sengupta, the face behind “Tfin Career”. Tfin Career is a sole proprietorship finance and consulting firm that makes complex tax and financial concepts easy to understand for everyone. With more than 21 years of experience in the field, I have noticed that people cannot make the right decisions in this field. So, I decided to create “Tfin Career” to help individuals and businesses alike. Here I urge those who are confused to make better choices. Also, it is good news for my dear clients and every visitor that I/we are going to start a training module for those who want to choose a career path in Finance and Taxation. Just follow my website.

Thank you for reading this post, don't forget to subscribe!