How DoorDash Taxes are implemented on Drivers

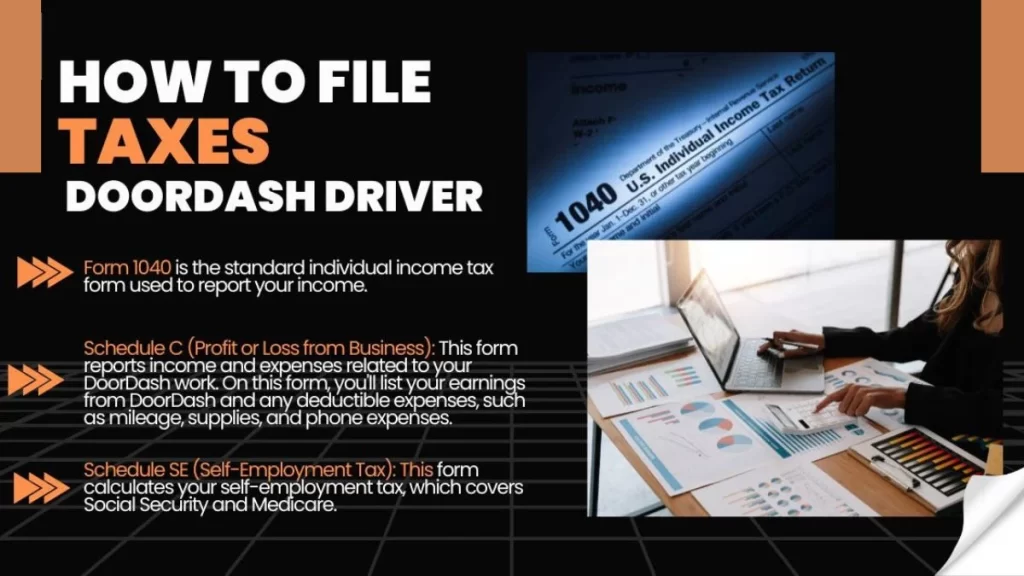

As an independent contractor, you are responsible for income and self-employment taxes.

Income tax: This tax is based on your total income for the year. As a DoorDash driver, your income includes:

- All payments you receive from DoorDash.

- Tips from customers.

- Any other sources of income you earn from driving.

Self-employment tax: Since you’re not an employee, you are also responsible for self-employment taxes. This tax covers Social Security and Medicare contributions, typically split between employers and employees in traditional jobs. However, as an independent contractor, you pay the employer and employee portions, totalling 15.3%.

These taxes can add up, so keeping track of all your earnings and deductions is essential to reducing your tax burden.

Hi there! I am Sudip Sengupta, the face behind “Tfin Career”. Tfin Career is a sole proprietorship finance and consulting firm that makes complex tax and financial concepts easy to understand for everyone. With more than 21 years of experience in the field, I have noticed that people cannot make the right decisions in this field. So, I decided to create “Tfin Career” to help individuals and businesses alike. Here I urge those who are confused to make better choices. Also, it is good news for my dear clients and every visitor that I/we are going to start a training module for those who want to choose a career path in Finance and Taxation. Just follow my website.

Thank you for reading this post, don't forget to subscribe!