Conclusion

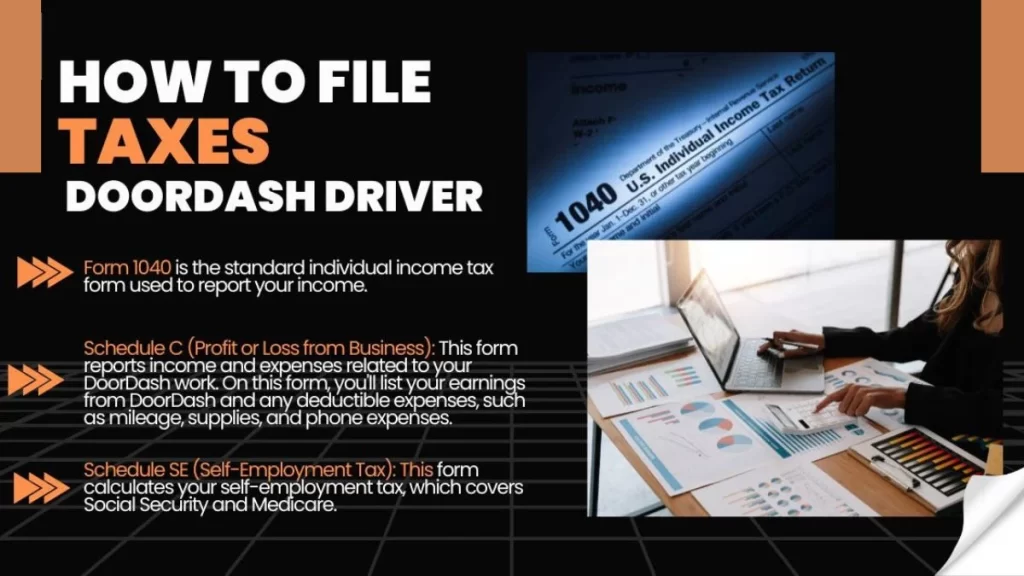

Recording tax as a DoorDash driver can appear overwhelming, but remaining organized and understanding your assessment commitments can make the preparation much more straightforward.

Remember to track your earnings and expenses, take advantage of available deductions, and file your taxes on time to avoid penalties. If you’re unsure, consulting a tax professional can provide peace of mind and ensure you file correctly. Start preparing early, and you’ll be ready for tax season!

Related Links to Know More…….

- www.everlance.com/tax-calculator/doordash

- https://support.stripe.com/express/questions/guide-to-1099-tax-forms-for-doordash-dashers-and-merchants

- help.doordash.com/merchants/s/article/How-do-I-file-taxes-when-partnering-with-DoorDash?

Hi there! I am Sudip Sengupta, the face behind “Tfin Career”. Tfin Career is a sole proprietorship finance and consulting firm that makes complex tax and financial concepts easy to understand for everyone. With more than 21 years of experience in the field, I have noticed that people cannot make the right decisions in this field. So, I decided to create “Tfin Career” to help individuals and businesses alike. Here I urge those who are confused to make better choices. Also, it is good news for my dear clients and every visitor that I/we are going to start a training module for those who want to choose a career path in Finance and Taxation. Just follow my website.

Thank you for reading this post, don't forget to subscribe!