Introduction: Why U.S. Tax Reform 2026 Is a Turning Point

Tax reform is not just a political headline. It affects your paycheck, your business, your savings, and even where you choose to live.

In 2026, the United States introduced major tax changes that reshape how income is taxed for workers, families, multinational companies, and Americans living abroad. These updates build on earlier reforms and introduce new worker-focused deductions, international adjustments, and corporate tax modifications.

Some people will benefit immediately.

Some will need to adjust their financial plans.

And everyone should understand what is changing.

This pillar guide explains everything in simple English, so every reader can understand it clearly.

Tax Reform and Next steps to Get Ready for the 2026 tax filing season

Section 1: The Big Picture – What Is U.S. Tax Reform 2026?

U.S. Tax Reform 2026 refers to a set of legislative updates designed to:

- Provide relief to workers

- Adjust international tax rules

- Maintain certain lower tax rates

- Increase fairness in corporate taxation

- Modernize compliance requirements

The reform package is connected to broader policy discussions often associated with the One Big Beautiful Bill Act and related tax extensions.

The main goals are economic growth, tax fairness, and stability.

But like every major reform, it has strengths and weaknesses.

2025 Tax Changes You Need to Know Before Filing

Tax Reform Section 2: Worker Tax Relief in 2026

One of the most talked-about elements of U.S. Tax Reform 2026 is worker-focused relief.

Key Changes for Workers

- Deduction options for tipped income

- Favorable treatment for certain overtime earnings

- Continued higher standard deductions

- Adjusted tax brackets

The focus is simple: increase take-home pay.

Pros of Worker Tax Relief

- More disposable income

- Supports service and hourly workers

- Encourages economic spending

- Helps middle-income households

Cons of Worker Tax Relief

- Temporary provisions may expire

- Budget deficit concerns

- Not equal benefit for all income groups

- Complexity in qualification rules

Section 3: Standard Deduction and Individual Tax Brackets

The standard deduction remains higher than pre-2017 levels. This means many taxpayers do not need to itemize deductions.

Tax Reform: Why This Matters

- Simplifies filing

- Reduces taxable income

- Benefits middle-class families

Adjusted brackets also prevent some taxpayers from moving into higher tax rates too quickly.

Pros

- Easier filing process

- Lower taxable income for many

- Stability in personal planning

Cons

- High earners may see limited benefit

- Future political changes could reverse policies

Section 4: Tax Changes for Americans Living Abroad

The U.S. taxes citizens on worldwide income. This is different from most countries.

Tax Reform 2026 Updates Include:

- Higher foreign earned income exclusion limits

- Continued enforcement of foreign bank reporting

- Ongoing debate about global taxation reform

This impacts digital nomads, retirees abroad, and international entrepreneurs.

Pros for Americans Abroad

- Higher exclusion reduces taxable income

- More clarity in reporting requirements

- Improved alignment with international standards

Cons for Americans Abroad

- Worldwide taxation remains

- Complex forms like FBAR are still required

- Penalties for non-compliance remain strict

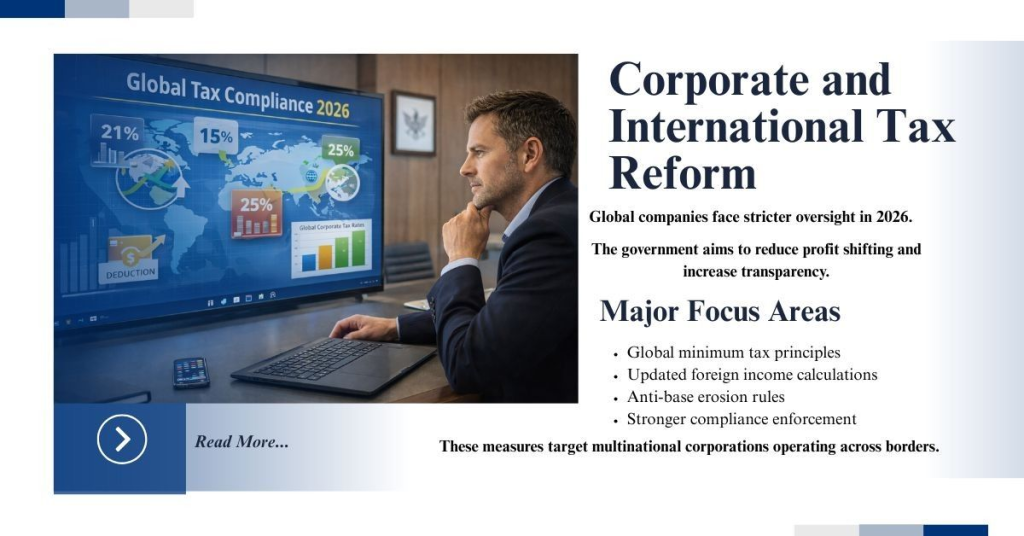

Tax Reform Section 5: Corporate and International Tax Reform

Global companies face stricter oversight in 2026.

The government aims to reduce profit shifting and increase transparency.

Tax Reform: Major Focus Areas

- Global minimum tax principles

- Updated foreign income calculations

- Anti-base erosion rules

- Stronger compliance enforcement

These measures target multinational corporations operating across borders.

Pros of Corporate Reform

- Increased fairness

- Higher transparency

- Potential rise in federal revenue

- Encourages domestic reinvestment

Cons of Corporate Reform

- Higher compliance costs

- More reporting complexity

- Possible competitive disadvantage globally

Section 6: Economic Impact of U.S. Tax Reform 2026

Tax policy influences:

- Job creation

- Business investment

- Consumer spending

- Federal debt levels

Supporters argue the reform boosts growth by putting money back into the economy.

Critics warn about long-term fiscal sustainability.

The real outcome depends on economic performance and future policy decisions.

Section 7: How Families and Retirees Are Affected

Tax Reform – Families benefit from:

- Higher deductions

- Adjusted credits

- Stable income brackets

Retirees may benefit from favorable income treatment and adjusted thresholds.

Pros for Families and Seniors

- Reduced tax liability

- Greater financial stability

- Easier retirement planning

Cons

- Temporary provisions create uncertainty

- Inflation may offset benefits

Section 8: Small Business Owners and Entrepreneurs

Small businesses often feel tax changes immediately.

In 2026:

- Certain pass-through benefits continue

- International compliance becomes stricter

- Deduction planning becomes more important

Pros for Small Businesses

- Continued access to key deductions

- Opportunity for strategic restructuring

- Potential growth incentives

Cons

- Increased paperwork

- Need for professional tax guidance

- Possible higher audit risk

Tax Reform Section 9: Compliance and Enforcement Trends

The IRS continues modernizing enforcement systems.

Technology and data analytics now play a larger role in:

- Detecting underreported income

- Reviewing foreign assets

- Corporate compliance checks

Taxpayers must be more accurate than ever.

Section 10: Strategic Tax Planning in 2026

Smart taxpayers should:

- Review income sources carefully.

- Evaluate deduction eligibility.

- Plan international income reporting early.

- Consider retirement contribution strategies.

- Consult certified professionals for complex matters.

Planning early reduces risk.

Form 1040 Tax Schedules Guide — How to File by April 15, 2026

Section 11: Long-Term Outlook for U.S. Tax Policy

Tax reform rarely ends with one law.

Future changes may depend on:

- Election outcomes

- Economic growth

- Federal debt levels

- Global tax agreements

Flexibility is essential.

Frequently Asked Questions

What is U.S. Tax Reform 2026?

It refers to major updates in tax law affecting workers, corporations, and Americans abroad.

Are tipped wages tax-free in 2026?

Certain deductions may apply, but a full tax exemption is not universal.

Do Americans abroad still pay U.S. taxes?

Yes. The U.S. continues to impose worldwide taxation, with exclusion limits available.

Will corporate taxes increase in 2026?

Some multinational rules have tightened, increasing compliance requirements.

Final Conclusion: Understanding the Balance

U.S. Tax Reform 2026 is both an opportunity and a challenge.

Workers may benefit.

Families gain stability.

Businesses face stricter oversight.

Americans abroad remain under global reporting rules.

Every reform includes trade-offs.

The smartest approach is awareness, preparation, and proactive planning.

Staying informed gives you financial power.

Hi there! I am Sudip Sengupta, the face behind “Tfin Career”. Tfin Career is a sole proprietorship finance and consulting firm that makes complex tax and financial concepts easy to understand for everyone. With more than 21 years of experience in the field, I have noticed that people cannot make the right decisions in this field. So, I decided to create “Tfin Career” to help individuals and businesses alike. Here I urge those who are confused to make better choices. Also, it is good news for my dear clients and every visitor that I/we are going to start a training module for those who want to choose a career path in Finance and Taxation. Just follow my website.

Thank you for reading this post, don't forget to subscribe!