Tax returns due April 15, 2026 — Advanced strategies backed by data and IRS 2025 rules focus to Legally Pay zero federal income tax

Table of Contents

- 1. Introduction: Big Idea: Legally Pay Zero Federal INCOME tAx

- 2. How Federal Income Tax Is Calculated (2025 Rules)

- 3. Key 2025 Tax Parameters (With Data)

- 4. Strategic Step-by-Step Tax Planning (With Analytics)

- 5. Data-Driven Examples & Analytics

- 6. Key Takeaways (Analytical Summary)

- 7. FAQs ON Legally Pay Zero Federal Income Tax

1. Introduction: Big Idea: Legally Pay Zero Federal INCOME tAx

Legally Pay zero federal income tax — even on a six-figure income — isn’t folklore. With smart, IRS-compliant planning, you can reduce taxable income and tax owed to zero for the 2025 tax year (returns due April 15, 2026). This guide synthesizes actual 2025 tax brackets, deduction limits, and credit values so you can see exactly which levers matter — with numbers and outcomes, not just ideas.

How to Take Tax Advantage of the 2025 SALT Deduction Increase | Year-End Tax Guide

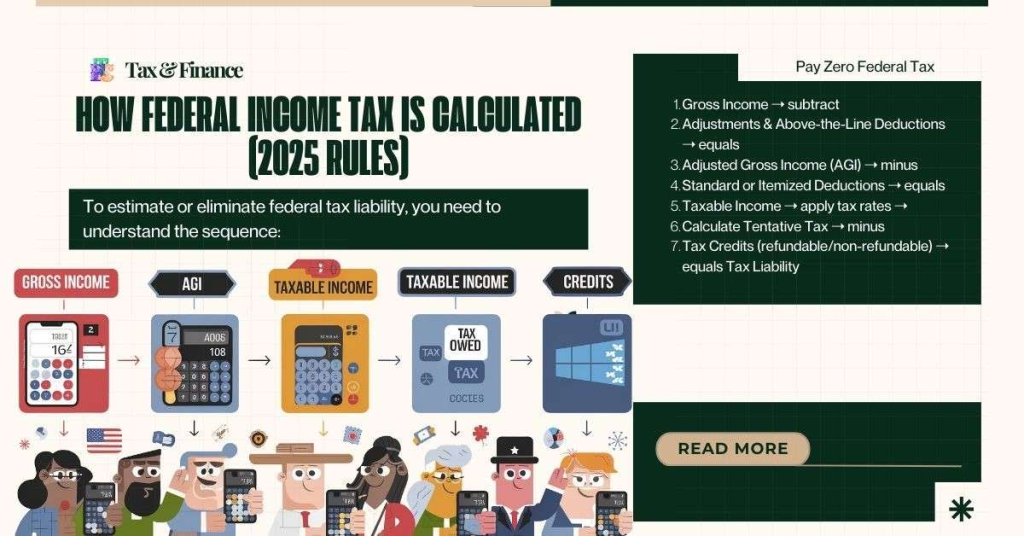

2. How Federal Income Tax Is Calculated (2025 Rules)

To estimate or eliminate federal tax liability, you need to understand the sequence:

- Gross Income ➝ subtract

- Adjustments & Above-the-Line Deductions ➝ equals

- Adjusted Gross Income (AGI) ➝ minus

- Standard or Itemized Deductions ➝ equals

- Taxable Income ➝ apply tax rates ➝

- Calculate Tentative Tax ➝ minus

- Tax Credits (refundable/non-refundable) ➝ equals Tax Liability

If deductions and credits reduce the tax owed to zero — legally — then you owe zero. It’s legal; it’s IRS-recognized. (Tax Foundation)

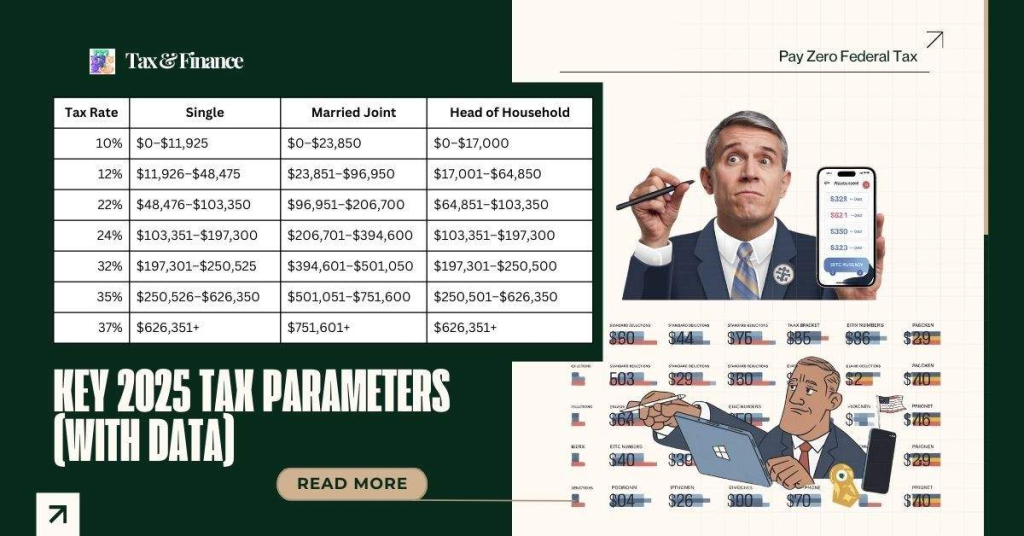

3. Key 2025 Tax Parameters (With Data)

2025 Federal Tax Brackets (Taxable Income)

| Tax Rate | Single | Married Joint | Head of Household |

| 10% | $0–$11,925 | $0–$23,850 | $0–$17,000 |

| 12% | $11,926–$48,475 | $23,851–$96,950 | $17,001–$64,850 |

| 22% | $48,476–$103,350 | $96,951–$206,700 | $64,851–$103,350 |

| 24% | $103,351–$197,300 | $206,701–$394,600 | $103,351–$197,300 |

| 32% | $197,301–$250,525 | $394,601–$501,050 | $197,301–$250,500 |

| 35% | $250,526–$626,350 | $501,051–$751,600 | $250,501–$626,350 |

| 37% | $626,351+ | $751,601+ | $626,351+ |

Top marginal rate still 37% — bracket limits inflated for 2025. (Tax Foundation)

2025 Standard Deductions

| Filing Status | Standard Deduction |

| Single | $15,000 |

| Married Filing Jointly | $30,000 |

| Head of Household | $22,500 |

Standard deductions rose modestly for 2025 due to inflation indexing. (Tax Foundation)

Earned Income Tax Credit (EITC) — 2025

| Qualifying Children | Max EITC |

| 0 | $649 |

| 1 | $4,328 |

| 2 | $7,152 |

| 3+ | $8,046 |

This refundable credit can directly reduce tax owed — and possibly generate a refund. (CNBC)

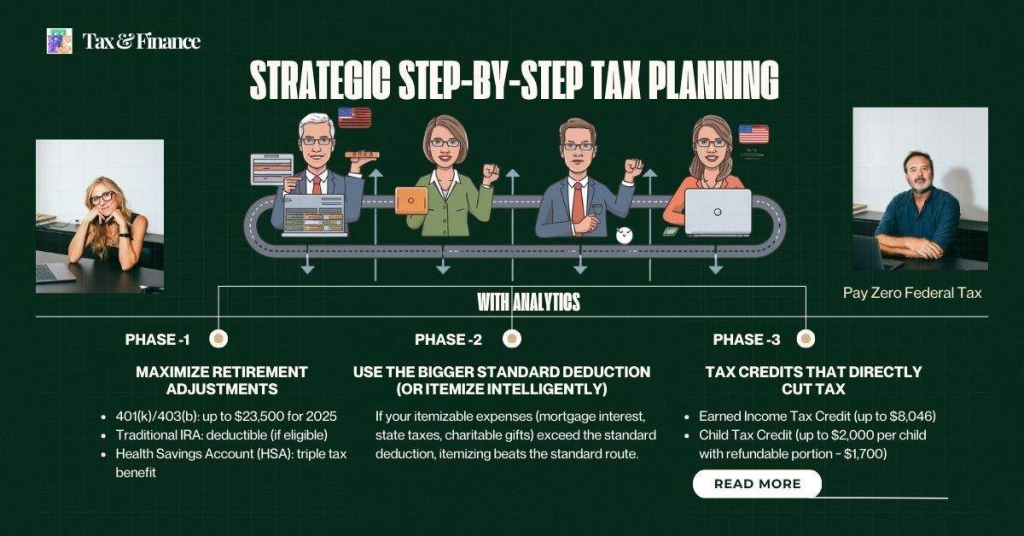

4. Strategic Step-by-Step Tax Planning (With Analytics)

How to Fill Out a W-9 Form — Step-by-Step Tutorial

Step A — Maximize Retirement Adjustments

Contributing to traditional retirement accounts lowers AGI before anything else.

- 401(k)/403(b): up to $23,500 for 2025

- Traditional IRA: deductible (if eligible)

- Health Savings Account (HSA): triple tax benefit

If you earn $150,000 and defer $23,500 into a 401(k), your AGI drops to $126,500 before standard deductions.

Step B — Use the Bigger Standard Deduction (or Itemize Intelligently)

If your itemizable expenses (mortgage interest, state taxes, charitable gifts) exceed the standard deduction, itemizing beats the standard route.

Behavioral Insight: Many taxpayers leave deductions on the table because they don’t tally expenses before year-end.

Step C — Tax Credits That Directly Cut Tax

Credits are dollar-for-dollar reductions.

- Earned Income Tax Credit (up to $8,046)

- Child Tax Credit (up to $2,000 per child with refundable portion ~ $1,700) (CNBC)

Example: A married couple with three children can apply a refundable EITC of $8,046 and refundable portion of the child tax credit of ~$1,700 — subtracting these directly from tax owed.

Step D — Income Smoothing & Timing

Many taxpayers can manage income timing — e.g., timing bonus payouts, capital gains — within a year to hit a lower effective tax bracket.

Data shows bracket creep can push more into higher marginal rates when income rises slightly without adjustments. (Tax Foundation)

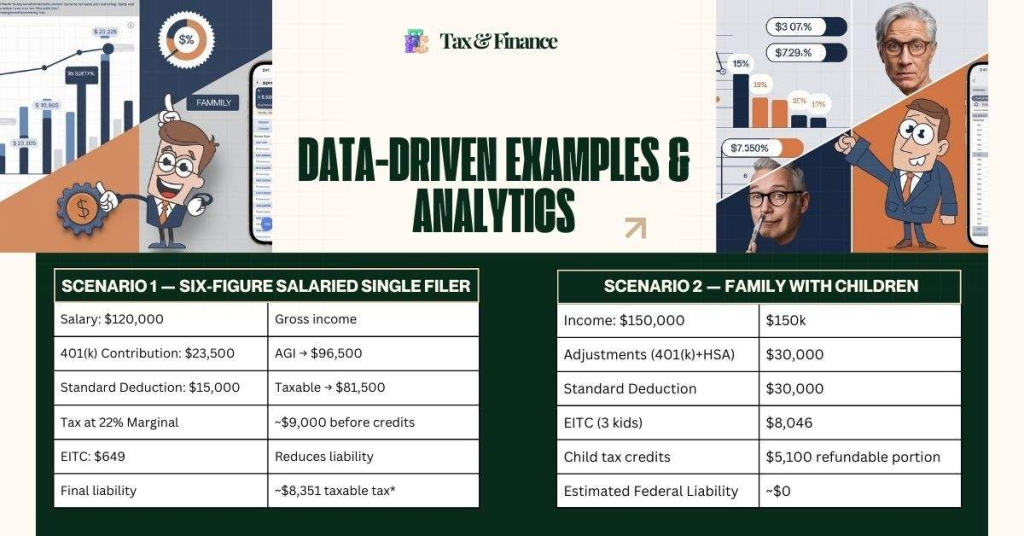

5. Data-Driven Examples & Analytics

Scenario 1 — Six-Figure Salaried Single Filer

| Step | Outcome |

| Salary: $120,000 | Gross income |

| 401(k) Contribution: $23,500 | AGI → $96,500 |

| Standard Deduction: $15,000 | Taxable → $81,500 |

| Tax at 22% Marginal | ~$9,000 before credits |

| EITC: $649 | Reduces liability |

| Final liability | ~$8,351 taxable tax* |

(*Additional credits could push liability further toward zero.)

Scenario 2 — Family With Children

| Item | Amount |

| Income: $150,000 | $150k |

| Adjustments (401(k)+HSA) | $30,000 |

| Standard Deduction | $30,000 |

| EITC (3 kids) | $8,046 |

| Child tax credits | $5,100 refundable portion |

| Estimated Federal Liability | ~$0 |

High credits + deductions bring liability to zero. (CNBC)

2026 TCJA Act: New IRS Training, Guide & Tips

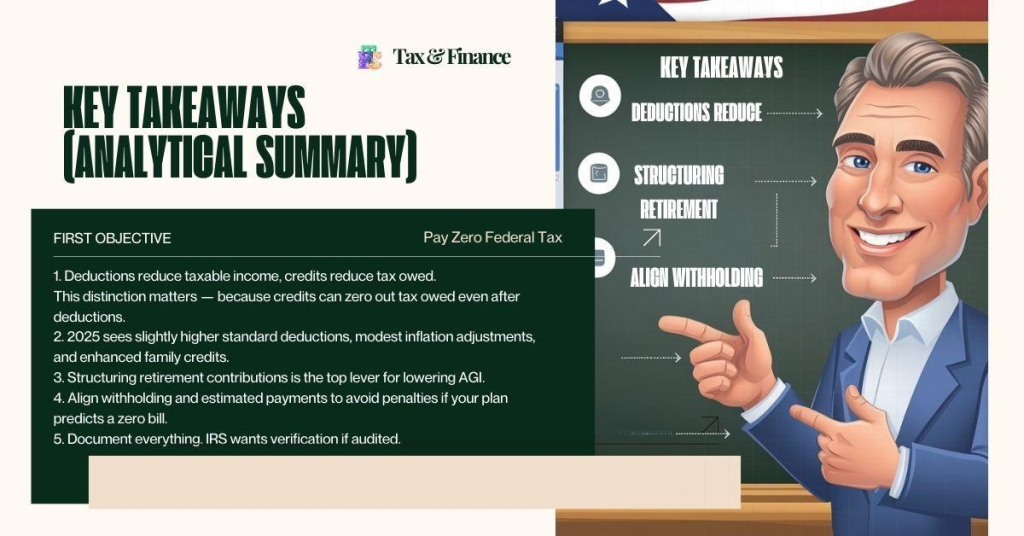

6. Key Takeaways (Analytical Summary)

1. Deductions reduce taxable income, credits reduce tax owed.

This distinction matters — because credits can zero out tax owed even after deductions.

2. 2025 sees slightly higher standard deductions, modest inflation adjustments, and enhanced family credits. (CNBC)

3. Structuring retirement contributions is the top lever for lowering AGI.

4. Align withholding and estimated payments to avoid penalties if your plan predicts a zero bill.

5. Document everything. IRS wants verification if audited.

7. FAQs ON Legally Pay Zero Federal Income Tax

Q1: Can a high-earner actually owe zero federal income tax?

Yes — if your deductions and credits reduce taxable income and tax liability to zero. This is legal and endorsed by the IRS.

Q2: Do tax credits always reduce tax to zero?

Some credits will give you money back if they exceed your tax, but others only reduce your existing tax liability. EITC and the refundable portion of child tax credit are powerful because they’re refundable. (CNBC)

Q3: What’s the difference between deduction and credit?

A deduction lowers taxable income; a credit lowers your tax bill directly.

Q4: What filing date applies for 2025 taxes?

Tax year 2025 returns are due April 15, 2026 — the same deadline unless extended by IRS notice.

Q5: Should I adjust pay-check withholding for a zero tax goal?

Yes. If withholding is too low, you may owe penalties even if your final liability is zero; adjust throughout the year to align with your plan.

Note: This content presents data and strategy based on 2025 IRS rules and inflation adjustments that will apply when filing your return in 2026. Always consult a qualified tax professional for personalized planning and compliance.

Hi there! I am Sudip Sengupta, the face behind “Tfin Career”. Tfin Career is a sole proprietorship finance and consulting firm that makes complex tax and financial concepts easy to understand for everyone. With more than 21 years of experience in the field, I have noticed that people cannot make the right decisions in this field. So, I decided to create “Tfin Career” to help individuals and businesses alike. Here I urge those who are confused to make better choices. Also, it is good news for my dear clients and every visitor that I/we are going to start a training module for those who want to choose a career path in Finance and Taxation. Just follow my website.

Thank you for reading this post, don't forget to subscribe!