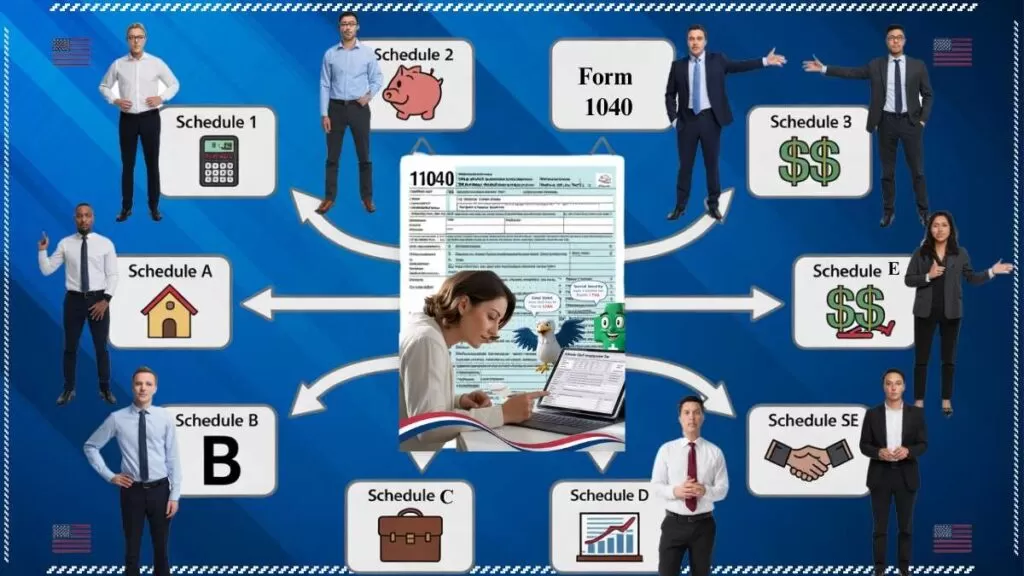

If you are filing your 2025 taxes, you will use Form 1040 Tax Schedules. This is the main tax form for all individuals in the U.S. The IRS uses it to calculate your income, deductions, credits, and taxes owed.

Sometimes, the Form 1040 alone is not enough. That’s where schedules come in. Schedules are like “attachments” that give details about specific types of income, deductions, or credits.

Here is a simple guide Form 1040 Tax Schedules to every common taxpayers might need.

A Simple Story Before We Begin

Imagine your tax return as a main book and a few extra pages clipped inside it.

- Form 1040 is the book cover.

- Tax schedules are the pages that explain special details.

Most people only need a few schedules. Some need more.

This guide walks you through each one in plain English, with examples you can understand—even if taxes scare you.

Your First Tax Return 2026 — A Complete Guide to Avoid Costly Mistakes (and Maximize Your Refund!)

What Is Form 1040?

Form 1040 is the main federal tax form used by almost every individual in the U.S.

It answers four big questions:

- How much money did you make?

- What deductions lower that amount?

- What credits reduce your tax?

- Do you owe money—or get a refund?

Form 1040 Tax Schedules help explain those answers.

Click here to download Form 1040

1. Form 1040 Tax Schedules 1 – Extra Income & Adjustments

What It Does:

- Reports income not on a W-2

- Reports adjustments to income that lower your AGI

Extra Income Examples:

- Unemployment benefits

- Taxable refunds of state taxes

- Freelance or business income (from Schedule C)

- Farm income

- Gambling winnings

Adjustments (Things That Reduce AGI):

- Student loan interest

- IRA contributions

- Health Savings Account (HSA) contributions

- Half of your self-employment tax

Simple Example:

- Anna got $5,000 unemployment and a $500 state refund.

- She also paid $1,000 in student loan interest.

- Schedule 1 calculation:

- Extra income = $5,500

- Adjustments = $1,000

- Net addition to your Form 1040 AGI = $4,500

Why: Makes sure all your income is reported and your AGI is correct.

2. Schedule 2 – Additional Taxes

What It Does:

- Reports taxes outside the normal income tax

- Most common:

- Self-employment tax (Social Security + Medicare)

- Alternative Minimum Tax (AMT)

Example:

- Mark is self-employed. His Schedule C shows net income of $40,000.

- His self-employment tax = $6,000.

- He reports this on Schedule 2, which flows to Form 1040.

Why: Keeps special taxes separate from standard income tax, making calculations clear.

3. Schedule 3 – Non-Refundable Credits

What It Does:

- Reduces your tax owed but cannot give a refund if it’s bigger than your tax

- Common credits:

- Education credits (Lifetime Learning, American Opportunity)

- Foreign tax credit

- Child/dependent care credit

Example:

- Sarah owes $3,000 in federal tax. She qualifies for $1,000 education credit.

- Schedule 3 applies the $1,000 → reduces tax owed to $2,000.

Why: Tracks credits separately for clarity and IRS verification.

Calculate Your Tax And Refund – 2025 Tax Return Calculator: Free & Accurate Refund Estimator

4. Schedule A – Itemized Deductions

What It Does:

- Lets you deduct specific expenses instead of taking the standard deduction

- Common deductions:

- Mortgage interest

- State and local taxes (SALT, up to $10,000)

- Charitable donations

- Medical expenses above 7.5% of AGI

Example:

- John paid $8,000 in SALT, $5,000 mortgage interest, $2,000 donations → $15,000 total

- Standard deduction for single filers in 2025 = $14,000

- John should itemize using Schedule A.

Why: Can save more taxes if your itemized deductions exceed the standard deduction.

5. Schedule B – Interest & Dividends

What It Does:

- Reports taxable interest and dividend income, usually over $1,500 or from foreign accounts

Example:

- Bank interest = $2,000

- Dividends = $500

- Total interest/dividends = $2,500 → reported on Form 1040

Why: IRS uses this to confirm your investment income.

6. Schedule C – Business Income (Self-Employed)

What It Does:

- Shows profit or loss from self-employment

- Net income flows to Schedule 1, then to Form 1040

Example:

- Freelancer earns $50,000

- Expenses (software, advertising, travel) = $15,000

- Net income = $35,000 → Schedule 1 → Form 1040

Why: Separates business income from wages and calculates self-employment tax.

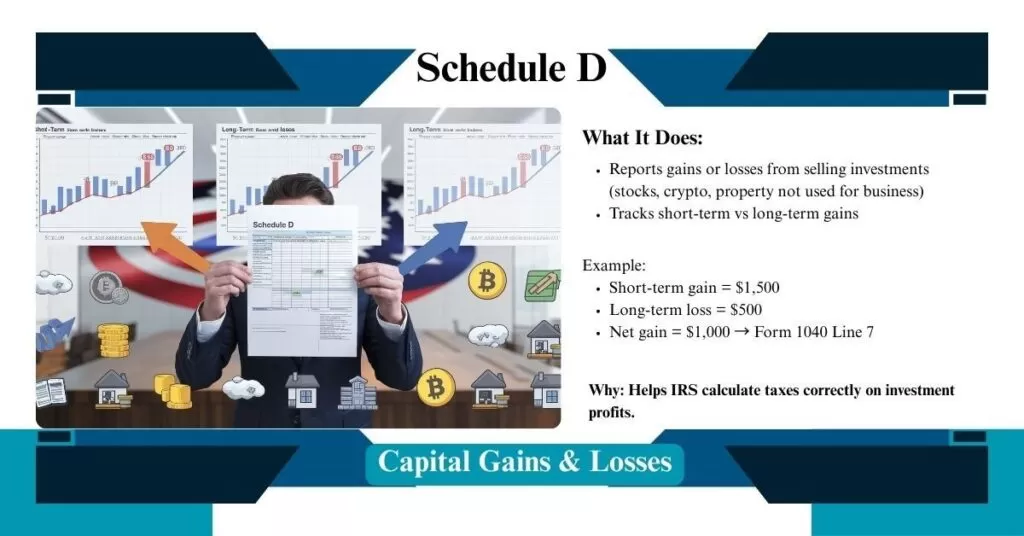

7. Schedule D – Capital Gains & Losses

What It Does:

- Reports gains or losses from selling investments (stocks, crypto, property not used for business)

- Tracks short-term vs long-term gains

Example:

- Short-term gain = $1,500

- Long-term loss = $500

- Net gain = $1,000 → Form 1040 Line 7

Why: Helps IRS calculate taxes correctly on investment profits.

Know more about Capital gains Taxes: How to Pay Zero Federal Capital Gains Tax on $1M+ Profits (2026 Guide)

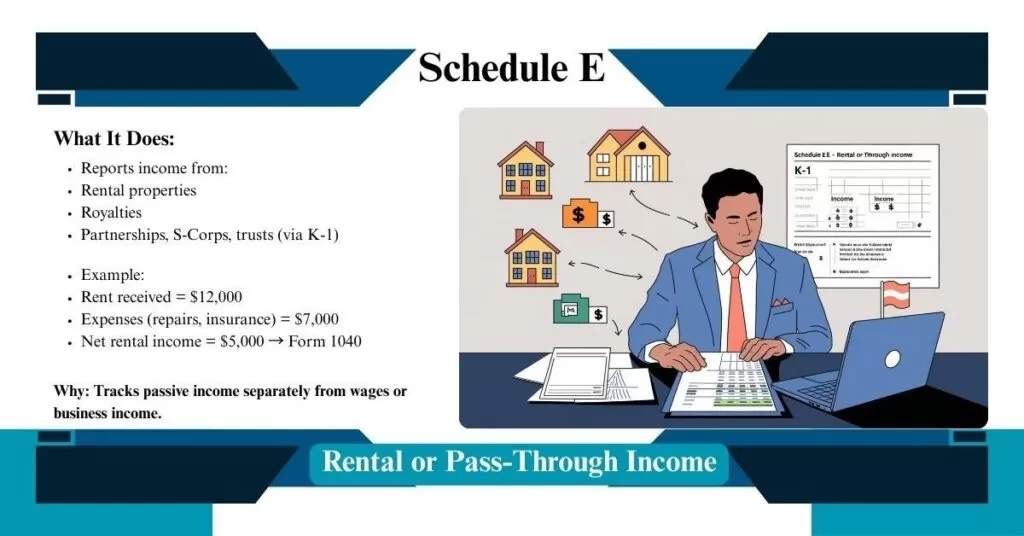

8. Schedule E – Rental or Pass-Through Income

What It Does:

- Reports income from:

- Rental properties

- Royalties

- Partnerships, S-Corps, trusts (via K-1)

Example:

- Rent received = $12,000

- Expenses (repairs, insurance) = $7,000

- Net rental income = $5,000 → Form 1040

Why: Tracks passive income separately from wages or business income.

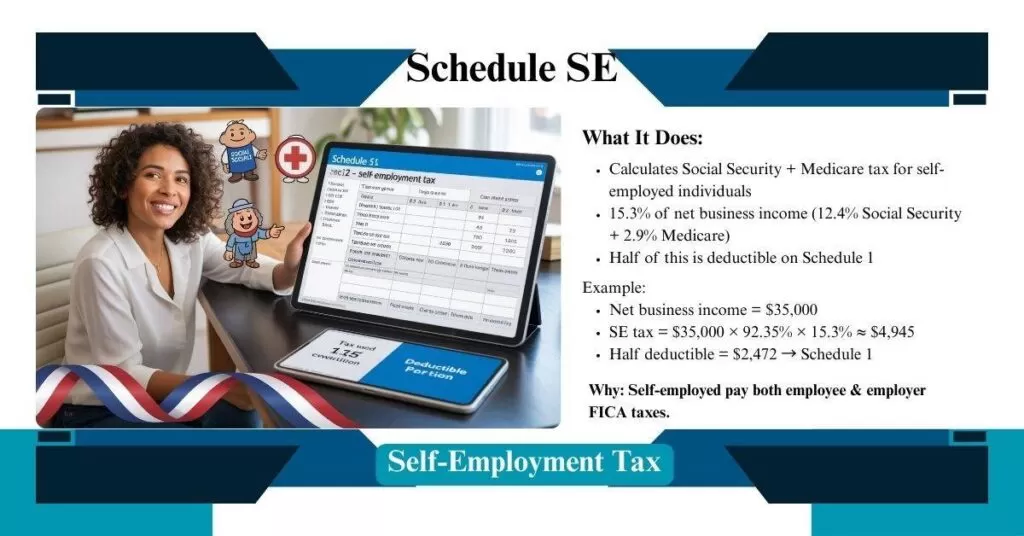

9. Schedule SE – Self-Employment Tax

What It Does:

- Calculates Social Security + Medicare tax for self-employed individuals

- 15.3% of net business income (12.4% Social Security + 2.9% Medicare)

- Half of this is deductible on Schedule 1

Example:

- Net business income = $35,000

- SE tax = $35,000 × 92.35% × 15.3% ≈ $4,945

- Half deductible = $2,472 → Schedule 1

Why: Self-employed pay both employee & employer FICA taxes.

Know More – Social Security Changes 2026: Everything Retirees, Seniors, and Workers Need to Know

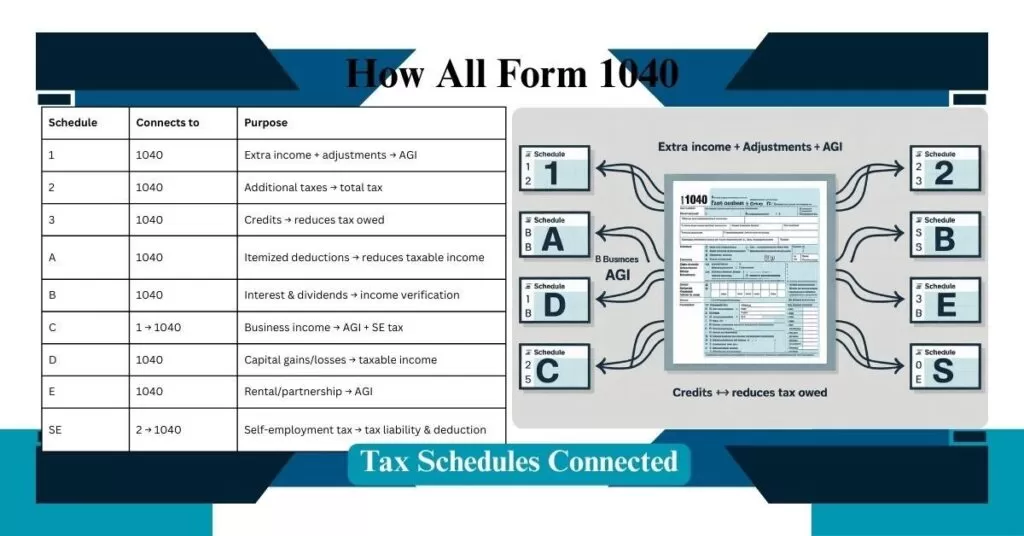

How All Form 1040 Tax Schedules Connected

| Schedule | Connects to | Purpose |

| 1 | 1040 | Extra income + adjustments → AGI |

| 2 | 1040 | Additional taxes → total tax |

| 3 | 1040 | Credits → reduces tax owed |

| A | 1040 | Itemized deductions → reduces taxable income |

| B | 1040 | Interest & dividends → income verification |

| C | 1 → 1040 | Business income → AGI + SE tax |

| D | 1040 | Capital gains/losses → taxable income |

| E | 1040 | Rental/partnership → AGI |

| SE | 2 → 1040 | Self-employment tax → tax liability & deduction |

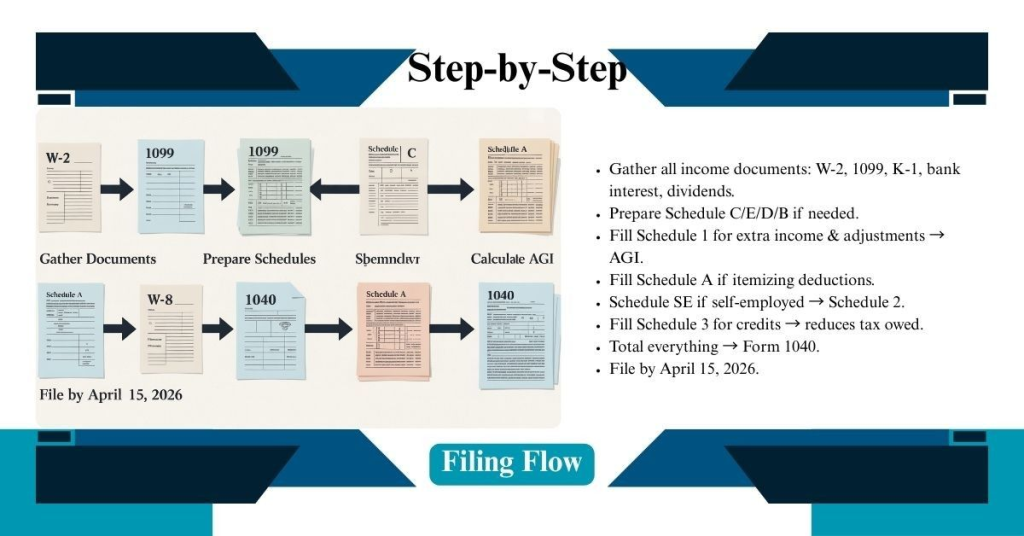

Simple Step-by-Step Filing Flow

- Gather all income documents: W-2, 1099, K-1, bank interest, dividends.

- Prepare Schedule C/E/D/B if needed.

- Fill Schedule 1 for extra income & adjustments → AGI.

- Fill Schedule A if itemizing deductions.

- Schedule SE if self-employed → Schedule 2.

- Fill Schedule 3 for credits → reduces tax owed.

- Total everything → Form 1040.

- File by April 15, 2026.

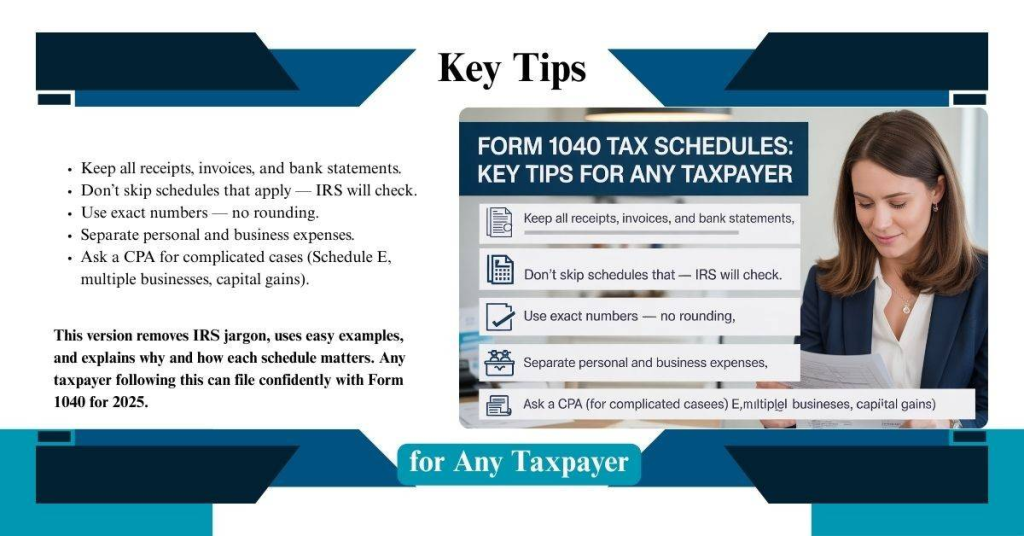

Form 1040 Tax Schedules: Key Tips for Any Taxpayer

- Keep all receipts, invoices, and bank statements.

- Don’t skip schedules that apply — IRS will check.

- Use exact numbers — no rounding.

- Separate personal and business expenses.

- Ask a CPA for complicated cases (Schedule E, multiple businesses, capital gains).

This version removes IRS jargon, uses easy examples, and explains why and how each schedule matters. Any taxpayer following this can file confidently with Form 1040 for 2025.

Know More from The Official Article Provided by The IRS – About Form 1040, U.S. Individual Income Tax Return

Thank you for reading this post, don't forget to subscribe!