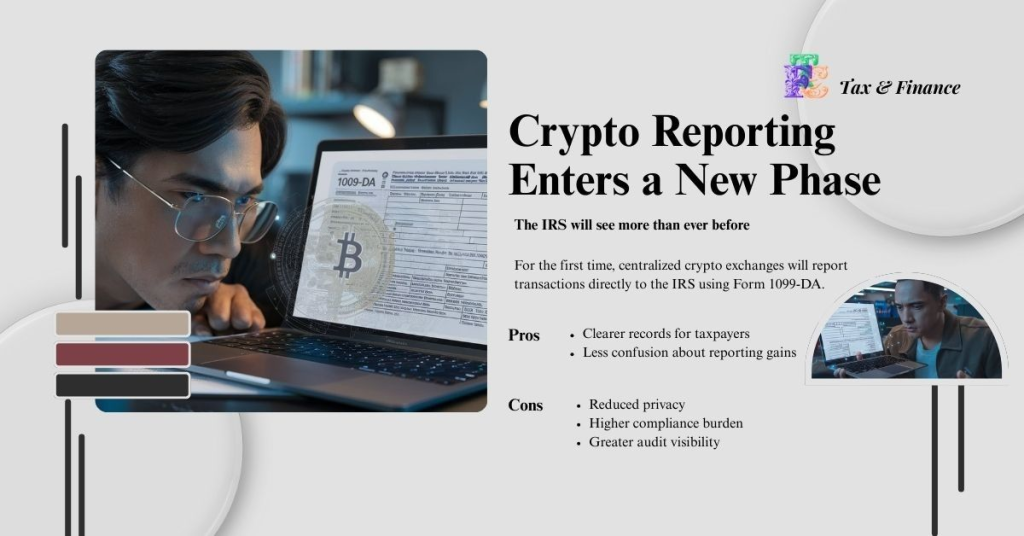

10. Crypto Reporting Enters a New Phase

The IRS will see more than ever before

For the first time, centralized crypto exchanges will report transactions directly to the IRS using Form 1099-DA.

Pros

- Clearer records for taxpayers

- Less confusion about reporting gains

Cons

- Reduced privacy

- Higher compliance burden

- Greater audit visibility

Form 1099-DA Explained (2025): How to Report Crypto Tax And Avoid IRS Penalties

Thank you for reading this post, don't forget to subscribe!