How to fill out Form W-4 correctly for 2024 and save your hard-earned money

As we approach the new tax season of 2024, understanding Form W-4 is more important than ever. Whether you’re starting a new job or want to review your current withholding, this form is key to understanding how much tax is withheld from your paycheck. Here’s everything you need to know to ensure you’re on track for the year ahead.

What is Form W-4? (Form download)

Form W-4 is a tax form you fill out when you begin a new job or want to adjust your tax withholding with your current employer. Based on your situation, it tells your employer how much federal income tax to withhold from your paycheck. This form is essential because the right amount of withholding helps you avoid a big tax bill at the end of the year or prevent overpaying your taxes.

The form asks for information such as your filing status, dependents, and any deductions or credits you may be eligible for. It’s a tool to help ensure your taxes are paid correctly throughout the year. You can also pay a hefty amount when you file your tax return.

Key Factors That Affect Your Withholding

Your W-4 determines how much tax is taken from your paycheck. Several factors go into calculating the right amount of tax to withhold. Understanding these can help you avoid paying too much or too little.

1. Filing Status:

Your filing status (single, married, head of household) is one of the main factors that affect your tax withholding. Each filing status comes with different tax rates and standard deductions. For example, if you’re married and filing jointly, your withholding will generally be less than filing as single because your tax brackets are broader.

Dependents: If you have children or other dependents, you can claim them on your W-4. Each dependent you claim reduces the amount of tax withheld from your paycheck. So, if you have a child, you qualify for the Child Tax Credit; it reduces the load of taxation on your back. Including them as dependents means the withholdings are then adjusted based on the number that will reflect off them.

2. Tax Credits and Deductions:

If you qualify for tax credits (such as the Earned Income Tax Credit or Child Tax Credit) or deductions (like student loan interest or mortgage interest). You can reflect those on your W-4. This will help reduce the tax withheld, ensuring you’re not overpaying during the year. The more credits and deductions you have, the less your employer must withhold.

3. Other Adjustments:

Suppose you have income from sources other than your job, such as freelance, rental, or investment. This will affect your tax situation. You can adjust your W-4 to have extra withholding taken from your paycheck to cover the additional taxes you owe.

Why is it Important to Get It Right?

Getting your W-4 right is essential because it directly impacts your tax withholding throughout the year. If too little tax is withheld, you could owe money when you file your tax return and even face underpayment penalties. On the other hand, if too much tax is withheld, you may receive a large refund when you file. But that’s money you could have been using throughout the year.

By filling out your W-4 correctly, you’re helping to ensure that you’re paying the right amount of tax, which can give you peace of mind. Proper withholding reduces the likelihood of tax surprises come tax season.

What Happens if You Don’t Fill Out a W-4?

If you don’t fill out a W-4 form when you start a new job or submit an incomplete or outdated W-4, your employer will default to the maximum withholding rate. This typically means they’ll withhold taxes as if you are single and have no dependents. In most cases, this will result in higher than necessary tax withholding. You may receive a larger-than-expected tax refund when you file your return.

However, it’s always best to complete the form accurately from the start to avoid overpayment. Additionally, if your life circumstances change (like getting married or having children), you should update your W-4 accordingly.

Can You Update Your W-4 During the Year?

Yes, you can and should update your W-4 any time during the year if there are significant changes in your personal or financial situation. For example:

- Marriage or Divorce: A change in marital status can affect your filing status and the amount of tax withheld.

- Children or Dependents: If you have a new child or dependent, you may qualify for additional tax credits, reducing your withholding.

- Additional Income or Deductions: If you start a side business, take on another job, or become eligible for new tax deductions, you may want to adjust your withholding.

You can submit a new W-4 to your employer whenever needed. This ensures your withholding is aligned with your current situation, helping you avoid overpaying or underpaying your taxes.

Do You Have to Fill Out a W-4 for Every Job?

You must complete a new Form W-4 each time you start a new job. Even if your tax situation hasn’t changed, your new employer needs a completed W-4 to know how much tax to withhold from your paycheck. While you may use the same information for multiple jobs, the form must be filled out individually for each one.

If you already have a job and are adjusting your withholding (due to a change in circumstances), you can also submit a new W-4 to that employer.

What’s New for 2024?

So, even though the basics of Form W-4 are pretty much the same, there might be a few little tweaks here and there because of tax law changes. Tax brackets could get a bump for inflation, or you might grab some new tax credits or deductions in 2024. It’s wise to check out any updates or guidance from the IRS, especially if your money situation changes.

You can also check IRS resources or use an online calculator to help determine the correct amount to withhold based on your income and personal situation.

How to Fill Out a W-4?

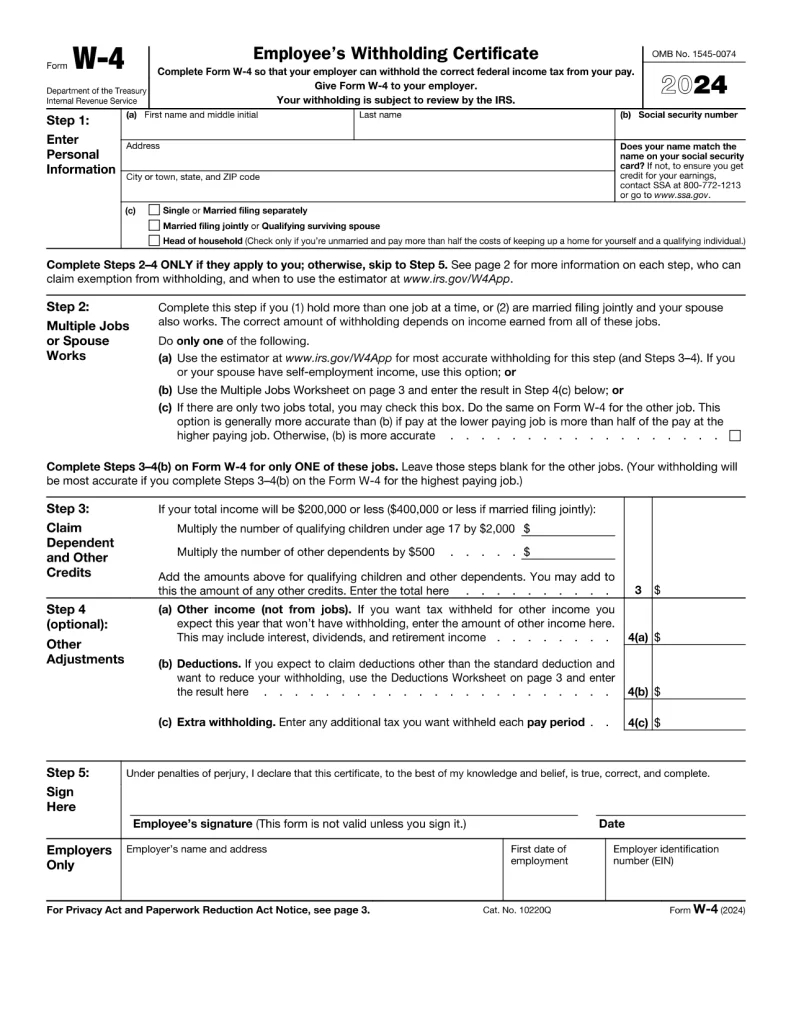

Filling out a W-4 is simple, but it’s essential to take your time and complete it accurately. Here’s a step-by-step guide to filling out the form:

- Personal Information: The first section asks for your name, address, Social Security number, and filing status (single, married, etc.). Make sure this information is correct.

- Multiple Jobs or Spouse Works: If you or your spouse has multiple jobs or expects a significant income from another source, this section helps ensure you’re not over-withheld. You may need to use the IRS withholding calculator or adjust your W-4 accordingly.

- Claim Dependents: If you have children or other dependents, this section allows you to claim them for tax credits like the Child Tax Credit. Each dependent will reduce the amount of tax your employer withholds.

- Other Adjustments: If you expect other income, deductions, or tax credits, you can enter this information here. This could include retirement contributions, student loan interest, or other tax benefits.

- Sign and Date: Finally, sign and date the form to confirm all the information is correct before submitting it to your employer.

Final Thoughts: How to fill out Form W-4

It might look like a little thing, filling out Form W-4. But it will make all the difference for your taxes. If you keep your W-4 on point, you avoid that massive tax bill at the end of the year and don’t miss out on any extraordinary tax benefits. You should check your W-4 and tweak it if you are unsure or if something has changed.

Taking a little time to review and adjust your withholding can save you money and headaches when filing your taxes.

If you’re unsure how to fill out your W-4, consult a tax professional or use IRS online tools to guide you.

This version should now include detailed explanations under each section, making it easier for readers to understand the role and importance of Form W-4 in the 2024 tax season.

Hi there! I am Sudip Sengupta, the face behind “Tfin Career”. Tfin Career is a sole proprietorship finance and consulting firm that makes complex tax and financial concepts easy to understand for everyone. With more than 21 years of experience in the field, I have noticed that people cannot make the right decisions in this field. So, I decided to create “Tfin Career” to help individuals and businesses alike. Here I urge those who are confused to make better choices. Also, it is good news for my dear clients and every visitor that I/we are going to start a training module for those who want to choose a career path in Finance and Taxation. Just follow my website.

Thank you for reading this post, don't forget to subscribe!