New IRS 1099-K Form: The IRS has made a major change that could impact millions of Americans earning side income. Starting in 2025, the 1099-K reporting threshold drops to just $600, meaning payment apps like PayPal, Venmo, Cash App, and online marketplaces (e.g., eBay, Etsy, Airbnb) must report transactions exceeding this amount to the IRS.

If you’ve been selling goods, freelancing, or earning extra cash through gig work, you must report this income, or risk penalties. Here’s what you need to know to stay compliant and avoid surprises at tax time.

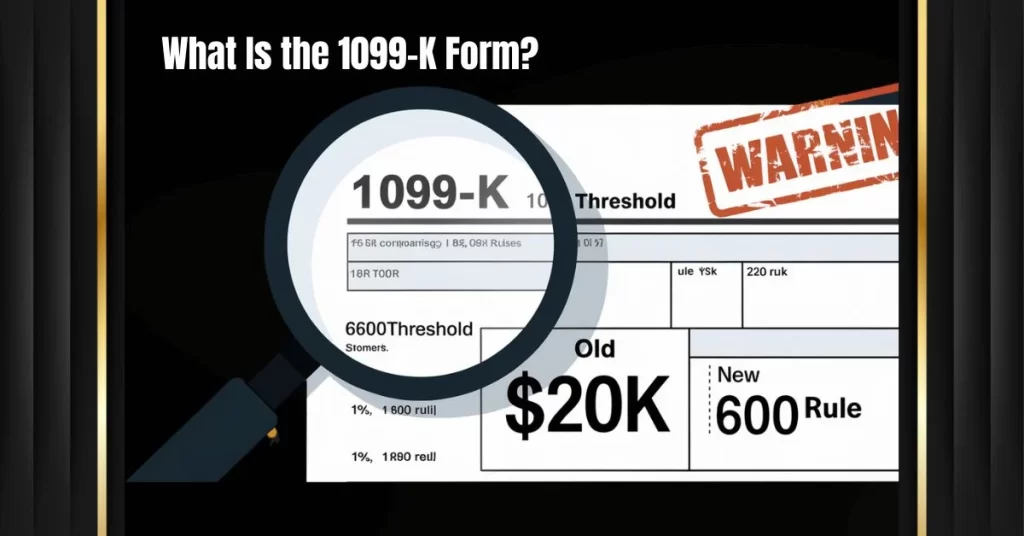

What Is the IRS 1099-K Form?

The 1099-K is an IRS tax form used to report payments received through third-party payment processors. Previously, the threshold was 20,000 and 200 + transactions, but the IRS has now lowered it to just 600 per year with no minimum transaction count.

Resources: irs.gov – Understanding your Form 1099-K

Who Needs to Worry About This Change?

- Side hustlers (freelancers, gig workers, consultants)

- Online sellers (eBay, Etsy, Poshmark, Facebook Marketplace)

- Landlords (Airbnb, VRBO)

- Creators (YouTube, Patreon, Twitch, etc.)

If you earn $600+ from any of these sources, the platform must send you (and the IRS) a 1099-K.

Read this article to learn more: Can You Go to Jail for Tax Evasion, Mistakes, or Unpaid Taxes? What you need to know

Key 2025 Tax Rules You Must Know

1. The $600 Threshold Is Now in Effect

Starting in 2025, any payment processor or marketplace must file a 1099-K if you receive $600+ in payments, even from a single transaction.

2. Personal vs. Business Payments

- Business transactions (selling goods/services) must be reported as taxable income.

- Personal payments (such as splitting dinner with friends or gifts) are not taxable, but if they are flagged, you may need to clarify these with the IRS.

3. You Must Report Even If You Don’t Get an IRS 1099-K

Some platforms may delay reporting, but you must still legally report all taxable income.

4. Deductions Can Lower Your Tax Bill

If you’re running a side business, track expenses like:

- Supplies and materials

- Shipping costs

- Home office deductions

- Platform fees (e.g., Etsy/PayPal fees)

Know more about Tax Law Changes: 2025 Tax Law Changes: Key Insights and How to Stay Informed- What You Need to Know

What Happens If You Don’t Report Side Income?

- IRS audits (if your 1099-K doesn’t match your tax return)

- Penalties & interest on unpaid taxes

- Future refund delays

The IRS is cracking down on unreported income, so don’t assume small earnings fly under the radar.

How to Stay Compliant in 2025

- Track All Income – Use apps like QuickBooks or spreadsheets.

- Separate Business & Personal Payments – Use a dedicated business account.

- Save Receipts for Deductions – Every expense counts!

- Consult a Tax Pro – If unsure, get expert advice.

FAQs: Everything You Need to Know About the IRS 1099-K Update

Q1. What happens if I don’t report my 1099-K income?

A1. If you don’t report income from a 1099-K, the IRS may send you a notice for underreporting your income, which could result in penalties and interest on unpaid taxes.

Q2. Will the IRS automatically know about my 1099-K income?

A2. The third-party payment processors send copies of the 1099-K to the IRS. If you report differently, the IRS will flag the discrepancy.

Q3. Is side hustle income taxable even if I don’t get an IRS 1099-K?

A3. Yes. Any income earned from side gigs or freelance work is generally taxable, even if you don’t receive a 1099-K form.

Q4. How do I report IRS 1099-K income on my taxes?

A4. You report 1099-K income on Schedule C (Profit or Loss from Business) of your tax return. Be sure to include your gross income and any related business expenses for deductions.

Q5. Can I deduct expenses related to my side income?

A5. Yes. Business-related expenses such as supplies, advertising, and business mileage are deductible and can reduce your taxable income.

Form 1099-K FAQs Provided by The IRS

Final Thoughts: Don’t Wait Until Tax Day!

The IRS’s new $600 rule means more taxpayers will get 1099-Ks—and more scrutiny on side income. Start organizing your records now to avoid headaches later.

Also read Taxes Deadlines for 2025 – Tax Filing 2025: Deadlines, New Rules & How to Get Max Refunds

Did you know about this change? Let us know in the comments!

About the Author

Sudip Sengupta is a tax professional with 23 years of experience helping freelancers, gig workers, and small businesses maximize deductions and stay IRS-compliant. For more tax tips, follow my Website: https://tfincareer.com.

Disclaimer

This article is for informational purposes only and not tax advice. Consult a qualified tax professional for personalized guidance.

Hi there! I am Sudip Sengupta, the face behind “Tfin Career”. Tfin Career is a sole proprietorship finance and consulting firm that makes complex tax and financial concepts easy to understand for everyone. With more than 21 years of experience in the field, I have noticed that people cannot make the right decisions in this field. So, I decided to create “Tfin Career” to help individuals and businesses alike. Here I urge those who are confused to make better choices. Also, it is good news for my dear clients and every visitor that I/we are going to start a training module for those who want to choose a career path in Finance and Taxation. Just follow my website.

Thank you for reading this post, don't forget to subscribe!