Introduction: When the IRS Comes Knocking

IRS Audit 2025: The IRS has already sent the Audit Notice for 2025. It’s not welcome news to receive an audit notice for your 2025 taxes, but here’s the truth: over 75% of audits result in no change or even refunds when handled properly [cite[3]. The key? Immediate, strategic action.

As a tax professional who’s helped hundreds of clients through audits, I’ve seen how the right response can turn a stressful situation into a manageable process. This guide walks you through exactly what to do – and crucially, whatnotto do – when facing a 2025 IRS audit.

- 1. Decode Your Notice: Understanding What the IRS Wants (And Why)

- 2. Gather Your Documentation: The Paper Trail That Protects You

- 3. Engage Professional Help: Why Going Solo Risks Disaster

- 4. Craft Your Response: The Art of Compliance Without Overexposure

- 5. Prepare for Next Steps: The Audit Isn't Over Until…

- FAQ: Your 2025 IRS Audit Questions Answered

- Conclusion: Turning Audit Anxiety Into Action

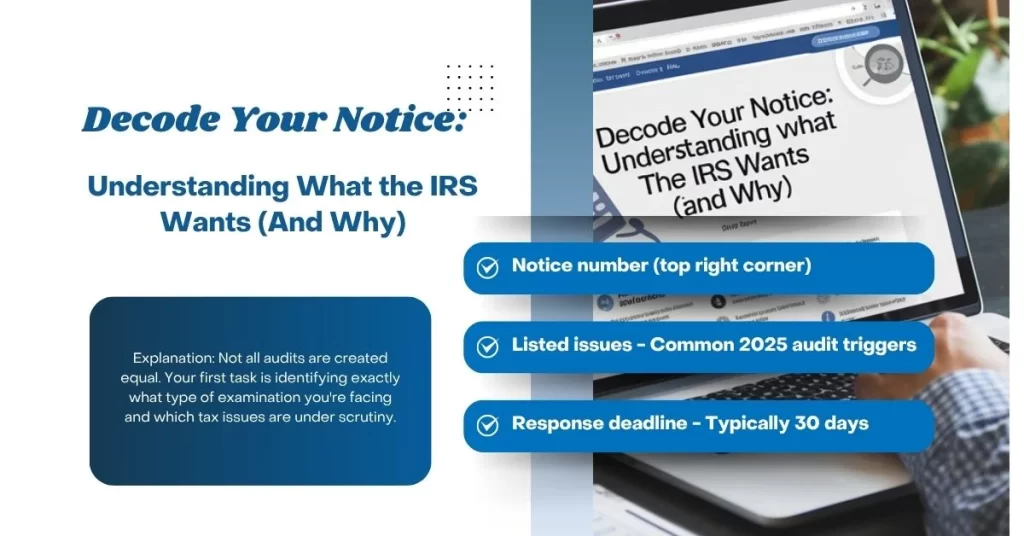

1. Decode Your Notice: Understanding What the IRS Wants (And Why)

Explanation:Not all audits are created equal. Your first task is identifying exactly what type of examination you’re facing and which tax issues are under scrutiny.

Look for these key details in your letter:

- Notice number(top right corner) – This determines your response timeline:cite[1]

- Listed issues– Common 2025 audit triggers include EITC claims, cryptocurrency transactions, or foreign income reporting:cite[3]:cite[4]

- Response deadline– Typically 30 days from notice date

Real-world example:Sarah, a freelance designer, received a CP2000 notice questioning $12,000 in unreported 1099 income. By identifying this as a “matching notice” rather than full audit, she could focus her response on that specific issue.

| IRS Audit 2025 Common Notice Types | ||

| Notice Type | What It Means | Urgency Level |

| CP2000 | Income matching discrepancy | High – 30 day response |

| CP75 | EITC/ACTC verification | Critical – refund held |

| Letter 525 | General examination | High – scope varies |

Avoid IRS Notice: Fill Form 1099-DA Explained (2025)

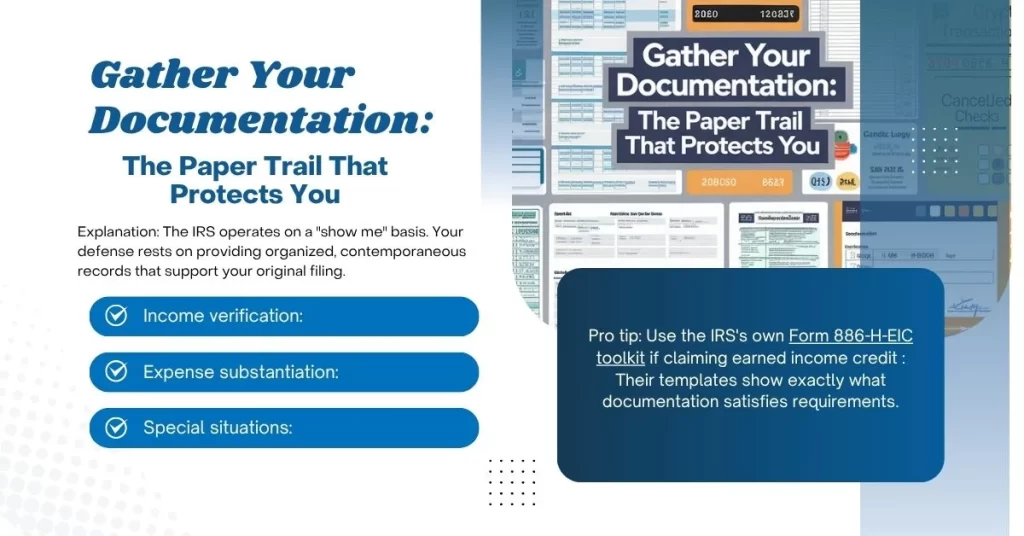

2. Gather Your Documentation: The Paper Trail That Protects You

Explanation:The IRS operates on a “show me” basis. Your defense rests on providing organized, contemporaneous records that support your original filing.

For 2025 audits, focus on:

- Income verification:W-2s, 1099s, bank statements matching deposits

- Expense substantiation:Receipts, mileage logs, canceled checks

- Special situations:Crypto transaction histories, foreign account records (FBAR/FATCA) : cite[3]

Pro tip:Use the IRS’s ownForm 886-H-EIC toolkitif claiming earned income credit :cite[1]. Their templates show exactly what documentation satisfies requirements.

Case study:A 2025 IRS report revealed audits using AI detected $520 million in unreported income from just 76 large partnership examinations: cite[4]. Proper documentation is your best defense against expanded scrutiny.

3. Engage Professional Help: Why Going Solo Risks Disaster

Explanation:The IRS trains auditors for years. Shouldn’t you have comparable expertise on your side?

Consider these professionals:

- Enrolled Agents (EAs):IRS-licensed specialists for straightforward audits

- CPAs:Ideal for complex business or investment situations

- Tax Attorneys:Crucial if facing potential fraud allegations

Key advantage:Privileged communication. What you tell your attorney is protected – conversations with CPAs are not :cite[7].

2025 statistic:Taxpayers with professional representation achieve 40% better outcomes in audits according to National Taxpayer Advocate data.

4. Craft Your Response: The Art of Compliance Without Overexposure

Explanation:Your reply must be complete yet precise – like answering a detective’s questions without volunteering extra information.

Follow this framework:

- Address only the items questioned

- Provide clear copies (never originals) of requested documents

- Include a cover letter summarizing your position

- Use certified mail with return receipt

Critical mistake to avoid:Don’t submit unsolicited documents. A client recently sent 300 pages of unrelated receipts, triggering an expanded audit into new tax years.

The IRS now accepts digital submissions through theirCampus Correspondence Exam Document Upload Toolfor certain notices :cite[1].

5. Prepare for Next Steps: The Audit Isn’t Over Until…

Explanation:Your initial response is just round one. Understand where the process goes from here.

Possible outcomes:

- No change:You substantiated all items (28% of cases)

- Agreed:You accept IRS adjustments (most common)

- Disagreed:You dispute findings (requires appeals process) :cite[2]

Appeals tip:You can request mediation through the IRS’s Alternative Dispute Resolution program before formal appeals :cite[2].

2025 development:The IRS’s newSimple Notice Initiativeaims to make audit communications clearer :cite[4], but complex cases still benefit from professional interpretation.

FAQ: Your 2025 IRS Audit Questions Answered

How long do I have to respond to an IRS audit letter?

Typically 30 days from the notice date, but this varies by notice type. CP2000 notices give 30 days, while some EITC verification requests may allow less. Always check your specific letter’s deadline :cite[1]:cite[9].

Can I get more time to respond to an audit?

Yes, for mail audits you can request a one-time 30-day extension by faxing your request to the number on your IRS letter. In-person audits require contacting your assigned auditor directly :cite[2].

What happens if I ignore an IRS audit letter?

The IRS will make determinations without your input, potentially resulting in additional taxes, penalties, and interest. They may also expand the audit to other years :cite[2]:cite[9].

Will the IRS call me about an audit?

No legitimate audit begins with a phone call. The IRS always initiates audits by mail. If you receive an audit call, it’s likely a scam :cite[2].

How far back can the IRS audit my taxes?

Generally 3 years, but this extends to 6 years if they find substantial errors (typically 25% or more underreporting). There’s no limit for fraudulent returns :cite[2].

What are my rights during an IRS audit?

You have the right to professional treatment, privacy, representation, and appeal. These are outlined in IRS Publication 1, Your Rights as a Taxpayer :cite[2].

Does an audit mean I did something wrong?

Not necessarily. Many audits are random, or result from mismatched information returns. About 1 in 5 audits result in no change to the tax return :cite[3]:cite[9].

How long does an IRS audit take?

Mail audits may resolve in weeks, while complex field audits can take months. The IRS aims to complete most within 6 months :cite[2]:cite[5].

Conclusion: Turning Audit Anxiety Into Action

An IRS audit notice triggers understandable stress, but as we’ve seen, methodical preparation transforms panic into empowerment. Remember these key takeaways:

- Decode first– Identify exactly what the IRS is questioning and why

- Document thoroughly– Build your paper trail with IRS-preferred formats

- Delegate wisely– Match professional help to your audit’s complexity

- Respond precisely– Answer completely without overexposing yourself

- Prepare persistently– The audit process continues until final resolution

The IRS processed over 160 million individual returns in 2025 :cite[4]. Yours attracted attention, but with these steps, you’re equipped to respond effectively. Take a deep breath, take these actions, and take control of your audit experience.

Need personalized guidance?Consult our network of vetted tax professionals at https://tfincareer.com for a free case evaluation specific to your 2025 IRS notice.