Investment Guide 2026: Everyone who dreams of financial freedom asks the same big question:

“How can I go from zero dollars invested to one million dollars by the end of 2026?”

2026 Investment Guide, the world of investing looks different from just a few years ago. New sectors like artificial intelligence are growing fast, and innovative tools like ETFs make investing simple for everyone. This “Investment Guide” article walks you through smart, realistic steps to help you chase that $1M goal — even if you’re just starting out.

1. Set the Foundation: You Can’t Grow Wealth Without a Investment Guide

Before putting money into the market, you need a clear roadmap.

Think of It Like a Journey

Imagine going on a cross-country trip without a map — you might get lost. Investing is similar. A good plan tells you:

- How much you can invest each month

- Your milestones (quarterly or yearly goals)

- Level of risk you’re comfortable with

- Your long-term strategy

Investment Guide helps to Planning you stay calm and focused during market ups and downs — a key to long-term success.

New AND Authentic Investment OpportuniTIES in 2026 | Smart US Outlook

2. Build a Diversified Core Portfolio — The Backbone of Your Strategy

Instead of trying to pick one “winning” stock, smart investors build a core portfolio full of diversified assets. One way to do this is through ETFs (Exchange-Traded Funds).

Investment Guide: Why ETFs Matter

ETFs are baskets of stocks or bonds that can hold hundreds or even thousands of companies in one fund. They make it easy to spread risk — you own many companies at once without buying each one individually. In 2026, ETFs continue to attract strong interest from U.S. investors because they are simple and tax-efficient. (Savvy Money Wise)

Investment Guide: ETF Advantages

- Instant broad market exposure

- Low fees compared with mutual funds

- Can be bought and sold easily like stocks

This makes ETFs ideal for both beginners and experienced investors.

3. Smart ETF Picks for 2026: Growth, Income & Balance

Here is how you can balance a portfolio that has both growth potential and stability.

Growth & Innovation ETFs – True Investment Guide

These focus on companies expected to grow quickly, especially in tech and innovation.

Examples:

- ETF tracking the Nasdaq-100 — filled with tech leaders offering long-term growth potential. (Savvy Money Wise)

Pros

- Strong upside during innovation booms

- Access to fast-growing companies

Cons

- More volatile — prices can swing up and down

- Less diversification outside tech

US Domestic Leadership ETFs

A good core holding can be an ETF that reflects the entire U.S. market.

Fund example: Vanguard Total Stock Market ETF (VTI) — covers thousands of U.S. stocks, large and small. (Savvy Money Wise)

Pros

- Great long-term growth track record

- Very broad exposure to U.S. economy

Cons

- Still subject to U.S. market downturns

- No guaranteed returns

Investment Guide on Income-Focused ETFs

Some ETFs give you income (like dividends) plus growth.

Example: JPMorgan Equity Premium Income ETF (JEPI) — creates income using smart strategies while still participating in stock market growth. (Financial Times)

Pros

- Generates monthly income

- Can reduce volatility vs pure growth funds

Cons

- May lag when markets rise quickly

- Income may be taxed

International & Emerging Market ETFs

Adding international exposure helps your portfolio grow beyond the U.S.

Example: Avantis International Equity ETF (AVDE) — focuses on developed markets outside the U.S. and offers diversification benefits. (themoneytimes.media)

Pros

- Spread risk across global markets

- Capture growth in economies outside the U.S.

Cons

- Sensitive to currency changes

- Some regions more volatile

Bonds & Defensive Positions

Bonds help balance risk when stocks fall. Adding bonds or bond ETFs makes your portfolio smoother and steadier over time. (DIY Investing Hub)

Pros

- Adds stability

- Reduces overall volatility

Cons

- Lower returns than stocks

- Sensitive to interest rate changes

4. Analyze Key Growth Themes: Where the Engines Are

Instead of generic investing, you can add targeted exposure to big future trends — but only within reason.

Investment Guide on Growth Themes for 2026

AI & Automation

AI is transforming every part of the economy — from self-driving cars to smarter healthcare tech. ETFs focused on this area include diversified AI funds that spread risk across many companies. (AInvest)

Know More About AI Investment – Why We Invest in AI Trader: Game Changer Finance Portfolio

Pros

- Exposure to fast-growing industry

- More diversified than single stocks

Cons

- Can be volatile

- Not all AI sectors grow at same speed

Defense & Security

Defense spending has risen across the world, helping companies in aerospace, technology, and cybersecurity to grow. These areas can show resilience in turbulent times. (Forbes)

Pros

- Strong government demand

- Industry less correlated with tech

Cons

- Heavy government regulation

- Returns tied to policy changes

ESG & Clean Energy -* New Investment Guide

Environmental and social investing is gaining popularity as businesses focus on sustainability and renewable energy. (Savvy Money Wise)

Pros

- Supports sustainable growth

- Long-run societal trend

Cons

- Performance depends on policy support

- Some ESG funds carry higher fees

5. The Power of True Diversification

Many investors think cash is safe, but holding too much cash or too few asset types can actually reduce growth over time. In fact, a recent study found that 86% of high-risk retirees failed a basic diversification test because their portfolios were too concentrated, limiting growth potential. (Investopedia)

What True Diversification Means

A diversified portfolio spreads money across:

- U.S. stocks

- International stocks

- Bonds

- Thematic sectors

- Alternatives (like real estate or commodities)

This approach helps protect you if one area performs poorly.

6. Risk Management: Rebalance to Protect Gains

Markets do not move in a straight line. Some parts of your portfolio may outgrow others. When this happens:

Rebalancing = Selling some winners + buying areas that lag

This keeps your long-term strategy on track and locks in gains without emotional decisions.

7. Behavioral Edge: Psychology Matters

Many investors think great timing or lucky trades make millionaires. The truth is simpler:

By Investment Guide, Successful investors stay disciplined.

Avoid:

- Trying to time every market move

- Panicking during dips

- Overtrading

Patience + consistency = compound success over time.

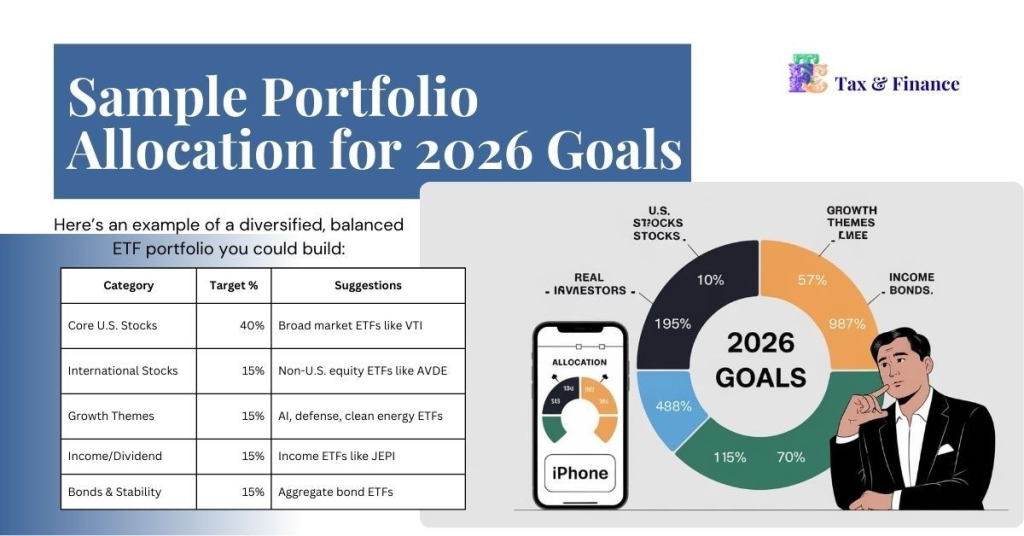

8. Sample Portfolio Allocation for 2026 Goals

Here is an example of a diversified, balanced ETF portfolio you could build:

| Category | Target % | Suggestions |

| Core U.S. Stocks | 40% | Broad market ETFs like VTI |

| International Stocks | 15% | Non-U.S. equity ETFs like AVDE |

| Growth Themes | 15% | AI, defense, clean energy ETFs |

| Income/Dividend | 15% | Income ETFs like JEPI |

| Bonds & Stability | 15% | Aggregate bond ETFs |

Your exact mix should match your risk tolerance and goals.

Related Topic – Longevity Investor: Why Your Investment Career Needs a New Playbook

Final Takeaway: Make 2026 Your Breakthrough Year

To go from $0 to $1M in 2026, you need:

- A clear investment plan

- Core investments that grow over time

- Exposure to future trends without too much risk

- Regular rebalancing

- Emotional discipline

The markets in 2026 offer chances for growth — but only those with a smart, steady strategy will benefit most.

Hi there! I am Sudip Sengupta, the face behind “Tfin Career”. Tfin Career is a sole proprietorship finance and consulting firm that makes complex tax and financial concepts easy to understand for everyone. With more than 21 years of experience in the field, I have noticed that people cannot make the right decisions in this field. So, I decided to create “Tfin Career” to help individuals and businesses alike. Here I urge those who are confused to make better choices. Also, it is good news for my dear clients and every visitor that I/we are going to start a training module for those who want to choose a career path in Finance and Taxation. Just follow my website.

Thank you for reading this post, don't forget to subscribe!