Financial storm shelter: Do you remember standing at the gas pump last year, watching prices rise higher than you’d ever seen? That uneasy feeling—realizing your paycheck wasn’t stretching as it used to—wasn’t just a passing moment. It was a sign of a deeper shift in the economy. I felt it myself outside Cincinnati, and like many Americans, I knew this wasn’t temporary.

Now, many economists warn that what’s coming toward 2026 could make the inflation of 2022 look mild. The choices you make today could determine whether you thrive or struggle in the years ahead.

The Gathering Clouds: What’s Coming for 2026

My grandfather lived through the stagflation of the 1970s. He used to say, “The economy has its own weather. Learn to read it.” And right now, that barometer is dropping fast.

Several major forces are converging: historic government spending, ongoing labor shortages, and global supply chain shifts. Together, they’re forming a potential economic storm as we approach 2026.

The Congressional Budget Office says inflation may stay around 3.2% by 2026. This is higher than what the Federal Reserve prefers. And this isn’t the “transitory” inflation we were promised before. It looks more structural, more embedded.

The job market adds more pressure. Baby boomers are retiring in large numbers. With stricter immigration policies, there aren’t enough skilled workers to take their place. In my own business, finding tradespeople has become harder and more expensive. Those higher wages don’t vanish—they pass through to consumers, fueling the cycle of rising prices.

Related Topic: Why US. Inflation Matters—and How to Protect Your Cash

Taking Your Financial Vital Signs: Know Your Weak Points

Before you can fix your finances, you need to understand them. Think of your household like a patient getting a check-up. Many people believe they’re financially secure until inflation exposes hidden risks.

Ask yourself:

- How stable is your income? If your job has few chances for raises or negotiation, you are more vulnerable than a business owner. A business owner can change prices or rates.

- What kind of debt do you have? Fixed-rate mortgages can actually help during inflation since you’re repaying with “cheaper” dollars. But variable-rate loans or credit cards will get more expensive.

- How liquid are your assets? Cash sitting idle in low-interest accounts loses value quickly when prices rise.

- What’s your career’s inflation protection? Jobs in healthcare, trades, and essential services often adjust better to inflation than static salaried roles. Your earning power is part of your inflation defense.

Building Your Financial Storm Shelter

When the 2008 financial crisis hit, I helped my sister rethink her investments. She was nervous about change—but those moves protected her. The same mindset applies today.

1. Strengthen Your Foundation: Asset Allocation That Works

The classic 60/40 stock-bond mix might not hold up well during persistent inflation. Here’s how to adapt:

- Own real assets. Farmland ETFs, infrastructure stocks, and real estate-linked investments tend to hold value when prices rise. They’re not flashy, but they’re solid anchors.

- Use inflation-linked securities. TIPS (Treasury Inflation-Protected Securities) and Series I Savings Bonds automatically adjust with inflation. Think of them as insurance that pays you.

- Add commodities. Broad-based commodity ETFs spread exposure across energy, metals, and agriculture—offering another hedge without needing to time the market.

2. Adjust Your Strategy: Smart Tweaks for Tough Times

- Shorten bond durations. Long-term bonds lose more when interest rates rise. Keep maturities under five years.

- Invest in pricing power. Companies that sell essentials—like utilities or consumer staples—can pass costs to customers more easily.

- Favor value over growth. Firms with steady profits and cash flow perform better than high-growth stocks dependent on future earnings.

Navigating the Policy Maze: The Fed’s Tightrope

The Federal Reserve faces a near-impossible balancing act—fight inflation without crashing the economy. After years of cheap money, raising rates high enough to cool prices could easily tip us into recession.

At the same time, government spending continues. Regardless of who wins elections, political pressure often favors stimulus over restraint. More public spending in 2025 could worsen inflationary forces by 2026.

The takeaway? Don’t rely on policy to save you. Build your own financial buffer instead.

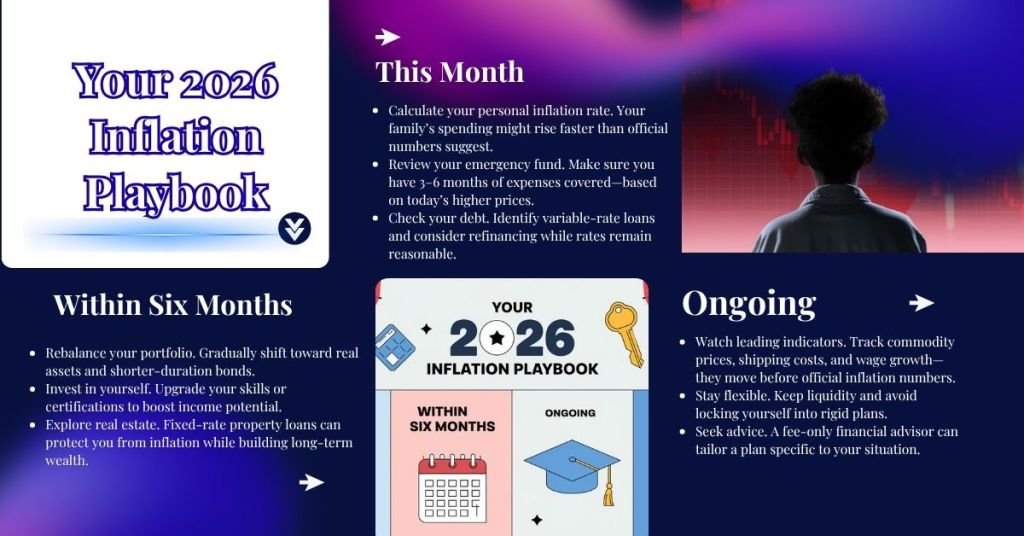

From Insight to Action: Your 2026 Inflation Playbook

It’s one thing to understand inflation—it’s another to act on it. Use this checklist to get started.

This Month

- Calculate your personal inflation rate. Your family’s spending might rise faster than official numbers suggest.

- Review your emergency fund. Make sure you have 3–6 months of expenses covered—based on today’s higher prices.

- Check your debt. Identify variable-rate loans and consider refinancing while rates remain reasonable.

Within Six Months

- Rebalance your portfolio. Gradually shift toward real assets and shorter-duration bonds.

- Invest in yourself. Upgrade your skills or certifications to boost income potential.

- Explore real estate. Fixed-rate property loans can protect you from inflation while building long-term wealth.

Ongoing

- Watch leading indicators. Track commodity prices, shipping costs, and wage growth—they move before official inflation numbers.

- Stay flexible. Keep liquidity and avoid locking yourself into rigid plans.

- Seek advice. A fee-only financial advisor can tailor a plan specific to your situation.

Your Inflation Questions Answered

How will Social Security help retirees?

Cost-of-living adjustments (COLAs) help, but they rarely keep pace with real costs—especially healthcare. Retirees may need additional income sources to stay ahead.

What should small business owners focus on?

Pricing power. Offer unique products or services so you can raise prices when costs rise. Improve efficiency and manage inventory carefully.

Are cryptocurrencies a good hedge?

Not yet. Bitcoin and others are too volatile and uncertain for most investors. Treat them as speculation, not protection.

How does inflation affect college savings?

College costs often grow faster than inflation. If your 529 plan is too conservative, it might not keep up—check your allocations regularly.

What’s the most overlooked inflation protection?

Investing in yourself. Increasing your earning potential through education or new skills is the best long-term hedge.

Should I prepay my mortgage?

If you have a low fixed rate, inflation works in your favor. You’re repaying with cheaper dollars. But if being debt-free gives you peace of mind, there’s value in that too.

How can renters protect themselves?

Try to lock in multi-year leases at fixed rates. Build savings and investments so you’re ready for rising rents—or eventual homeownership.

What psychological traps should I avoid?

Beware “money illusion”—focusing on dollar amounts instead of purchasing power. Avoid panic moves and stick to a long-term, disciplined plan.

Steering Through the Fog: Final Thoughts

That day at the gas pump, I felt the same anxiety millions of Americans feel now. But experience has taught me this: economic storms don’t just destroy—they reveal who prepared.

My grandfather used to say, “You can’t stop the weather, but you can build a better barn.” Inflation may rise, the Fed may wobble, and markets may shift—but you still have time to strengthen your financial foundation.

Start today. Review your debts. Update your savings plan. Talk to a financial advisor. The peace of mind from being proactive is worth far more than any single investment.

You can’t control the storm ahead—but you can control how ready you are when it hits.

Disclaimer: This article reflects the author’s opinion based on economic research and personal experience. It is not financial advice. Always consult a qualified financial professional before making investment or planning decisions. All investments carry risk, including possible loss of principal.

Hi there! I am Sudip Sengupta, the face behind “Tfin Career”. Tfin Career is a sole proprietorship finance and consulting firm that makes complex tax and financial concepts easy to understand for everyone. With more than 21 years of experience in the field, I have noticed that people cannot make the right decisions in this field. So, I decided to create “Tfin Career” to help individuals and businesses alike. Here I urge those who are confused to make better choices. Also, it is good news for my dear clients and every visitor that I/we are going to start a training module for those who want to choose a career path in Finance and Taxation. Just follow my website.

Thank you for reading this post, don't forget to subscribe!