How to File Your Taxes as a DoorDash Driver

Filing taxes as a DoorDash driver involves several steps. Here’s a basic rundown of the forms you’ll need and how to complete your tax return:

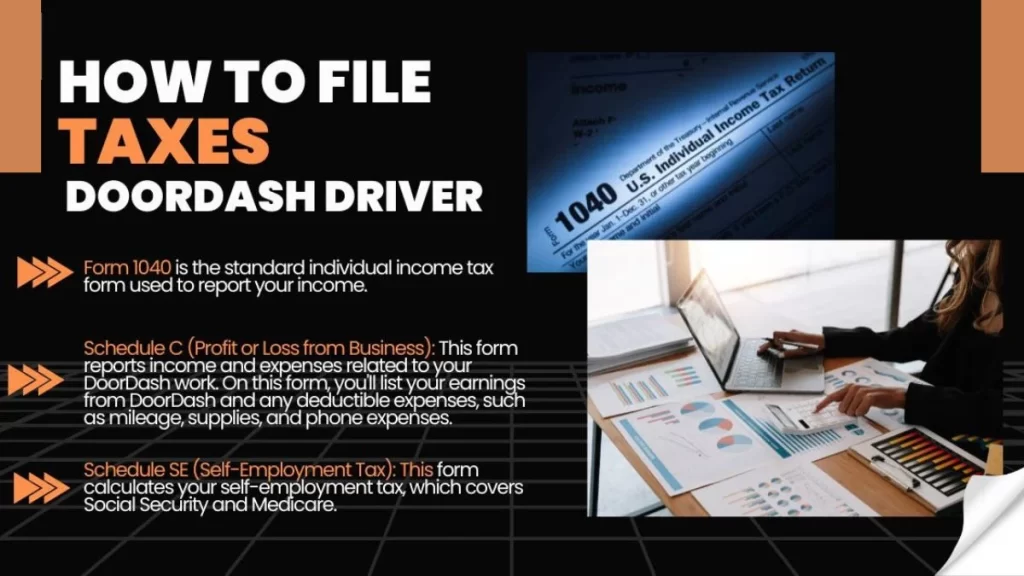

Form 1040 is the standard individual income tax form used to report your income.

Schedule C (Profit or Loss from Business): This form reports income and expenses related to your DoorDash work. On this form, you’ll list your earnings from DoorDash and any deductible expenses, such as mileage, supplies, and phone expenses.

Schedule SE (Self-Employment Tax): This form calculates your self-employment tax, which covers Social Security and Medicare.

If you need help completing these forms, consider using tax software like TurboTax or H&R Block, which can guide you through the process.

Thank you for reading this post, don't forget to subscribe!