What to Do If You Receive Multiple 1099 Forms

It’s common for DoorDash drivers to receive both a 1099-NEC and a 1099-K. If you receive both forms, you’ll need to report the income from both on your tax return.

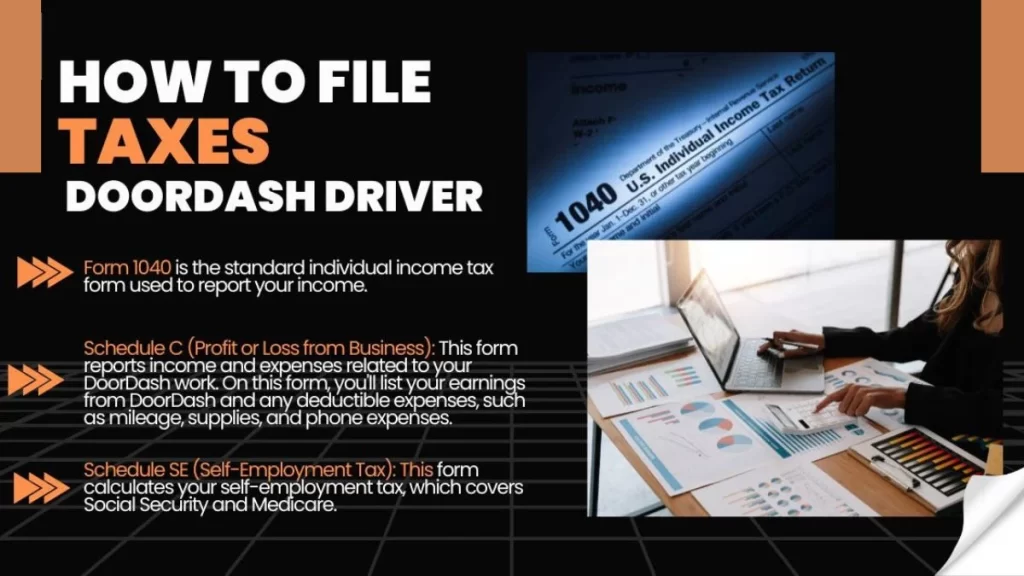

1099-NEC: Report this income on Schedule C (Profit or Loss from Business).

1099-K: Report the income from this form as part of your total earnings. It will show up as “gross receipts” in your business income on Schedule C.

If you receive multiple forms, you must ensure that your reported earnings match those shown on all the forms.

Hi there! I am Sudip Sengupta, the face behind “Tfin Career”. Tfin Career is a sole proprietorship finance and consulting firm that makes complex tax and financial concepts easy to understand for everyone. With more than 21 years of experience in the field, I have noticed that people cannot make the right decisions in this field. So, I decided to create “Tfin Career” to help individuals and businesses alike. Here I urge those who are confused to make better choices. Also, it is good news for my dear clients and every visitor that I/we are going to start a training module for those who want to choose a career path in Finance and Taxation. Just follow my website.

Thank you for reading this post, don't forget to subscribe!