Credit Mastery 101: Credit can feel like a mystery—some magical number determining your financial fate. But what if you could demystify credit, boost your score, and use it strategically to build wealth instead of debt?

This guide on Credit Mastery 101 removes confusion and provides seven powerful principles for confidently mastering credit. Whether you’re rebuilding, starting fresh, or optimizing your score, these rules will put you in control.

Key Points:

- 1. Credit Isn’t Free Money—It’s Borrowed Cash with Strings Attached

- 2. Your Credit Score is Your Financial Report Card—And It Opens (or Closes) Doors

- 3. Never Miss a Payment—Punctuality Pays Off (Literally)

- 4. The 30% Rule: Why Maxing Out Cards Hurts Your Score

- 5. Credit Cards Are Power Tools—Not Magic Wands

- 6. Spend with Purpose—Every Swipe Should Serve Your Future

- 7. Start Strong, Stay Strong—Good Habits Compound Over Time

- FAQS on Credit Mastery 101

- Final Thought: Credit is a Tool—Master It, Don’t Fear It

1. Credit Isn’t Free Money—It’s Borrowed Cash with Strings Attached

Every time you swipe your credit card, you take out a mini-loan that must be repaid, often with interest. The biggest mistake people make is treating credit like an extension of their bank account.

Key Mindset on Credit Mastery 101:

- Plastic = Future Debt – If you wouldn’t pay cash for it, don’t charge it.

- Interest is the Enemy – Carrying a balance turns small purchases into long-term costs.

- Borrow with Purpose – Use credit strategically, not impulsively.

Pro Tip: Before swiping, ask: “Would I buy this if I had to pay cash today?” If the answer is no, reconsider.

2. Your Credit Score is Your Financial Report Card—And It Opens (or Closes) Doors

That three-digit number (300–850) isn’t just a score—it’s a financial reputation. Lenders, landlords, and even employers use it to judge your reliability.

Learn more at usa.gov about your credit report and how to get a copy

Credit Mastery 101: Why It Matters

- High Score (700+) = Lower interest rates, better loan terms, premium rewards.

- Low Score (Below 600) = Higher costs, rejections, missed opportunities.

Credit Mastery 101: Fast Boost Strategies:

- Check your score for free (Credit Karma, Experian).

- Dispute errors that are dragging you down.

- Keep old accounts open (more extended history = better score).

3. Never Miss a Payment—Punctuality Pays Off (Literally)

Your payment history is 35% of your score—the most significant factor. Just one late payment can hurt you for years.

How to Stay Flawless:

- Autopay is Your Best Friend – Set it for the minimum payment (just in case).

- Calendar Alerts – Sync due dates with paydays.

- Pay Early – Avoid last-minute processing delays.

Bottom Line: Lenders don’t care why you missed a payment—only that you did. Stay ahead of deadlines.

4. The 30% Rule: Why Maxing Out Cards Hurts Your Score

Credit Mastery 101: Even if you pay in full, using too much of your limit hurts your score. The magic number? Stay under 30% (ideally 10%).

Why?

- High credit utilization = higher risk in lenders’ eyes.

- Low balances = discipline = better approval odds.

Pro Move: Pay down balances before the statement closes to keep reported usage low.

5. Credit Cards Are Power Tools—Not Magic Wands

Used right, credit cards build wealth. Used wrong, they wreck finances.

Investopedia provided the article: Credit Cards Are Power Tools. How Do Credit Cards Work?

DO:

- Pay in full every month (avoid interest).

- Earn rewards on planned purchases.

- Boost your score with responsible use.

DON’T:

- Treat cards like emergency funds.

- Carry a balance “just this once.”

- Open too many accounts too fast.

Smart Strategy: Pick one card, use it wisely, and let your score grow.

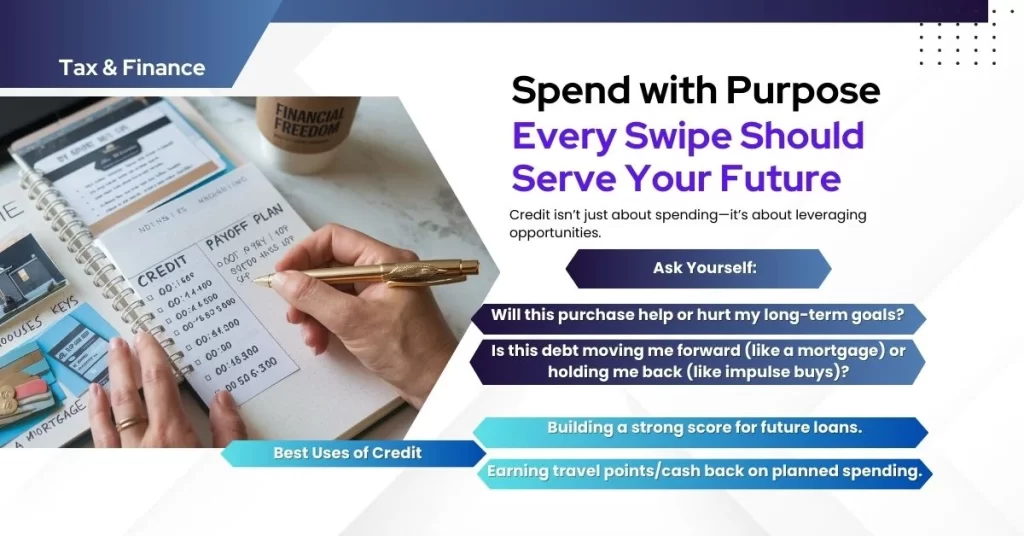

6. Spend with Purpose—Every Swipe Should Serve Your Future

Credit isn’t just about spending—it’s about leveraging opportunities.

Credit Mastery 101: Ask Yourself:

- Will this purchase help or hurt my long-term goals?

- Is this debt moving me forward (like a mortgage) or holding me back (like impulse buys)?

Best Uses of Credit:

- Building a strong score for future loans.

- Earning travel points/cash back on planned spending.

- Covering true emergencies (not “I want it” moments).

7. Start Strong, Stay Strong—Good Habits Compound Over Time

The earlier you build smart credit habits, the faster you’ll unlock:

- Lower mortgage rates (saving thousands).

- Premium credit cards with elite perks.

- Financial flexibility when life surprises you.

Your Action Plan:

- Check your score today.

- Set up autopay for bills.

- Keep balances low (under 30%).

- Use credit strategically—not as a crutch.

FAQS on Credit Mastery 101

1. How can I quickly improve my credit score?

- Pay bills on time (even one late payment hurts).

- Lower credit utilization (keep balances under 30%).

- Dispute errors on your credit report.

- Avoid closing old accounts (more extended history = better score).

- Limit hard inquiries (too many loan applications can lower your score).

Quick Tip: Paying down debt before the statement closes can boost your score faster.

2. How long does it take to build good credit?

Starting from scratch? 6–12 months of responsible use to generate a score.

Rebuilding bad credit? 12–24 months of on-time payments and low balances.

Excellent credit (750+)? Typically, 3–5 years of disciplined habits.

Key Factor: Consistency matters more than speed.

3. Does checking my credit score lower it?

No! Checking your score (a “soft inquiry”) doesn’t hurt.

But… When lenders check (a “hard inquiry”), your score can drop by 1–5 points.

Smart Move: Use free tools like Credit Karma or Experian to monitor without risk.

4. What’s the #1 mistake that hurts credit scores?

Late payments (even one 30-day late mark can drop your score 100+ points).

Other big mistakes:

Maxing out credit cards

Closing old accounts

Applying for too much credit at once

Pro Fix: Set up autopay so you never miss a due date.

5. How much of my credit limit should I use?

Ideal: Under 10% (best for maximizing your score).

Good: Under 30% (avoids significant damage).

Risk Zone: Over 50% (can significantly lower your score).

Bonus Tip: Pay early to reduce the reported balance if you need to spend more.

Final Thought: Credit is a Tool—Master It, Don’t Fear It

You don’t need to be a finance expert to win with credit. You need the proper habits. Follow these rules, and you’ll build a score that opens doors, not debt that holds you back.

Ready to take control? Start today. Your future self will thank you.

Liked This? Share It!

Credit Mastery 101: If this guide helped you, pay it forward—share it with a friend who could use a credit boost! 💳🚀

Got questions? Drop them in the comments—we’ll help!

Hi there! I am Sudip Sengupta, the face behind “Tfin Career”. Tfin Career is a sole proprietorship finance and consulting firm that makes complex tax and financial concepts easy to understand for everyone. With more than 21 years of experience in the field, I have noticed that people cannot make the right decisions in this field. So, I decided to create “Tfin Career” to help individuals and businesses alike. Here I urge those who are confused to make better choices. Also, it is good news for my dear clients and every visitor that I/we are going to start a training module for those who want to choose a career path in Finance and Taxation. Just follow my website.

Thank you for reading this post, don't forget to subscribe!