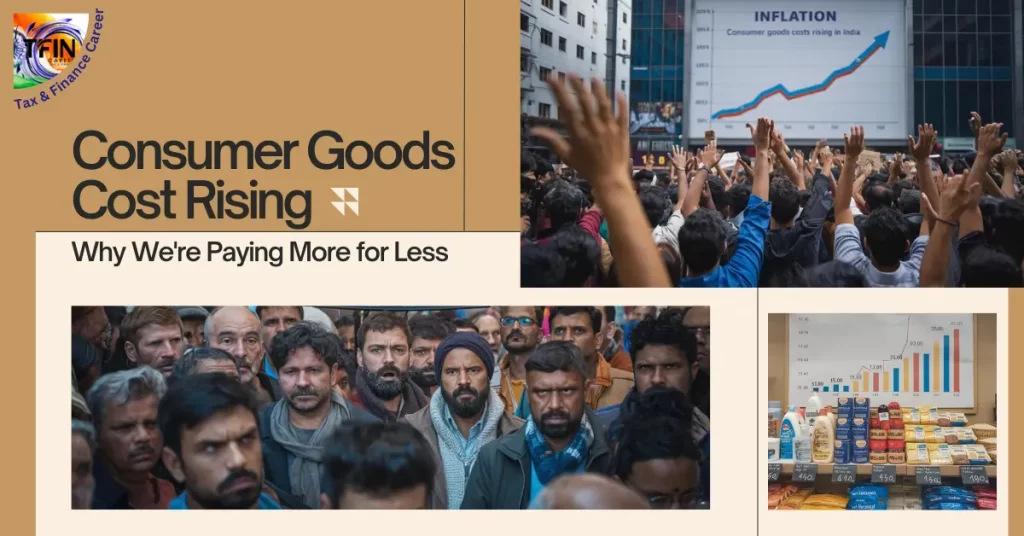

With consumer Goods costs rising in India, people face a big issue—the cost of everyday items is increasing. At the same time, many feel the quality and amount of what they buy are getting worse. Over the last five years, the prices of these items have jumped a lot, making life harder for people’s wallets.

The COVID-19 pandemic, supply chain problems, and high inflation have worsened. Many Indians are paying more but getting less, making it challenging for families to budget. People are choosing between what to buy and how to spend their money.

Key Takeaways

- The average cost of consumer goods in India has skyrocketed over the past five years, with the retail industry experiencing a significant percentage increase.

- The ratio of price inflation to wage growth in the consumer goods sector has widened over the past decade, putting a strain on household budgets.

- A sizable percentage of Indian consumers pay more for consumer goods while perceiving a decline in product quality and quantity.

- The rising cost of consumer goods, driven by factors like inflation and supply chain disruptions, leads to an affordability crisis for many households.

- The squeeze on household budgets may have broader economic implications, potentially impacting consumer spending power and the overall financial landscape.

Exploring the Impact of Inflation and Supply Chain Disruptions

In India, the cost of everyday items increases because of inflation and supply chain issues. These problems have made it harder for people to buy what they need, cutting into their money. It is making life harder for many families.

Pandemic-induced bottlenecks and labor shortages

The COVID-19 pandemic has caused significant problems, like factory shutdowns and delays getting goods to stores. Lockdowns and travel limits have stopped the flow of goods, making it hard to get what we want. Now, people are paying more for things and finding them hard to get.

Rising energy and transportation costs

Prices for energy and moving goods have increased a lot, making things more expensive. It has made the whole supply chain more expensive, leading to higher costs for shoppers and tighter budgets at home.

Inflation and supply chain issues have hit the consumer goods industry hard. Companies’ faceless supply, higher costs, and changing what people want to make things challenging for everyone involved.

“The interactions with people while selling the magazine are considered life-saving as they bring vendors back into the real world and prevent isolation.”

The Phenomenon of Shrinkflation: Paying More for Less

Consumer goods prices are increasing, and so is a worrying trend – shrinkflation. This happens when companies make products smaller or less but keep the price the same or raise it. It means people pay more for less. Companies do this to keep making money as costs increase, but it’s already hard on people’s wallets.

The same money doesn’t go as far as it used to, making it harder for people to afford what they need. This has led to discussions about corporate greed and the need for better rules and protection for buyers.

Shrinkflation is happening in many products, from everyday items to packaging changes. In the UK, prices for one litre of olive oil have jumped by 42% a year, with a two-litre bottle of extra virgin olive oil set to cost over £16 soon. This is because bad weather affects olive crops, especially in Spain, which produces most of the world’s olives.

Chocolate lovers also see the effects of shrinkflation, with brands keeping prices the same but making their products smaller. In the UK, chocolate sizes have shrunk by 3.5% over two years, making consumers pay more for less. Companies are trying to compensate for higher costs by reducing what they give you.

As shrinkflation continues to affect household budgets, people are looking for cheaper options and even refillable packaging to fight back. Social media sites like TikTok show that people are talking more about the need for honesty and fairness in stores.

The ongoing cost crisis means shrinkflation will continue to be a big problem for shoppers and leaders. Fixing this will require many steps, like better rules, clearer labels, and focusing on making consumer goods more affordable.

The Rising Cost of Consumer Goods: Why We’re Paying More for Less

Corporate greed or economic necessity?

There’s a considerable debate about why prices for everyday items are increasing in India. Some say companies are making more money by charging more. Others believe the prices reflect real economic issues like higher costs to make things, supply chain problems, and rising prices overall.

The squeeze on household budgets

Whatever the reason, it’s clear that families are feeling the pinch. Because of the high prices, they have to spend less and make tough choices. This affects the whole economy, possibly slowing down spending and growth.

We need to tackle this issue from many angles. This includes government actions, companies’ responsibility, and consumer education. We must also ensure that things stay affordable and help the economy recover healthily.

| Company | Year-to-Date Performance |

|---|---|

| FTSE 100 Index | Up 8% |

| S&P 500 | Up 17% |

| Nasdaq Composite | The market capitalization of $3.07 trillion, more significant than the entire FTSE 100 market value of £2.32 trillion |

| Microsoft | Vestry |

| “Magnificent Seven” tech stocks | Account for a third of the S&P 500’s market value and contributed to 88% of the S&P 500’s gains in 2023 |

| Rolls-Royce | Up 66% year-to-date, with an underlying operating profit of £1.1 billion reported in August and a raised full-year guidance |

| NatWest | Up 47% year-to-date, with sales rate improving to 1.21 units per site per week and an expected 10% higher adjusted operating profit |

| Down 35% year-to-date, indicating a decline in performance for the gambling giant. | Vestry |

| Darktrace | Up 58% year-to-date due to a potential takeover bid by US private equity firm Thoma Bravo |

| DS Smith | Up 55% year-to-date following a buyout deal by International Paper (IP) worth £5.8 billion |

| Beazley | Up 43% year-to-date, benefitting from its early move into cyber risk underwriting |

| Burberry | Down 53% year-to-date, signaling a significant performance decline and a potential relegation from the FTSE 100 |

| Entain | Down 35% year-to-date, indicating a decline in performance for the gambling giant |

“Addressing the rising cost of consumer goods will require a multi-faceted approach, including government policies, corporate responsibility, and consumer education to ensure affordability and promote a sustainable economic recovery.”

Conclusion

The cost of everyday items in India is going up for many reasons. These include high inflation, supply chain issues, and the COVID-19 pandemic’s lasting effects. People are paying more for less, making life harder on their wallets.

Things like “shrinkflation” make it even more challenging to afford what we need. Who should take the blame? Companies or the economy? But the truth is, families are finding it hard to keep up their standard of living.

We need a big plan to fix this. This means government actions, companies doing their part, and consumers being taught. By working together, we can solve the big problems and get back on track for a better future.

It won’t be easy, but we’re hopeful. With the right steps and everyone’s help, we can overcome these challenges and ensure everyone has access to what they need.

During these challenging times, it’s essential to stay updated, push for real fixes, and support each other. By doing this, we can deal with the rising costs and create a better future for everyone.

FAQ

What is causing the rising cost of consumer goods in India?

The cost of goods in India is rising because of high inflation, supply chain issues, and the effects of the COVID-19 pandemic. These things make production more expensive, and companies raise consumer prices.

What is “shrinkflation”, and how does it impact household budgets?

Shrinkflation means companies make products smaller or less, but keep prices the same or higher. It means people pay more for less. It makes it harder for families to afford things.

Is the rising cost of consumer goods due to corporate greed or broader economic factors?

There’s a debate on why prices are going up. Some say companies are making more money off of us. Others say prices reflect real economic challenges like higher costs and supply chain problems.

How are households coping with the rising cost of consumer goods?

Families are struggling to keep up with the cost of daily items, making it hard for them to live comfortably. They’re having to spend less and make tough choices, which is affecting the whole economy.

What can be done to address the rising cost of consumer goods?

We need to tackle this issue from many angles. It includes government actions, company responsibility, and teaching consumers. We should reduce inflation, improve supply chains, and make things more transparent. It will help make things more affordable and support a strong economy.

Hi there! I am Sudip Sengupta, the face behind “Tfin Career”. Tfin Career is a sole proprietorship finance and consulting firm that makes complex tax and financial concepts easy to understand for everyone. With more than 21 years of experience in the field, I have noticed that people cannot make the right decisions in this field. So, I decided to create “Tfin Career” to help individuals and businesses alike. Here I urge those who are confused to make better choices. Also, it is good news for my dear clients and every visitor that I/we are going to start a training module for those who want to choose a career path in Finance and Taxation. Just follow my website.

Thank you for reading this post, don't forget to subscribe!