Welcome to the comprehensive guide on Form 1040, the essential tax form for person citizens in the U.S. As taxes are a basic portion of overseeing individual accounts, getting each angle of Form 1040 from A to Z is vital.

This guide will walk you through each form section, providing explanations, examples, and the 2025 tax slabs to help you confidently navigate your tax return.

- What is Form 1040?

- Who Needs to File Form 1040?

- What’s New in 2025 for Form 1040?

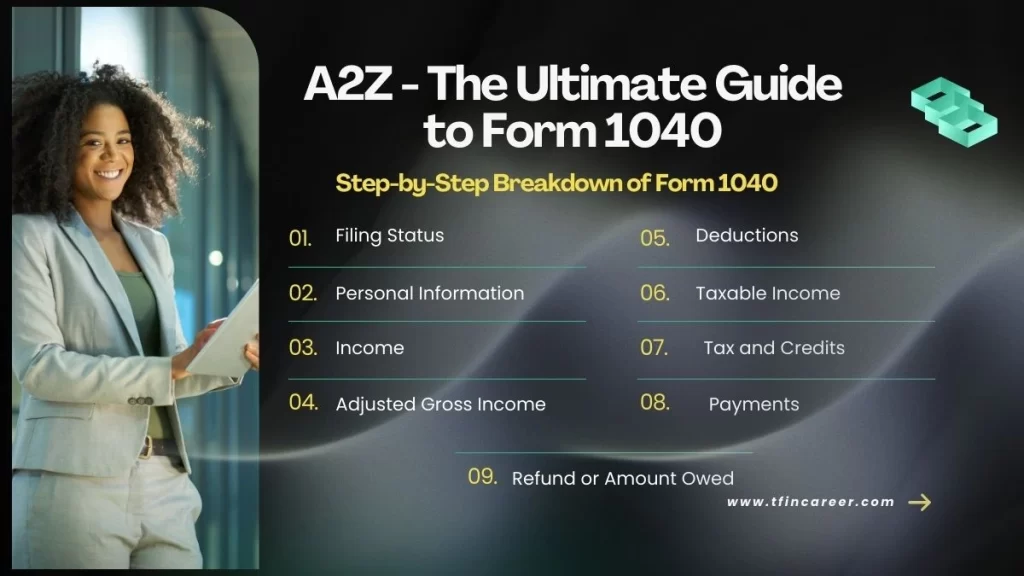

- Step-by-Step Breakdown of Form 1040

- 1. What is Form 1040?

- 2. Who needs to file Form 1040?

- 3. What is the deadline for filing Form 1040?

- 4. What is the difference between Form 1040, Form 1040A, and Form 1040EZ?

- 5. What are the 2025 federal tax brackets?

- 6. Can I file Form 1040 online?

- 7. What are tax credits, and how do they affect my Form 1040?

- 8. What is the standard deduction for 2025?

- 9. Can I deduct my student loan interest on Form 1040?

- You can deduct up to $2,500 in student loan interest on your Form 1040 if you meet certain income requirements. This deduction is available even if you do not itemize your deductions.

- Advanced FAQ Section for Form 1040: Understanding the U.S. Individual Income Tax Return

- Conclusion: Mastering Form 1040

What is Form 1040?

Form 1040 is an official tax form for individuals filing their federal income tax returns in the United States. The IRS uses this form to collect Income, deductions, and tax liability data. The goal is simple: determine whether you owe additional taxes or are entitled to a refund.

To get more detailed information about Form 1040, visit the IRS’s official Form 1040 page.

Form 1040 helps determine:

- Gross Income: Total Income earned in a given year.

- Adjusted Gross Income (AGI): Your Income after specific deductions.

- Taxable Income: The amount of Income you pay taxes on.

- Tax Liability: The amount of taxes you owe to the IRS.

Who Needs to File Form 1040?

In general, you need to file Form 1040 if:

- You are a U.S. citizen or resident alien.

- You meet the minimum income requirements for your filing status.

- You are self-employed and earn over a certain threshold.

Even if your income is below the filing threshold, you may still want to file a return to claim a refund for any taxes already paid through withholding or estimated tax payments.

If you’re unsure whether you need to file Form 1040, the IRS offers a Tax Filing Requirements page that can help clarify your situation.

What’s New in 2025 for Form 1040?

For the 2025 tax year, some important changes have been made to the tax code. Here is a quick look at the 2025 tax brackets and other updates:

2025 Federal Income Tax Slabs (For Single, Married Filing Jointly, and Head of Household)

For the 2025 tax year, the IRS has adjusted the tax brackets for inflation. Here’s how the tax slabs look for single filers, married filing jointly, and head of household filers:

For Single Filers:

| Tax rate | Taxable income from . . . | up to . . . |

|---|---|---|

| 10% | $0 | $11,600 |

| 12% | $11,601 | $47,150 |

| 22% | $47,151 | $100,525 |

| 24% | $100,526 | $191,950 |

| 32% | $191,951 | $243,725 |

| 35% | $243,726 | $609,350 |

| 37% | $609,351 | And up |

For Married Filing Jointly:

| Tax rate | Taxable income from . . . | up to . . . |

|---|---|---|

| 10% | $0 | $23,200 |

| 12% | $23,201 | $94,300 |

| 22% | $94,301 | $201,050 |

| 24% | $201,051 | $383,900 |

| 32% | $383,901 | $487,450 |

| 35% | $487,451 | $731,200 |

| 37% | $731,201 | And up |

For Head of Household Filers:

| Tax rate | Taxable income from . . . | up to . . . |

|---|---|---|

| 10% | $0 | $16,550 |

| 12% | $16,551 | $63,100 |

| 22% | $63,101 | $100,500 |

| 24% | $100,501 | $191,950 |

| 32% | $191,951 | $243,700 |

| 35% | $243,701 | $609,350 |

| 37% | $609,351 | And up |

Step-by-Step Breakdown of Form 1040

Now, let’s break down Form 1040 step by step. We’ll go through each section and explain what needs to be filled out, what information is required, and where to enter it.

1. Filing Status (Part 1)

At the top of Form 1040, you must choose your filing status. Your filing status determines your tax rate and eligibility for deductions and credits. The available statuses are:

- Single: If you are unmarried.

- Married Filing Jointly: If you are married and filing with your spouse.

- Married Filing Separately: If you are married but filing separately.

- Head of Household: If you are unmarried and have dependents.

- Qualifying Widow(er): If your spouse passed away in the past two years, you have a dependent child.

2. Personal Information (Part 1)

In this section, you’ll need to enter your personal information:

- Your Name and Social Security Number (SSN).

- Spouse’s Name and SSN (if applicable).

- Your Address.

- Dependents: If you have children or other dependents, list them here. Include their names, SSNs, and relationships with you (e.g., son or daughter).

3. Income (Part 1, Line 1-7)

Now, we get to the income section of Form 1040. Here, you’ll report all your sources of Income:

- Wages, Salaries, and Tips (Line 1): This is where you’ll report Income from your job(s) or other compensation.

- Interest and Dividends (Line 2a, 2b): Income from savings, investments, or stocks.

- Other Income (Line 7): Income from side jobs, freelance work, rental Income, etc.

To learn more about the different sources of income and how to report them, check the IRS Income page.

To complete this section correctly, be sure to have all your income-related documents, such as W-2s and 1099 forms.

Also Read, How to Fill Out Form W-2 in 2025: All About the Wage and Tax Statement

4. Adjusted Gross Income (AGI) (Line 8-10)

This section is where you calculate your Adjusted Gross Income (AGI). Your AGI is your total Income minus certain deductions, also known as “adjustments.”

- Retirement Contributions (IRA, 401(k), etc.)

- Student Loan Interest

- Health Savings Account (HSA) Contributions

Subtract these from your total Income to arrive at your AGI.

5. Deductions (Part 2, Line 12)

You can either take the standard deduction or itemize deductions. In 2025, the standard deduction amounts are:

- $13,850 for single filers

- $27,700 for married couples filing jointly

- $20,800 for heads of household

Itemized deductions can include things like:

- Mortgage interest

- Charitable contributions

- Medical expenses (if they exceed a certain percentage of your AGI)

If your itemized deductions exceed the standard deduction, it’s generally better to itemize.

6. Taxable Income (Line 15)

You’ll arrive at your taxable Income after deducting either the standard or itemized deductions from your AGI. This amount will be taxed based on your applicable tax brackets.

7. Tax and Credits (Part 3, Line 16-20)

Now, it’s time to calculate your tax:

- Calculate your taxes owed based on your taxable Income and the tax brackets.

- Apply any tax credits you may qualify for. Credits directly reduce your tax bill. Examples include:

- Child Tax Credit for dependent children. Everything You Need to Know About the 2025 Child Tax Credit Reforms Under Trump

- Education credits are for tuition and other education expenses.

- Earned Income Tax Credit (EITC) for lower-income workers. Don’t Miss Out! Claim the Earned Pay Tax Credit (EITC) and Get the Discount You Deserve

8. Other Taxes (Part 4, Line 23-24)

In this section, you’ll report any other taxes you owe, such as:

- Self-Employment Tax if you are self-employed.

- Additional Medicare Tax.

9. Payments (Part 5, Line 25-33)

Here, you’ll report any prepaid taxes, such as:

- Federal income tax withheld (from your W-2 or 1099 forms).

- Estimated tax payments you made during the year. Estimate Your Tax Liability – tax calculator

- Refundable credits include the American Opportunity Tax Credit or the Premium Tax Credit.

If you’re unable to pay, learn more about payment options on the IRS Payment Plan page.

10. Refund or Amount Owed (Part 6, Line 34-37)

Finally, this is the section where you determine whether you’ll receive a refund or need to pay additional taxes. You’ll receive a refund if the total of your payments and credits exceeds your tax liability. If your tax liability exceeds your payments, you’ll owe additional taxes.

Complete Guide to IRS Form 1040: Everything You Need to Know for Tax Filing in 2025

FAQ Section for Form 1040: Understanding the U.S. Individual Income Tax Return

1. What is Form 1040?

Form 1040 is the standard U.S. individual income tax return form used by taxpayers to report their Income, calculate their tax liability, and claim any tax deductions, credits, or exemptions. It is filed annually with the Internal Revenue Service (IRS). For more about Form 1040, visit the IRS Form 1040 Overview.

2. Who needs to file Form 1040?

Most U.S. taxpayers must file Form 1040 if their Income meets or exceeds the IRS filing requirements. This includes self-employed individuals, salaried employees, retirees, and those who receive Income from investments. Even if your Income is below the filing threshold, you may still want to file a claim for a refund for taxes withheld or to qualify for tax credits.

3. What is the deadline for filing Form 1040?

The standard deadline for filing Form 1040 is April 15th of each year for the previous tax year. If April 15th falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers can also request an automatic extension until October 15th, but they must pay any estimated taxes owed by the original deadline to avoid penalties and interest.

2024 Tax Deadlines: Key Dates You Need to Know

4. What is the difference between Form 1040, Form 1040A, and Form 1040EZ?

- Form 1040: The standard form for most taxpayers, including those with itemized deductions or who need to claim credits and deductions like child tax credits or earned income credits.

- Form 1040A: A simplified version of Form 1040 for taxpayers with straightforward tax situations. It is no longer in use as of 2018, as the IRS has consolidated it into Form 1040.

- Form 1040EZ: This form was simplified for those with basic tax situations (like no dependents and Income from wages or salaries only) and eliminated as of 2018.

5. What are the 2025 federal tax brackets?

For the 2025 tax year, the federal income tax brackets are as follows:

- 10%: Income up to $11,000 (single) or $22,000 (married filing jointly)

- 12%: Income from $11,001 to $44,725 (single) or $22,001 to $89,450 (married filing jointly)

- 22%: Income from $44,726 to $95,375 (single) or $89,451 to $190,750 (married filing jointly)

- 24%: Income from $95,376 to $182,100 (single) or $190,751 to $364,200 (married filing jointly)

- 32%: Income from $182,101 to $231,250 (single) or $364,201 to $462,500 (married filing jointly)

- 35%: Income from $231,251 to $578,100 (single) or $462,501 to $693,750 (married filing jointly)

- 37%: Income over $578,100 (single) or $693,750 (married filing jointly)

Find the detailed 2025 federal tax brackets on the IRS official page.

6. Can I file Form 1040 online?

Yes, Form 1040 can be filed online using the IRS e-file system, the fastest way to submit your tax return. Many tax software programs, such as TurboTax or H&R Block, also support e-filing. The IRS encourages taxpayers to file electronically for faster processing and quicker refunds.

To e-file your tax return, check out the IRS E-File page.

7. What are tax credits, and how do they affect my Form 1040?

Tax credits directly reduce the amount of tax you owe. There are two tax credits: nonrefundable (which can reduce your tax liability to zero but no further) and refundable (which can result in a refund even if your tax liability is reduced to zero). Some popular tax credits include the Child Tax Credit, Earned Income Tax Credit (EITC), and American Opportunity Credit. Tax credits are claimed on your Form 1040 and can significantly reduce your overall tax liability.

8. What is the standard deduction for 2025?

The standard deduction for 2025 is:

- $13,850 for single filers

- $27,700 for married couples filing jointly

- $20,800 for heads of household

These amounts may change annually with inflation adjustments. The standard deduction automatically reduces your taxable Income if you do not itemize your deductions.

9. Can I deduct my student loan interest on Form 1040?

You can deduct up to $2,500 in student loan interest on your Form 1040 if you meet certain income requirements. This deduction is available even if you do not itemize your deductions.

10. What is the difference between taxable and adjusted gross Income (AGI)?

- AGI (Adjusted Gross Income) is your total Income after certain deductions, such as student loan interest, retirement contributions, or business expenses if you’re self-employed. It’s calculated on Schedule 1.

- Taxable Income is your AGI minus your standard or itemized deductions. This Income is subject to federal income tax.

Advanced FAQ Section for Form 1040: Understanding the U.S. Individual Income Tax Return

1. What happens if I make a mistake on my Form 1040?

If you make an error on your tax return, you can file an amended return using Form 1040-X. This form allows you to correct mistakes or omissions, such as changing your filing status, Income, or deductions. You must file Form 1040-X within three years of the original filing date to claim any refund due.

1. How can I track my refund after filing Form 1040?

You can track the status of your refund using the IRS tool, Where’s My Refund? To use this tool, you must provide your Social Security number, filing status, and refund amount.

3. Can I claim my children or other dependents on Form 1040?

You can claim children and other dependents on your Form 1040 to get certain tax benefits, such as the Child Tax Credit or the Child and Dependent Care Credit. The IRS has particular rules around who qualifies as a subordinate, so it is imperative to get the prerequisites before claiming them.

Find more on claiming dependents at the IRS Dependents page.

4. What is the Alternative Minimum Tax (AMT)?

The Alternative Minimum Tax (AMT) ensures that high-income earners who benefit from certain tax deductions and credits still pay a minimum level of tax. If you are subject to the AMT, you must calculate your taxes using a different set of rules and pay the higher of your regular tax or AMT. For detailed information about the AMT, visit the IRS AMT page.

5. What should I do if I cannot fully pay my tax liability?

If you owe taxes but cannot afford to pay the full amount, you should still file your Form 1040 on time to avoid penalties for failing to file. You may qualify for a payment plan or an offer in compromise, an agreement to settle your tax liability for less than the full amount owed. Visit the IRS website for more details on payment options.

If you’re unable to pay, learn more about payment options on the IRS Payment Plan page.

Conclusion: Mastering Form 1040

By now, you ought to understand Form 1040 and how to fill it out. It’s all almost precise detailing and arrangement, from choosing your tax status to calculating your taxable Salary and findings, and applying credits.

Remember, tax planning is key—staying organized, keeping track of your Pay and costs, and taking advantage of deductions and credits can diminish your tax burden. Frame 1040 may seem complex, but with this comprehensive direct, you can file and record your taxes like a master!

Please let me know if you still have any questions or need assistance with specific sections of the form. Happy Filing!

To get further help with filing your taxes, check out the IRS Taxpayer Assistance page.

Thank you for reading this post, don't forget to subscribe!