Introduction: Get Ready for the 2024 Tax Filing Season

The 2024 tax deadlines are formally upon us, and it’s fundamental to stay on top of the key dates to avoid penalties and ensure that you get the most out of your tax return.

Whether you’re a first-time filer, self-employed, or someone who’s filed taxes many times before, understanding when to file, how to claim valuable credits like the Earned Income Tax Credit (EITC), and how to avoid common filing mistakes can make a big difference.

The IRS has worked hard to streamline the process, providing resources like IRS Free File and other online tools to help you file accurately and efficiently. In this post, we’ll walk through some important dates you need to know for the 2024 filing season and provide helpful tips to ensure a smooth and stress-free tax experience.

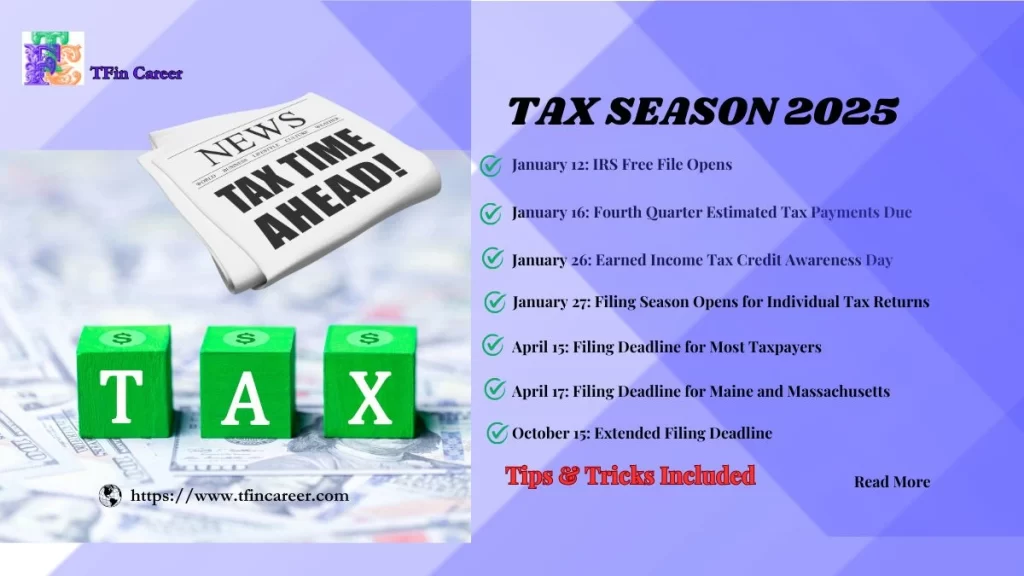

Key 2024 Tax Deadlines: What You Should Know

Here’s a list of the most important dates for 2024 tax filing:

1. January 12: IRS Free File Opens

If your income is $73,000 or less, you can file your taxes for free using the IRS’s Free File service, which opens on January 12. It is an excellent option for qualified people because it’s an easy way to get your taxes done without paying for expensive software or tax preparers.

Tip: To save time, make sure you have all your documents ready (W-2s, 1099s, etc.) when you start using Free File.

2. January 16: Fourth Quarter Estimated Tax Payments Due

Simplify calculating your Tax Liabilities and refund in Tax Season with this tax calculator

For those who make estimated tax payments, the due date for the 2023 fourth-quarter payment is January 16. It reminds freelancers, self-employed workers, or anyone who pays quarterly taxes. If you miss this, you could face interest or penalties.

Tip: Use the IRS Direct Pay tool to easily make payments directly from your bank account.

3. January 26: Earned Income Tax Credit Awareness Day

If you qualify for the Earned Income Tax Credit (EITC), stamp January 26 on your calendar as EITC Mindfulness Day. This credit can assist moderate-income laborers in reducing their debt and getting a larger discount. To qualify, you must meet particular income and filing prerequisites.

Tip: Use the EITC Assistant tool on the IRS website to check if you’re eligible for this valuable credit.

4. January 27: Filing Season Opens for Individual Tax Returns

The 2024 tax filing season officially begins on January 27. It is when the IRS starts accepting individual tax returns. You can immediately file your return if you’re ready and have all your documents.

Tip: Filing early can speed up your refund. If you expect a refund, filing electronically and choosing direct deposit are the fastest ways to get your money.

5. April 15, 2024: Tax Deadlines for Most Taxpayers

The tax filing due date for most citizens is April 15, 2024. If you miss this date, you might face punishment. In any case, you can file for an extension to push the due date to October 15. Fair be mindful that an expansion, as it were, gives you more time to file, not more time to pay any taxes owed.

Tip: If you require additional time, record for an expansion sometime recently, April 15. To maintain a strategic distance from punishments, attempt to pay as much as possible by the due date.

6. April 17: Filing Deadline for Maine and Massachusetts

If you’re a citizen of Maine or Massachusetts, your tax filing due date is April 17, 2024, due to Patriots’ Day being recognized on April 15.

Ensure you don’t miss this extended deadline if you live in these states.

7. October 15: Extended Filing Deadline

For anyone who filed for an extension, the final deadline to submit their taxes is October 15, 2024. It gives you several additional months, but remember that interest and penalties will still accrue on unpaid taxes, so it’s best to pay as much as possible by the April 15 deadline.

Tip: Use time wisely to double-check your tax return or gather any missing documents.

Bottom Line: 2024 Tax Filing – Stay Ahead with Preparation

The 2024 Tax filing season can feel overwhelming, but with a few courses of action, you can breeze through it. Check your calendar with the key dates over, collect your records early, and utilize the IRS’s free tax return to make strides in the process.

Whether you file early or must ask for an extension, remaining proactive about almost due dates will help you maintain a strategic distance from punishments and guarantee that you file accurately.

Filing early can lead to a faster discount, and using tools like the IRS Free Record and the IRS Online Account can save you time and money. So, get organized, remain organized, and make 2024 your smoothest tax season!

Hi there! I am Sudip Sengupta, the face behind “Tfin Career”. Tfin Career is a sole proprietorship finance and consulting firm that makes complex tax and financial concepts easy to understand for everyone. With more than 21 years of experience in the field, I have noticed that people cannot make the right decisions in this field. So, I decided to create “Tfin Career” to help individuals and businesses alike. Here I urge those who are confused to make better choices. Also, it is good news for my dear clients and every visitor that I/we are going to start a training module for those who want to choose a career path in Finance and Taxation. Just follow my website.

Thank you for reading this post, don't forget to subscribe!