Hello World

Taxes

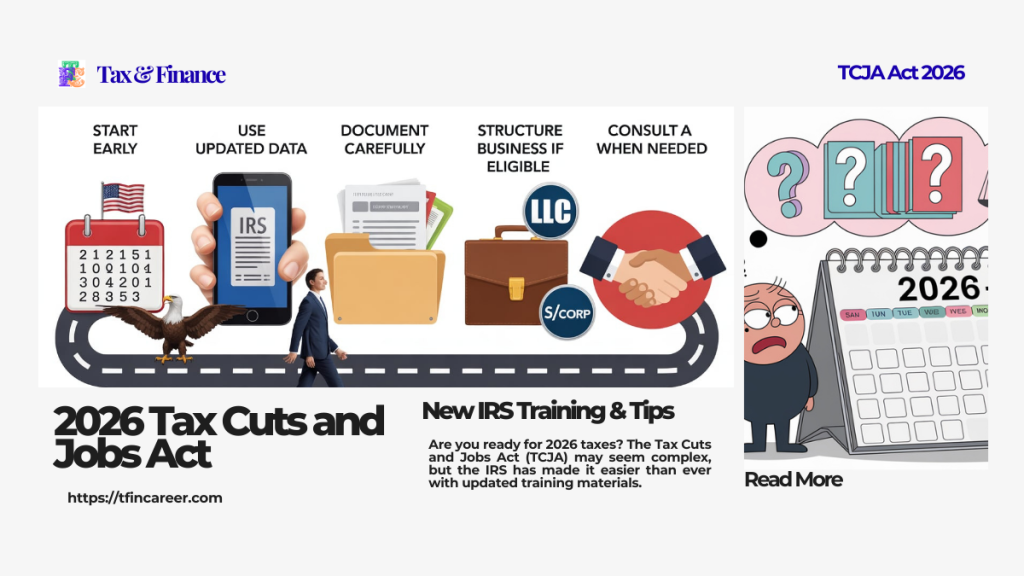

2026 TCJA Act: New IRS Training, Guide & Tips

Dive into the 2026 TCJA Act. updates — discover new IRS guidance, deduction limits, and tax-planning strategies for individuals and small businesses.

Taxes

Finally! A Tax Break on New Car Loan Interest (2026)

New car loan interest may be tax‑deductible — even without itemizing. Learn the rules, exceptions, and filing steps to lower your 2026 taxable income.

Investment

New AND Authentic Investment OpportuniTIES in 2026 | Smart US Outlook

Explore top upcoming investment opportunities in the US for 2026: from green energy to AI-powered real estate. Data-driven, EEAT-friendly analysis

Taxes

2026 US tax law changes: How to Prepare Your Finances This Year

2026 US tax law: Every few years, a new tax law appears and changes everything. Some people cheer, some panic,...

Investment

Retirement WARNING: New 401(k) Rule in 2026 Will Cost High Earners Big

High earners aged 50+ — preparing for 2026: catch up 401(k) contributions will no longer be pre-tax. We break down the Roth-only tax rule.