IRS Update: Have you ever waited for a payment that never arrived? It feels stressful. Many U.S. taxpayers are now facing this situation. A recent IRS update has changed some rules. These changes may affect who gets stimulus money, when it arrives, and how much you receive.

So yes, things are different now.

But do not worry. This guide explains everything in simple English. Whether you already received payments or are still waiting, this article will help you understand what is happening. Let’s go step by step.

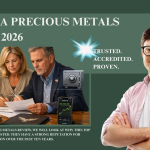

1. IRS Update: New Eligibility Rules Could Change Who Qualifies

Explanation: Why this matters for your money

The IRS has updated income limits and verification steps. This means some people who qualified before may not qualify now.

Why did this happen? Mainly to stop fraud and make sure the right families get support.

For example, many Americans got higher salaries after the pandemic. Because of this, their income now crosses the limit. So they may lose eligibility.

The IRS now checks recent tax returns instead of older ones. That is a big change.

IRS Update: Here is what you should know:

- Single taxpayers must meet updated income limits

- Married couples must provide combined income details

- Dependents now need stronger proof

If your income changed in 2024 or 2025, you should review your status. Keeping your tax records updated is now very important.

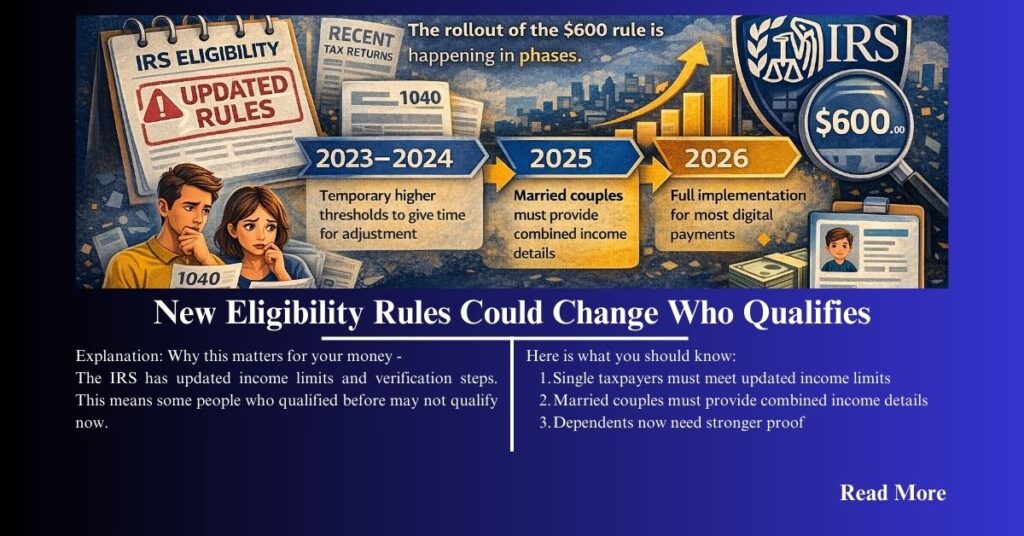

2. Recovery Rebate Credit Rules Are Stricter

IRS Update Explanation: What to do if you missed a payment

Article Published by the IRS: Recovery Rebate Credit and Economic Impact Payments: partner and promotional materials

Did you miss a previous stimulus check? You may still claim it through the Recovery Rebate Credit. However, the IRS now requires more documents.

In recent years, many people filed incorrect claims. Because of this, the IRS has become stricter.

Let me share a real example. One taxpayer filed for a missed payment in 2024. He received his refund after review. But now, similar claims may take longer.

Common reasons for delay include:

- Wrong Social Security number

- Dependents claimed by two taxpayers

- Old or incorrect bank details

So before filing, double-check everything. A small mistake can slow down your refund.

Tax Reform 2026: New Deductions, Benefits & What It Means for You

3. Payments May Take Longer in 2026

Explanation: Why delays are increasing

This is one of the biggest concerns. The IRS has added new security checks. These checks reduce fraud, but they also slow the process.

Electronic filing is still faster. Yet identity checks and manual reviews can add extra weeks.

Government reports show that fraud prevention has saved billions of dollars. So the IRS will continue using these systems.

What should you do?

- File your taxes early

- Respond quickly to IRS messages

- Check your email and mail regularly

Even a small delay in documents can push your payment back.

IRS Online Account Warning 2026 Tax Deadline: One Simple Step Could Protect Your Tax Refund

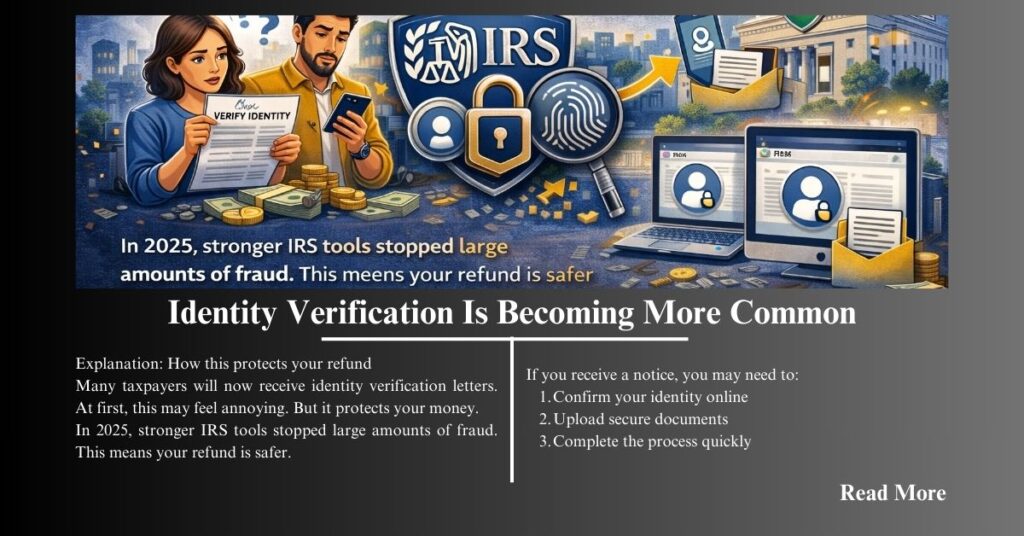

4. Identity Verification Is Becoming More Common

IRS Update Explanation: How this protects your refund

Many taxpayers will now receive identity verification letters. At first, this may feel annoying. But it protects your money.

In 2025, stronger IRS tools stopped large amounts of fraud. This means your refund is safer.

If you receive a notice, you may need to:

- Confirm your identity online

- Upload secure documents

- Complete the process quickly

Ignoring these steps can delay or cancel payments. So always respond on time.

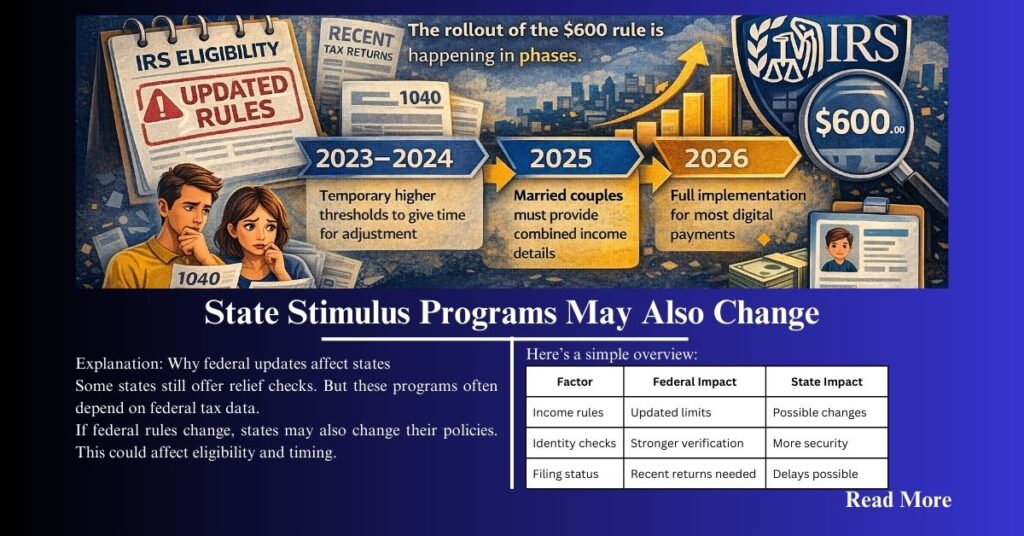

5. State Stimulus Programs May Also Change

Explanation: Why federal updates affect states

Some states still offer relief checks. But these programs often depend on federal tax data.

If federal rules change, states may also change their policies. This could affect eligibility and timing.

Here’s a simple overview:

| Factor | Federal Impact | State Impact |

| Income rules | Updated limits | Possible changes |

| Identity checks | Stronger verification | More security |

| Filing status | Recent returns needed | Delays possible |

So if your state offers payments, check local updates regularly.

6. Filing Accuracy Is More Important Than Ever

IRS Update Explanation: Small mistakes can cause big delays

Today, IRS systems are smarter. They can detect errors quickly. Even a tiny mistake may trigger a review.

From my own work with tax filings, I have seen this happen. One client waited three months because of a small number mismatch. That experience taught us an important lesson.

Here are simple tips:

- Use trusted tax software

- Review your return carefully

- Keep copies of documents

- Answer IRS notices fast

Speed is good, but accuracy is better.

Tax Season 2026: How to Stop Overpaying by These Hidden Tax Tips

Frequently Asked Questions on IRS Update

1. Will everyone get a new stimulus check?

No. Payments depend on income, eligibility, and government programs.

2. How can I check my payment status?

Use official IRS tools or check your tax records.

3. What if I missed an earlier stimulus?

You may claim it through the Recovery Rebate Credit.

4. Can identity checks delay payments?

Yes. Verification can slow the process.

5. Are stimulus payments taxable?

Usually no, but always check official rules.

6. Are state payments taxable?

Some may be taxable depending on federal and state law.

7. How long does processing take?

Electronic returns are faster, but reviews may add weeks.

8. What income is used?

Your recent adjusted gross income.

9. Can dependents qualify?

Yes, but stricter proof is required.

10. Should I file early?

Yes. Early filing reduces delays.

IRS Update: Final Thoughts – What You Should Do Now

IRS Update: IRS rules are changing. That is the reality. But staying informed can help you avoid stress and protect your finances.

The best steps today are simple:

- Keep your tax records updated

- File early and accurately

- Respond to notices quickly

- Monitor official updates

If you are unsure, talk to a tax professional. Every case is different.

In the end, preparation is your strongest tool. Stay organized. Stay alert. And you will stay ahead.

Disclaimer

This content is for education only. It is not legal or tax advice. Rules may change. Always consult a licensed professional or official IRS guidance.

Hi there! I am Sudip Sengupta, the face behind “Tfin Career”. Tfin Career is a sole proprietorship finance and consulting firm that makes complex tax and financial concepts easy to understand for everyone. With more than 21 years of experience in the field, I have noticed that people cannot make the right decisions in this field. So, I decided to create “Tfin Career” to help individuals and businesses alike. Here I urge those who are confused to make better choices. Also, it is good news for my dear clients and every visitor that I/we are going to start a training module for those who want to choose a career path in Finance and Taxation. Just follow my website.

Thank you for reading this post, don't forget to subscribe!