Business Tax Breaks: Did you know that billions of dollars in business tax breaks go unclaimed every year? Many entrepreneurs unknowingly leave money on the table simply because they are not aware of the deductions and credits they qualify for. Whether you’re a solopreneur, an S-Corp owner, or a small business leader, understanding these tax breaks could be the difference between an average year and your most profitable one yet.

In this guide, we’ll uncover the most overlooked tax breaks, how to claim them, and why they matter for your bottom line.

Key Takeaways: Business Tax Breaks You Shouldn’t Miss

- Home Office Deduction – Claim a portion of rent, utilities, and maintenance if you work from home.

- 20% QBI Deduction – Pass-through entities (S-Corps, LLCs, sole proprietors) can deduct up to 20% of qualified business income.

- Section 179 & Bonus Depreciation – Write off large equipment purchases (up to $1.25M) in the same year.

- Hiring Family Members – Paying your kids (legitimately) can shift income tax-free while deducting wages.

- Self-Employed Health Insurance Deduction – Deduct 100% of health insurance premiums if you’re self-employed.

- Pro Tip: Work with a tax strategist (like Boris Musheyev for S-Corps) to ensure you’re not missing any industry-specific deductions.

Also Read – Unlocking the Hidden Tax Breaks: Save Big This Year

Why Business Owners Overpay Taxes (And How to Stop)

Tax laws are complex, and the IRS isn’t going to hand you a checklist of every deduction you qualify for. Many business owners miss out because:

- They don’t track expenses properly – Without accurate records, deductions like mileage, home office expenses, and business meals slip through the cracks.

- They assume they don’t qualify – Some tax breaks, like the20% Qualified Business Income (QBI) deduction, apply to more businesses than people realize.

- They rely on outdated advice – Tax laws change frequently (e.g., theTax Cuts and Jobs Act reforms), and strategies that worked years ago may no longer be optimal.

The good news? A few strategic moves can help you reclaim thousands in savings.

Seniors must read – Top 5 Tax Breaks for 50+: Take Full Benefits of Tax-Saving Opportunities.

Top 5 Overlooked Business Tax Breaks

1. The Home Office Deduction (Even for Side Hustlers)

If you use part of your home exclusively for business, you can deduct a portion of expenses like:

- Mortgage interest or rent

- Utilities (electricity, internet)

- Repairs and maintenance

Two ways to claim it:

- Simplified method: $5 per square foot (up to 300 sq. ft.).

- Standard method: Deduct actual expenses based on the percentage of your home used for business.

Example: A 200 sq. ft. home office could save you$1,000+ annually.

2. The 20% QBI Deduction (A Hidden Gem for Pass-Through Entities)

If your business is structured as anS-Corp, LLC, or sole proprietorship, you may qualify for a20% deduction on your net business income.

Who benefits most?

- Service-based businesses (consultants, freelancers, real estate agents)

- Businesses under$191,950 (single) or $383,900 (joint) taxable income.

Example: If your business nets $100,000, this deduction couldsave you $5,000+ in taxes.

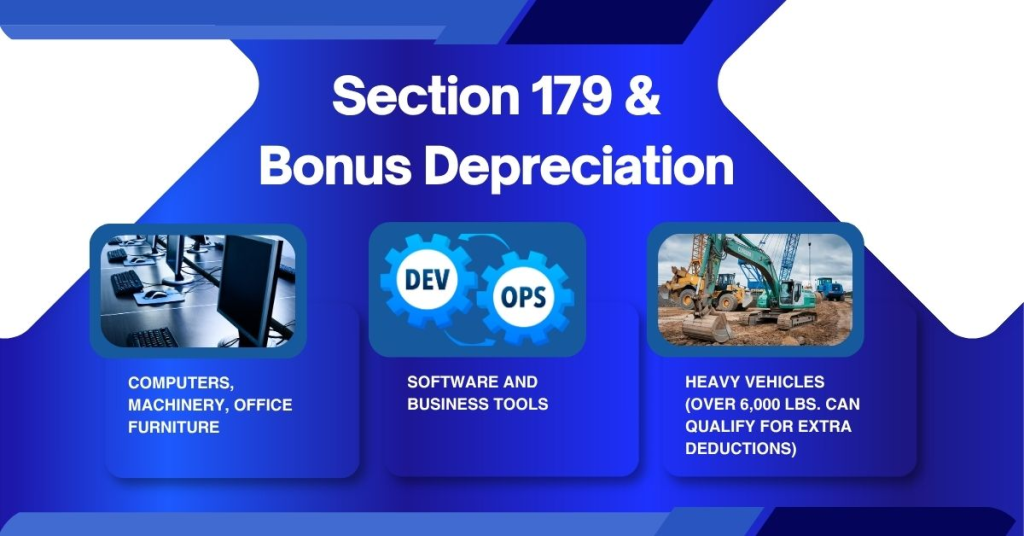

3. Section 179 & Bonus Depreciation (Write Off Big Purchases Faster)

Bought equipment, vehicles, or tech for your business?Section 179 lets you deduct the full cost (up to$1.25M) in the year of purchase—instead of spreading it over the years.

What qualifies?

- Computers, machinery, office furniture

- Heavy vehicles (over 6,000 lbs. can qualify for extra deductions)

- Software and business tools

Example: A $50,000 equipment purchase could mean$12,500+ in immediate tax savings (assuming a 25% tax rate).

4. Hiring Your Kids (A Legal Tax Loophole)

If you pay your children (under 18) for legitimate work in your business:

Read this Publication 929 by the IRS, Tax Rules for Children and Dependents

- Their wages aretax-deductible for your business.

- They can earn up to thestandard deduction ($15,000 in 2025) tax-free.

Example: Paying your teen $15,000 for admin work couldsave you $3,750+ (at a 25% tax rate).

Read also these great strategies – Child Payroll Tax Loophole: How to Save Thousands Legally

5. Self-Employed Health Insurance Deduction

If you’re self-employed and pay for your own health insurance, you can deduct100% of premiums—even if you don’t itemize.

Example: A $10,000 annual premium couldsave you $2,500+ (at a 25% rate).

Self-Employed Health Insurance Deduction – Read the full article from the IRS

How to Avoid Missing Out (Pro Tips)

- Track Everything – Use apps like QuickBooks or MileIQ for expenses, mileage, and receipts.

- Consult a Tax Strategist – A CPA (like Boris Musheyev, who specializes in S-Corp strategies) can uncover hidden savings.

- Review Entity Structure – Switching from a sole proprietorship to an S-Corp could save thousands in self-employment taxes.

Frequently Asked Questions (FAQ)

1. What’s the most significant tax deduction most small businesses miss?

The Qualified Business Income (QBI) deduction is often overlooked because many business owners assume they don’t qualify. If your taxable income is under $191,950 (single) or $383,900 (married), you could deduct 20% of your business income—potentially saving thousands.

2. Can I still claim the home office deduction if I’m a freelancer?

Yes! Freelancers, independent contractors, and side hustlers can claim the home office deduction if they use a dedicated space for business. The simplified method ($5/sq. ft.) makes it easy to calculate.

3. Does buying a vehicle for my business help with taxes?

Absolutely. If the vehicle is used for business (over 50% of the time), you can:

- Deduct actual expenses (gas, repairs, insurance)

- Use the IRS mileage rate (67 cents per mile in 2024)

- Take Section 179 deduction for SUVs/trucks over 6,000 lbs.

4. How does hiring my child save me money on taxes?

- Their wages are tax-deductible for your business.

- If they earn under $15,000 (2025 standard deduction), they pay $0 in federal income tax.

- No payroll taxes if they’re under 18 (for sole proprietors or LLCs).

5. What’s the difference between a tax credit and a tax deduction?

- Dedication = Reduces taxable income (e.g., a $1,000 deduction saves ~$250 at a 25% tax rate).

- Credit = Directly reduces tax owed (e.g., a $1,000 credit = $1,000 less in taxes).

Final Thought: Don’t Let the IRS Keep Your Money

Tax breaks aren’t about loopholes—they’re incentives designed to help businesses grow. By staying informed and proactive, you can legally minimize your tax burden and reinvest those savings into scaling your business.

Want More?

- Check out Boris Musheyev’sS-Corp Tax Strategies Book for advanced tactics.

- Subscribe for more tax-saving tips—because keeping more of your hard-earned money should be a priority!

Thank you for reading this post, don't forget to subscribe!