Missed April Tax Deadline? Did April 15 sneak up on you this year? You’re in good company – IRS data shows about 20 million taxpayers file late yearly. But here’s what most people don’t realize: the clock starts ticking immediately on penalties, and your refund could disappear if you wait too long. Whether you owe money or are due a refund, this comprehensive “Missed April Tax Deadline 2025?” guide will walk you through every step you need to take.

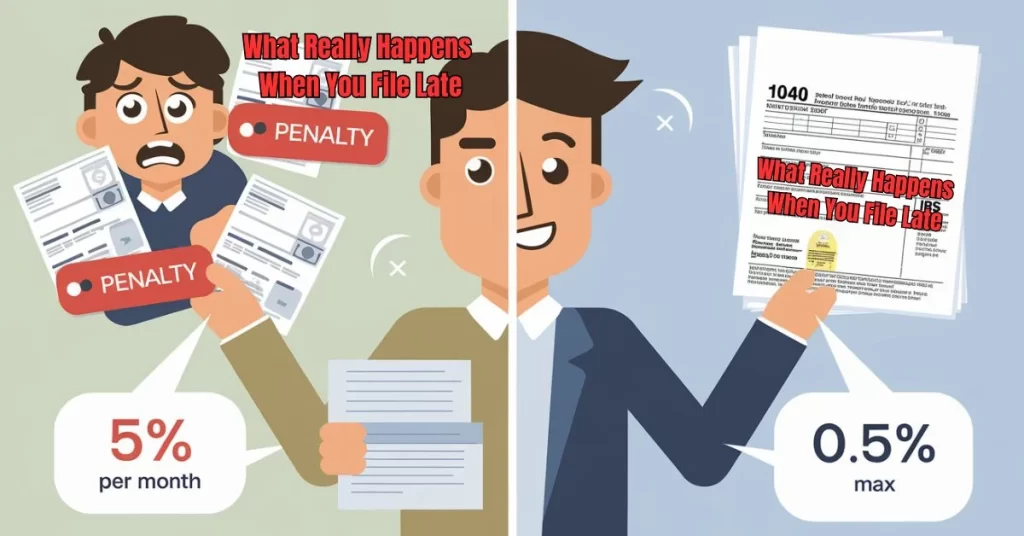

Understanding the Consequences: What Really Happens When You File Late

The IRS has a two-tier penalty system for late filers, and understanding this could save you hundreds or even thousands of dollars:

- The Failure-to-File Penalty: This is the big one—5% of your unpaid taxes for each month or part of your late return, up to 25%. Even if you can’t pay, filing your return stops this penalty from maxing out.

- The Failure-to-Pay Penalty: This is smaller at 0.5% per month, but it adds up. The good news is that setting up a payment plan immediately reduces this to 0.25%.

Real Example: a freelance graphic designer, Sarah, owed $8,000 but missed the deadline. By filing just 2 weeks late and setting up a payment plan, she limited her total penalties to $520 instead of what could have been $1,200.

Also Read, Tax Filing 2025: Deadlines, New Rules & How to Get Max Refunds

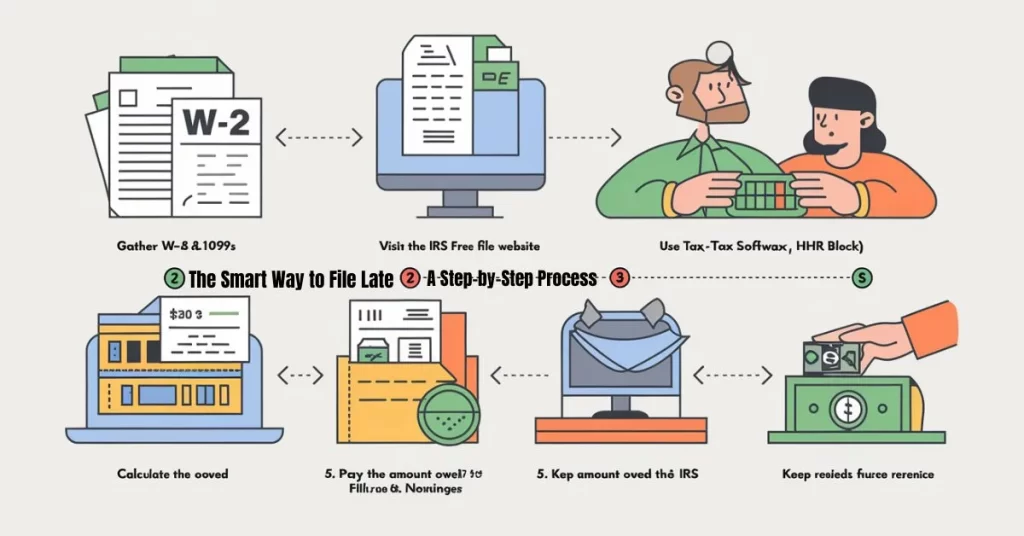

The Smart Way to File Late: A Step-by-Step Process

Follow this exact sequence to minimize your penalties and stress:

- Gather Your Documents Immediately: Start with your W-2s, 1099s, and deduction records. Missing documents? Request wage transcripts from the IRS using Form 4506-T.

- Choose Your Filing Method Wisely:

- IRS Free File (for incomes under $73,000), Commercial tax software (TurboTax, H&R Block accepts late filings.

- Paper filing (only if necessary – it slows processing)

- Pay What You Can Today: Even $100 helps. The IRS considers “good faith” partial payments when assessing penalties.

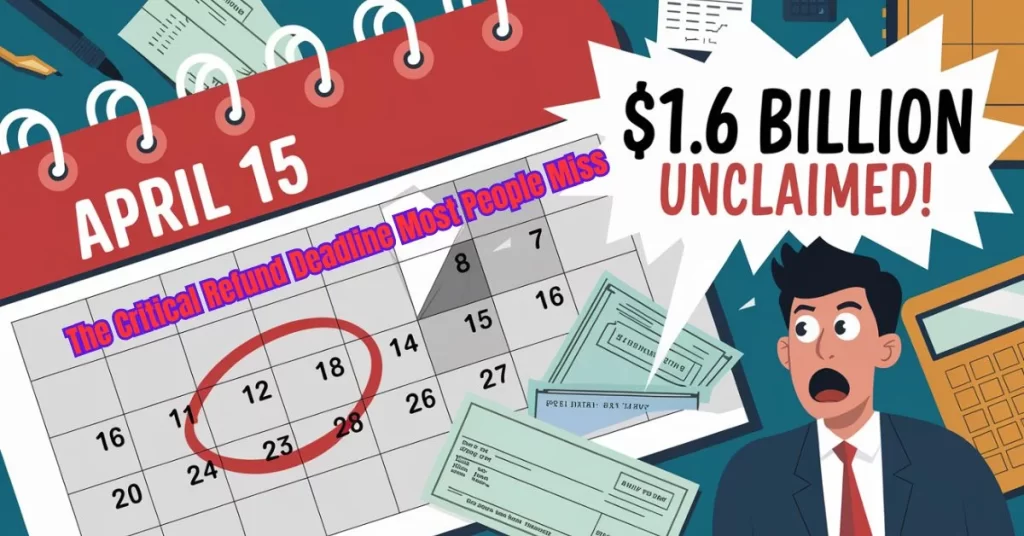

The Critical Refund Deadline Most People Miss

Here’s a shocking fact: The IRS reports that nearly $1.6 billion in unclaimed refunds from 2021 expired in April 2024. If you’re owed money, you have exactly three years from the original due date to claim it. For 2022 returns, that means filing by April 15, 2025.

Refund Timeline:

| Tax Year | Last Filing Date | Average Unclaimed Refund |

| 2022 | April 15, 2025 | $893 |

| 2023 | April 15, 2026 | TBD |

How to Reduce or Eliminate Penalties

The IRS actually offers several ways to get penalty relief:

- First-Time Abatement (FTA): If you’ve been penalty-free for 3 years, you might qualify for automatic relief.

- Reasonable Cause: Documented illness, natural disasters, or circumstances beyond your control.

- Penalty Appeal: Use Form 843 if you believe penalties were assessed unfairly.

Pro Tip: IRS agents report that 80% of eligible taxpayers never request FTA – don’t leave this money on the table!

State-Specific Considerations

While the federal deadline is April 15, your state might have different rules:

- Extended Deadlines: 7 states (including IA and VA) automatically extend for disasters or state holidays

- Different Penalties: Some states charge higher late fees than the IRS

- Separate Filing: Even if you get a federal extension, check your state requirements

Comprehensive FAQ: Your Late Filing Questions Answered

Q1. Can I file my 2025 taxes late before serious trouble starts?

A1. The IRS considers returns filed within 60 days of the deadline as “routine” late filings. After that, you risk additional scrutiny. However, any late filing is better than none – the failure-to-file penalty maxes out at 5 months (25%), but interest continues accruing.

Q2. I can’t pay anything right now – should I still file?

A2. Absolutely. Filing without payment stops the 5% failure-to-file penalty (reducing it to 2.5%), while not filing keeps that penalty growing. You can request a payment plan after filing.

Q3. Will filing late trigger an audit?

A3. Late filing alone doesn’t increase audit risk. However, returns with large refunds or significant deductions may receive additional scrutiny regardless of when filed. Keep thorough documentation.

Q4. How do I calculate exactly how much I owe in penalties?

A4. Use the IRS online penalty calculator or wait for the IRS to send you a bill (typically within 3-5 months of filing late). You can dispute any discrepancies.

Q5. What if I missed multiple years of filing?

A5. Start with the most recent year first (2025), then work backward. The IRS generally only requires the last 6 years of filings unless there’s evidence of fraud. Consider consulting a tax professional for multi-year filings.

Q6. Can I still contribute to my IRA for 2024 if I file late?

A6. Yes! You have until the original April 15, 2025, deadline for 2024 IRA contributions, even if you file your return late. For 2025 contributions, you have until April 15, 2026.

What’s the most common mistake people make when filing late?

Rushing and making calculation errors. While speed is important, accuracy matters more. Double-check all numbers, especially if you’re filing without professional help.

Action Plan: Your Next Steps Today

Here’s exactly what to do right now:

- Set aside 2 hours today to gather your tax documents

- File electronically by midnight tonight – even with a $0 payment

- Call the IRS tomorrow at 800-829-1040 to discuss payment options

- Mark your calendar for April 1, 2026, to avoid this stress next year

Remember: The IRS processes over 10 million late filings annually. While not ideal, your situation is manageable if you act now. Every day you wait makes the problem worse and more expensive.

“The best time to file was April 15. The second-best time is today.”

Hi there! I am Sudip Sengupta, the face behind “Tfin Career”. Tfin Career is a sole proprietorship finance and consulting firm that makes complex tax and financial concepts easy to understand for everyone. With more than 21 years of experience in the field, I have noticed that people cannot make the right decisions in this field. So, I decided to create “Tfin Career” to help individuals and businesses alike. Here I urge those who are confused to make better choices. Also, it is good news for my dear clients and every visitor that I/we are going to start a training module for those who want to choose a career path in Finance and Taxation. Just follow my website.

Thank you for reading this post, don't forget to subscribe!