Introduction: Why Capital Gains Tax Matters for Investors

Did you know how long you hold an investment can mean the difference between paying 0% or 37% in taxes? The capital gains tax significantly impacts investment returns, yet many Americans don’t fully understand how it works.

This guide will break down:

- What capital gains are (and when you owe taxes)

- Short-term vs. long-term tax rates (2024-2025 IRS brackets)

- How to use capital losses to reduce your tax bill

- Smart strategies to legally minimize what you owe

Let’s dive in.

1. What Is a Capital Gain?

A capital gain occurs when you sell an asset for more than your adjusted basis (typically what you paid plus improvements). The taxable amount is the difference between your sale price and basis.

- Purchase price (cost basis)

- Sale price

- Holding period (short-term vs. long-term)

Example:

- You buy **10 shares of Amazon at 100∗∗(100∗∗(1,000 total).

- Sell them later for **150 per share∗∗(150 per share∗∗(1,500 total).

- Your **capital gain = 500∗∗(500∗∗(1,500 – $1,000).

Key Insight:

- Unrealized gains (still holding the asset) → No tax

- Realized gains (after selling) → Taxable

Know more about Capital Gains: What Are They and How Are They Taxed?

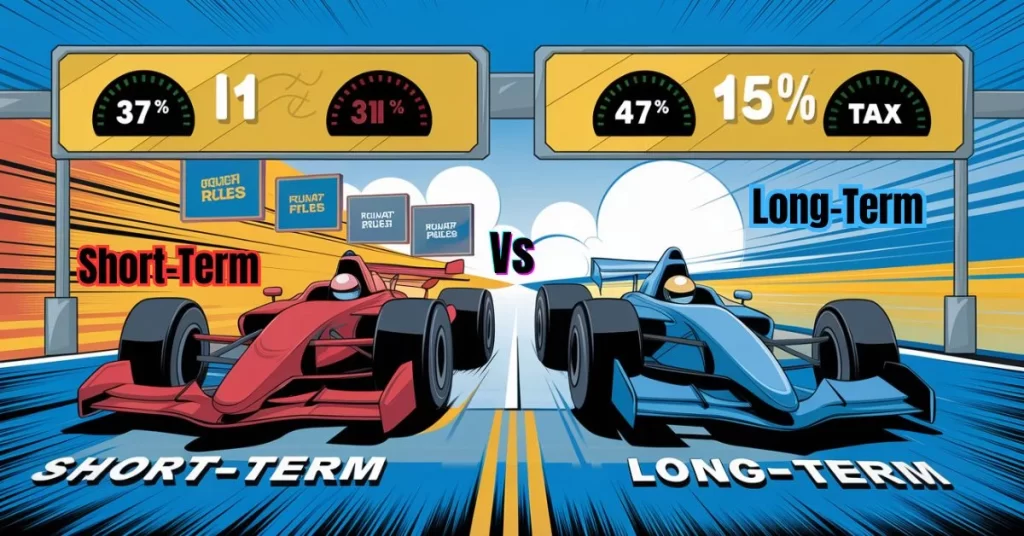

2. Short-Term vs. Long-Term Capital Gains: The 1-Year Rule

The IRS taxes gains differently based on how long you hold the asset before selling:

| Factor | Short-Term Capital Gains (≤1 Year) | Long-Term Capital Gains (>1 Year) |

| Tax Rate | Same as ordinary income (10%-37%) | Lower rates (0%, 15%, or 20%) |

| Best For | Day traders, short-term flips | Buy-and-hold investors |

| NIIT Surcharge | Yes (if income over $200k) | Yes (if income over $200k) |

Real-Life Example:

- Short-term: Sell Tesla stock after 6 months → Pay 24% tax (or higher).

- Long-term: Sell after 1 year + 1 day → Pay 15% tax (or 0% if income is low).

Why This Matters:

Holding an asset just one extra day can save you thousands in taxes.

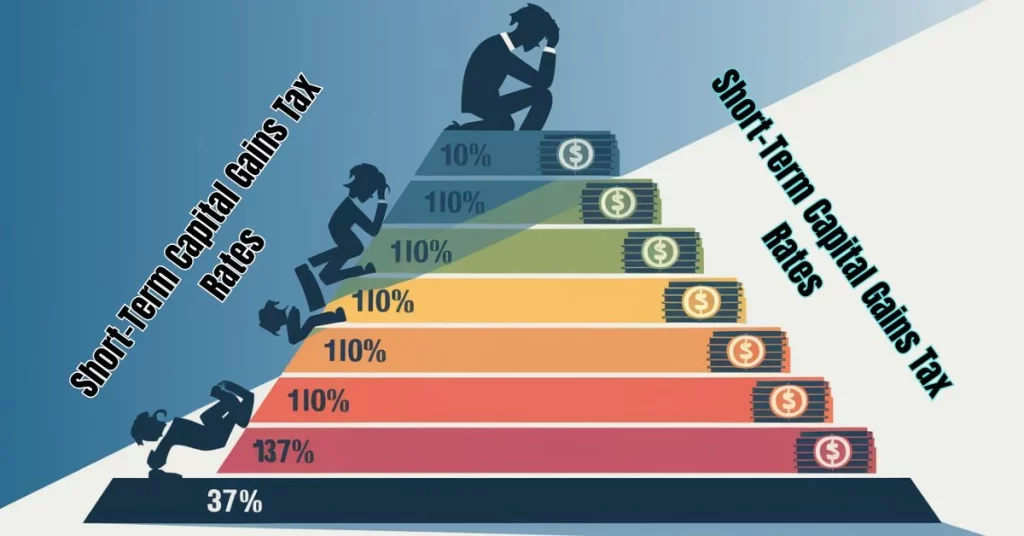

3. Short-Term Capital Gains Tax Rates (2024-2025)

Short-term gains are taxed at ordinary income rates—the same as your salary or wages.

2024 Short-Term Capital Gains Tax Rates (Filing in 2025)

| Single Filers | Married Filing Jointly | Tax Rate |

| 0−0−11,600 | 0−0−23,200 | 10% |

| 11,601−11,601−47,150 | 23,201−23,201−94,300 | 12% |

| 47,151−47,151−100,525 | 94,301−94,301−201,050 | 22% |

| Up to $609,350 | Up to $731,200 | 37% |

2025 Short-Term Capital Gains Tax Rates (Filing in 2026)

- Expect ~5% inflation adjustments (exact IRS numbers TBD).

Key Takeaway: Short-term gains can push you into a higher tax bracket, increasing your overall tax bill.

*Estimated based on inflation adjustments per Tax Policy Center data

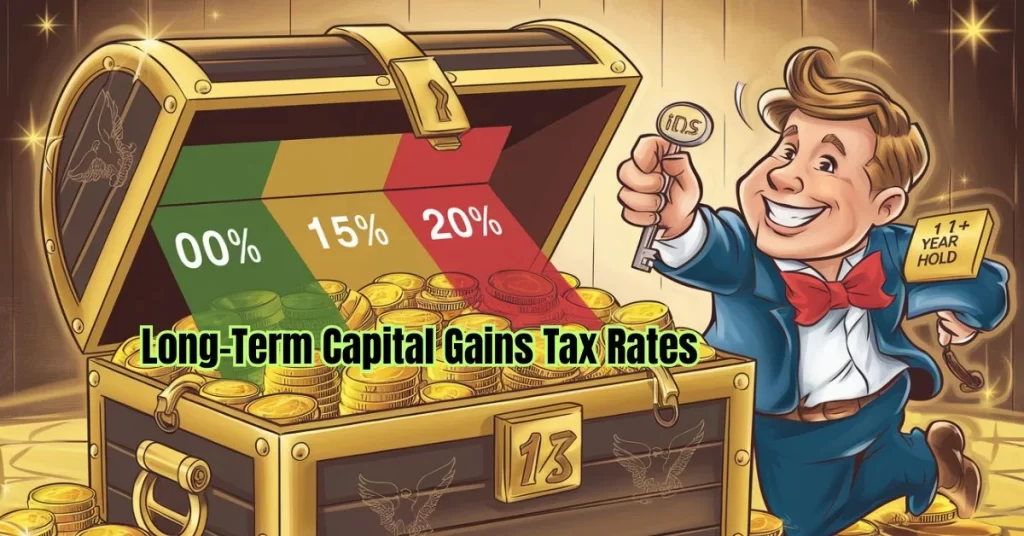

4. Long-Term Capital Gains Tax Rates (2024-2025)

The IRS rewards long-term investors with lower tax rates:

2024 Long-Term Capital Gains Tax Rates (Filing in 2025)

| Single Filers | Married Filing Jointly | Tax Rate |

| 0−0−47,025 | 0−0−94,050 | 0% |

| 47,026−47,026−518,900 | 94,051−94,051−583,750 | 15% |

| Over $518,900 | Over $583,750 | 20% |

2025 Long-Term Capital Gains Tax Rates (Filing in 2026)

- Similar brackets, adjusted for inflation.

Pro Tip: If your income is just above the 0% bracket, consider selling in chunks to stay under the limit.

5. The 3.8% Net Investment Income Tax (NIIT) Surcharge

If your Modified Adjusted Gross Income (MAGI) exceeds:

- $200,000 (Single)

- $250,000 (Married Filing Jointly)

You’ll pay an extra 3.8% on capital gains.

Example:

- Single filer with 220,000income+220,000income+50,000 long-term gains

- Pays 15% (7,500)+∗∗3.87,500)+∗∗3.820,000** (760)→∗∗Totaltax:760)→∗∗Totaltax:8,260**

6. Capital Gains in Retirement Accounts (401(k), IRA, Roth IRA)

Different accounts have different tax rules for capital gains:

| Account Type | Capital Gains Tax Treatment |

| Traditional 401(k)/IRA | Tax-deferred (pay ordinary income tax at withdrawal) |

| Roth IRA | Tax-free growth (no capital gains tax if rules followed) |

| Taxable Brokerage | Standard capital gains tax rules apply |

Best Strategy:

- Hold high-growth stocks in Roth IRAs (tax-free forever).

- Keep bonds/dividend stocks in tax-deferred accounts.

7. How Capital Losses Can Reduce Your Tax Bill

The IRS lets you use investment losses to offset gains:

- Same-year offsetting: Short-term losses first reduce short-term gains.

- $3,000 deduction: Excess losses can reduce ordinary income.

- Carryforward: Unused losses roll over indefinitely.

Example:

- $10,000 short-term gain

- $4,000 short-term loss

- 3,000long−termloss∗∗→∗∗Nettaxablegain:3,000long−termloss∗∗→∗∗Nettaxablegain:3,000 (instead of $10,000).

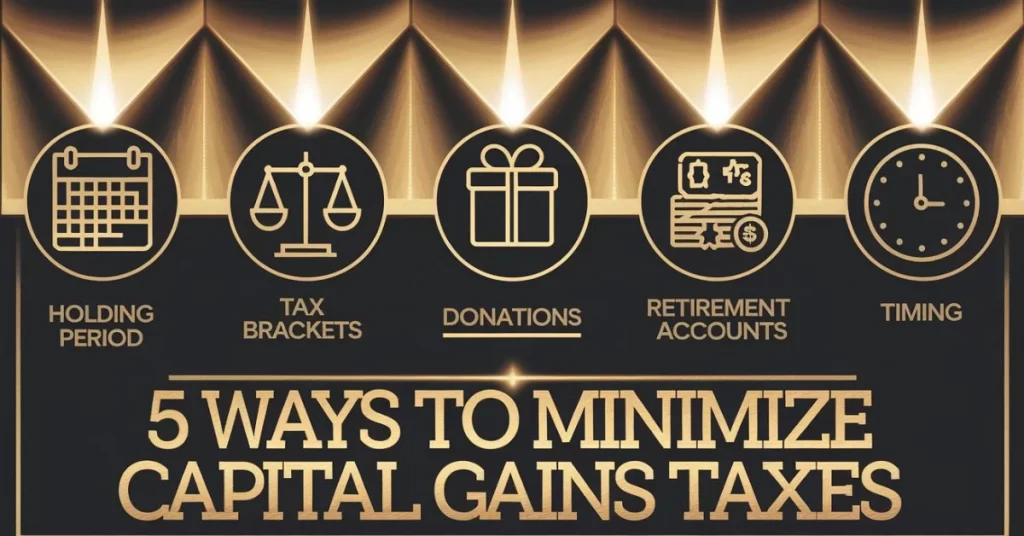

8. 5 Smart Ways to Minimize Capital Gains Taxes

1. Hold Investments >1 Year

- Convert 37% short-term tax → 15% or 0% long-term rate.

2. Tax-Loss Harvesting

- Offset gains with investment losses (up to $3,000/year excess can be deducted against income)

3. Use Retirement Accounts

- Roth IRAs = no capital gains tax ever.

4. Gift Appreciated Stock

- Donate to charity → avoid gains + get a deduction.

5. Time Sales in Low-Income Years

- Retirees can often pay 0% on long-term gains.

You can read this article for details – Capital Gains Tax Simplified: Short-Term vs. Long-Term & Ways to Reduce Your Tax Bill

9. FAQs (What Real Investors Ask)

Q1: Does the 1-year rule apply to cryptocurrency?

✅ Yes! Crypto follows the same rules as stocks.

Q2: What if I sell my home?

- 250k(single)/250k(single)/500k (married) exclusion if lived there 2 of last 5 years.

Q3: Are there states with no capital gains tax?

- Yes! Texas, Florida, Nevada, and 6 others have 0% state capital gains tax.

Q4. Do I Owe Capital Gains Tax If I Reinvest My Profits?

✅ Yes! Reinvesting profits (e.g., using stock sale proceeds to buy another stock) doesn’t avoid taxes. The IRS still treats the sale as a realized gain, so you’ll owe tax in the year you sold the asset. The only way to defer taxes is by using retirement accounts (like a 401(k) or IRA) or a 1031 exchange (for real estate).

Q5. Can I Avoid Capital Gains Tax by Moving to a No-Tax State?

🚩 It depends. While states like Florida and Texas have no state capital gains tax, the IRS still enforces federal taxes. To fully escape state tax, you must:

- Establish residency in the new state (e.g., change driver’s license, voter registration).

- Spend most of the year there (many states require 183+ days).

Warning: High-tax states (e.g., California, New York) may still tax you if they consider you a “part-year resident.”

Final FAQ Bonus: What’s the “Wash Sale Rule”?

🚫 Don’t get penalized! The IRS disallows the loss if you sell a stock at a loss and rebuy it (or a “substantially identical” asset) within 30 days. This applies to stocks, crypto, and options.

Workaround: Wait 31+ days to repurchase, or buy a similar (but not identical) asset (e.g., swap SPY for VOO).

Read this article, provided by the IRS: Topic no. 409, Capital gains and losses

Final Takeaways: How to Keep More of Your Profits

- Track holding periods (1 extra day can save thousands).

- Use tax-loss harvesting to offset gains.

- Maximize retirement accounts (Roth IRAs = best for growth).

- Consult a tax pro for complex situations.

Want More? Bookmark this guide and revisit before selling investments!

Now go invest smarter—and keep more of your money! 🚀

Hi there! I am Sudip Sengupta, the face behind “Tfin Career”. Tfin Career is a sole proprietorship finance and consulting firm that makes complex tax and financial concepts easy to understand for everyone. With more than 21 years of experience in the field, I have noticed that people cannot make the right decisions in this field. So, I decided to create “Tfin Career” to help individuals and businesses alike. Here I urge those who are confused to make better choices. Also, it is good news for my dear clients and every visitor that I/we are going to start a training module for those who want to choose a career path in Finance and Taxation. Just follow my website.

Thank you for reading this post, don't forget to subscribe!