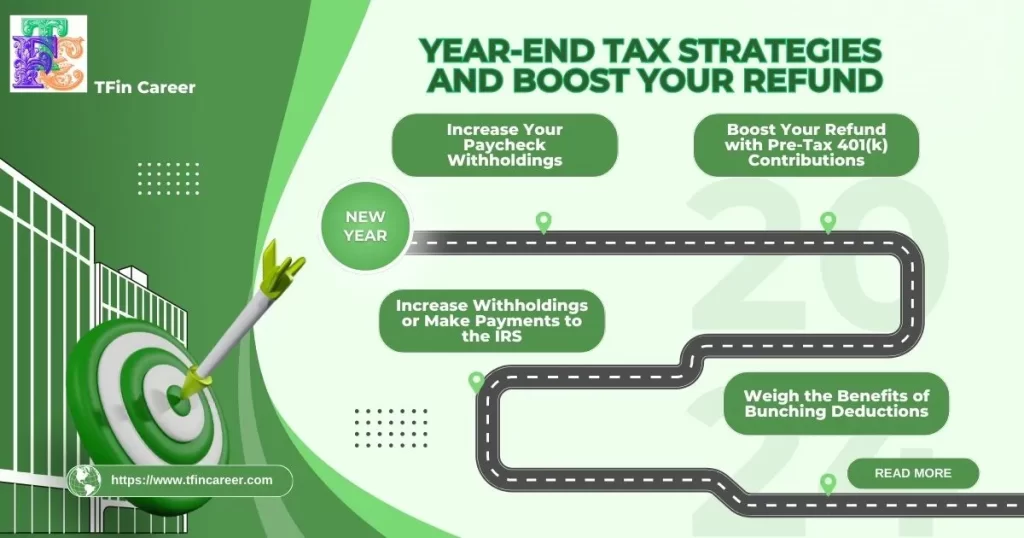

Year-End Tax Strategies and Boost Your Refund

As 2024 approaches, many of us are starting to think about taxes. While it might seem like taxes are a distant concern, financial experts say there are still ways to lower your tax burden or boost your refund before the year ends.

Year-End Tax Strategies and Boost Your Refund: In this post, we’ll go over a few basic procedures you can consider to make sure that any doubt, you’re not overpaying and may get a more significant discount. Let’s jump into a few tips to make a distinction in your 2024 Tax return.

Key Point 1: Increase Your Paycheck Withholdings

Explanation/Example: One way to lower your taxes for the coming year is to adjust your paycheck withholdings. This means you ask your employer to deduct more tax from each paycheck. It can be beneficial if you owe taxes at the end of the year or want to avoid a surprise tax bill. You’re essentially prepaying your tax liability by withholding more throughout the year.

For example, let’s say you’re expecting a tax bill and want to avoid paying it all simultaneously. By increasing your withholding now, you’ll pay off that tax bill little by little through your paycheck. This can reduce your overall liability when you file your return.

Summarized: Increasing your paycheck withholding ensures you pay more yearly taxes, lowering the chances of a big tax bill when you file.

Bottom Line: If you’re looking for a more relentless and unsurprising assessment instalment arrangement, this is an essential way to decrease push when charge season rolls around and feel more secure in your Money-related circumstances.

Know More from The Internal Revenue Service about Withholdings Tax

Key Point 2: Boost Your Refund with Pre-Tax 401(k) Contributions

Explanation/Example: Another effective strategy to reduce taxable income is contributing more to your pre-tax 401(k) retirement account. The more you contribute, the lower your taxable income will be.

For instance, if you can contribute an extra $5,000 to your 401(k), that amount is deducted from your taxable income, meaning you will be taxed on a smaller amount of Money.

Let’s say you earn $60,000 a year. If you contribute $5,000 to your 401(k), your taxable income is now $55,000. This can lower your overall tax liability and potentially bump you into a lower tax bracket, saving you Money.

Summarized: Contributing more to your 401(k) lowers your taxable income, which can reduce the amount you owe in taxes.

Bottom Line: If you’re not yet maxing out your 401(k), consider increasing your contributions before the year ends to lower your tax bill and set yourself up for a stronger financial future.

Know More from The Internal Revenue Service about 401(k) Contributions

Key Point 3: Increase Withholdings or Make Payments to the IRS

Explanation/Example: If you’re self-employed or receive income that doesn’t have taxes automatically withheld, you might want to consider making additional estimated payments to the IRS before the end of the year. This can be particularly helpful if you expect to owe significant taxes.

For instance, if you receive freelance or side income, it’s easy to fall behind on taxes since no Money is being withheld automatically. By making an additional payment to the IRS now, you can reduce your liability and potentially avoid underpayment penalties.

Summarized: If taxes are not withheld from your income, making extra payments or increasing your withholding can help reduce your tax bill and avoid penalties.

Bottom Line: Pay what you owe in April. Making estimated payments now can ease the burden later and ensure you’re on track with the IRS.

Key Point 4: Weigh the Benefits of Bunching Deductions

Explanation/Example: If you itemize your deductions, consider “bunching” certain expenses, like charitable donations, into one year. Bunching means you group deductions into one tax year to exceed the standard deduction and take full advantage of itemizing. For example, if you usually donate $2,000 to charity annually, consider giving $4,000 in one year instead. This seems to thrust your add-up to conclusions over the standard finding limit, permitting you to itemize and lower your assessable income.

This methodology works well with therapeutic costs, property charges, and other deductible costs. Moving or quickening these costs can boost your findings for a more noteworthy charge break in one year.

Summarized: Bunching conclusions into one year can help you surpass the standard derivation and maximize your assessed investment funds.

Bottom Line: If you’re near the standard deduction threshold, consider grouping deductible expenses to increase your itemized deductions and lower your taxes for 2024.

Know More from The Internal Revenue Service about Credits and deductions for individuals

Final Thoughts – How to Boost Your Refund

Year-End Tax Strategies and Boost Your Refund: While taxes can feel overwhelming, simple strategies exist to maximize your financial situation before the year ends. Whether altering your withholdings, contributing more to your 401(k), creating additional instalments to the IRS, or utilizing the bunching technique for derivations, taking activity modifying can decrease your charge risk and possibly increment your discount, giving you a sense of control and confidence in your financial future.

Remember, taxes don’t have to be stressful if you plan and take advantage of these simple strategies. Talk to a tax professional or financial advisor to see what options are best for your situation, and make 2024 the year you optimize your tax savings. This will give you peace of mind and control over your financial future.

Hi there! I am Sudip Sengupta, the face behind “Tfin Career”. Tfin Career is a sole proprietorship finance and consulting firm that makes complex tax and financial concepts easy to understand for everyone. With more than 21 years of experience in the field, I have noticed that people cannot make the right decisions in this field. So, I decided to create “Tfin Career” to help individuals and businesses alike. Here I urge those who are confused to make better choices. Also, it is good news for my dear clients and every visitor that I/we are going to start a training module for those who want to choose a career path in Finance and Taxation. Just follow my website.

Thank you for reading this post, don't forget to subscribe!